Guide to the Equifax Credit Score Range in the UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you want to understand your Equifax credit score range in the UK? You’re in the right place. Each month, over 170,000 people visit our website for guidance on debt and credit score issues.

We know credit scores can be puzzling. That’s why we’ve created this guide that will explain:

- Who Equifax is and what it does.

- The range of credit scores in the UK.

- How to check your credit score on Equifax.

- How to correct errors on your Equifax credit score report.

- Ways to improve your credit score.

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9201. So, it’s quite common for people to feel concerned about their credit score. Some of our team have even been there.

Don’t worry; we’re here to help you understand your credit score and know how to manage your debt.

Why Are They Important?

How to View Your Credit Report

With Equifax’s 30-day free trial, you can view your full credit report and score for free.

After the trial ends, the service costs £7.95 a month, but you can cancel anytime. It gives you a detailed view of your credit report, including your credit score and personal information.

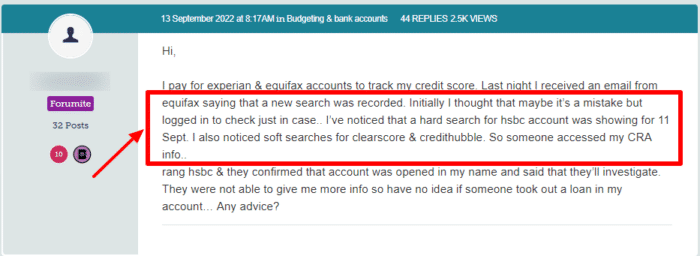

Equifax paid users can take advantage of the identity protection feature, which will alert you if your financial details are accessed by fraudsters.

As this forum user notes, this helps you keep a closer eye on your finances and flag any issues you discover.

To view your credit score on Equifax, you will need to provide:

- name,

- date of birth,

- phone number,

- driving licence/passport number and

- addresses for the past three years.

Remember, there’s no downside to checking your credit score regularly. From my experience, your checks are not recorded and do not work against you when you apply for credit.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I Correct Errors?

If you believe there is an error on your credit file, you should have it corrected immediately.

For example, in my case, I had an old payment that was paid off, but the company wrongly informed Equifax that I hadn’t. I emailed both Equifax and the lender, and they corrected it within a month.

To correct any credit report errors, you have a few options:

- Email the lender that put the details on your file, asking them to update your payment details.

- Email Equifax about the incorrect details. If you are subscribed to the service, you can add a note to your file online or send the correction to the agency via post.

- Make a complaint to the Financial Ombudsman Service

What Impacts Your Credit Score?

» TAKE ACTION NOW: Fill out the short debt form

How To Improve It

Budget Advice

Budgeting empowers you to take control of your financial situation, even if you’re dealing with a bad credit score.

Here are 10 budgeting tips that will help you manage your finances effectively:

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.