Fashion World Debt – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying your Fashion World debt, and unsure of what to do if you can’t? This clear and simple guide is just for you. Every month, over 170,000 people visit our website for advice on managing their debts.

In this article, we’ll explain:

- What Fashion World debt is

- The steps to pay back your Fashion World debt

- What happens if you can’t make your minimum payment to Fashion World

- Different ways to manage your Fashion World debt

- How and where to get help and advice if your debt is too much

We know that not being able to pay a catalogue debt can make you feel worried. It’s tough to understand what to do or who to talk to.

But remember, you’re not alone. We’re here to help you find out your choices and make the best decision.

Let’s start looking at your Fashion World debt management plan.

How Can I Pay?

Get in touch with Fashion World and offer a repayment plan with an amount you can realistically afford. This payment will be every month and can help you to spread out the cost of the debt you owe.

However, you risk going into persistent debt if you only manage to pay the minimum payment requested. If possible, try to go slightly above what you’ve agreed with Fashion World.

If you still cannot afford your catalogue repayments or your Fashion World debt has become unmanageable, I suggest you contact a reputable debt advisor, such as StepChange or Citizens Advice, for help.

What Happens If I Can’t Afford My Minimum Payment?

If you think you will miss a payment to Fashion World, it’s worth contacting them as soon as possible. The company has advisors who will listen to you, gain information and try to work with you to create a debt management plan.

If you stop making payments outright or fail to contact them, you can face administration charges being added to what you owe. Also, missed payments can negatively affect your credit score.

What if I Don’t Pay?

Don’t panic if you can’t afford to pay Fashion World. First, Use our monthly budget tracker to see what’s happening with your money. It’s a fantastic way of discovering unnecessary spending and figuring out exactly what you can afford to pay.

Once you have a clear understanding of your income and expenses, contact Fashion World and negotiate a repayment plan you can afford. Fashion World may be willing to work with you to find a workable solution.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

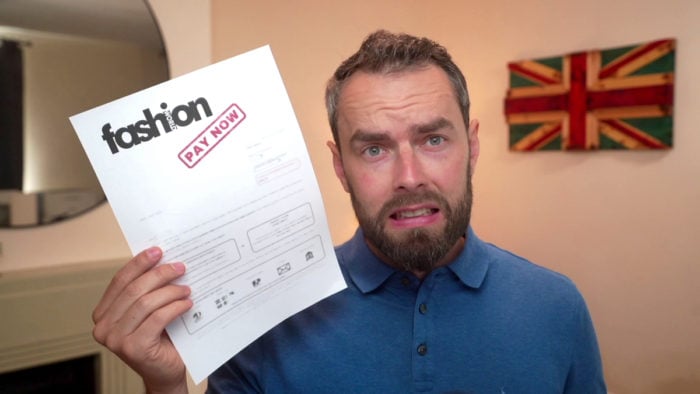

Do They Use Debt Collectors?

Fashion World will pass your debt to a debt collector if you fail to make your payments. If you do not get in touch quickly and keep missing payments, your account will default. Their next course of action will be the debt collectors reaching out to you and asking you to pay.

Will They Come to My House?

Debt collectors might turn up on your doorstep, but this is rare. They will often try to sort out the debt through phone calls and letters. But they could still visit you if you continue to ignore their efforts to reach you.

Debt collectors, nonetheless, must follow the FCA regulations when chasing you for a debt.

If you feel you are being unfairly harassed, you do have rights. You can request all contact to be through the post if you are disturbed by the phone calls. Also, note that while debt collectors can come to your house, they don’t have the same powers as bailiffs.

For example, if they turn up at your house, you don’t have to interact with them. According to the FCA rules for debt collectors, you can ask them to leave and only contact you by letter. If they continue to harass you or come to your home again, you have every right to report them to the FCA.

Having said that, the best way to stop the letters and phone calls is to contact the debt collector to negotiate an affordable debt repayment solution.

You could also try to contact Fashion World directly, explain your financial hardship, and offer them a repayment plan. They may grant your request, but it will depend on whether they have sold your account to a debt collector agency or they collect the debt themselves.

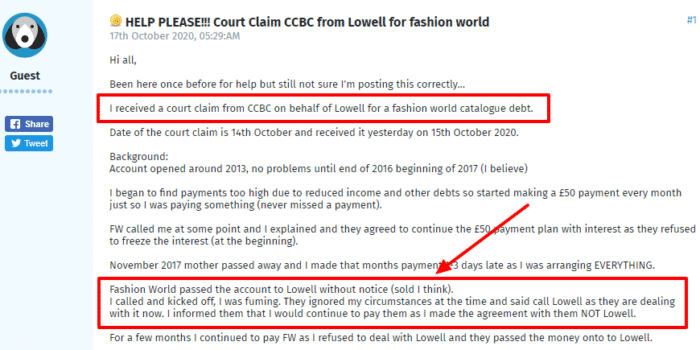

Companies usually have the right to assign/sell the debt to a debt collection agency (e.g. Lowell), which might make the situation more expensive and difficult to handle. My advice is: don’t let your catalogue debt get to this stage. If you think you’re at risk of missing a payment, contact Fashion World immediately to negotiate a more affordable payment plan.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can They Send Bailiffs?

Fashion World cannot enforce the debt you owe them nor the debt collectors. However, your Fashion World debt can lead to bailiffs if they or their debt collectors take you to court and have a County Court Judgement (CCJ) issued against you.

A CCJ is usually the last resort for creditors, but that doesn’t mean it won’t happen. Having a CCJ on your credit file can stop you from getting a mortgage, credit card, and car finance.

It’s important to keep the communication regarding the debt you owe open, as you’ll have a warning about the possibility of a CCJ.

Speak to a debt advisor immediately if you learn about impending court action. There is usually still time to avoid court action, even after it gets to this point. Work with a debt advisor to establish an affordable way of clearing your catalogue credit account debt. This can be done directly through Fashion World or via their debt collectors. Who you pay will depend on who owns the debt at that time.

How to Contact Fashion World About Payments

As mentioned above, the best course of action is to contact Fashion World as soon as you know you might miss a payment. However, you should also get in touch if you have already missed one or more payments. This helps avoid late payment implications like costly admin charges and interests. You may be able to avoid further action if you are honest and are willing to discuss solutions to manage your catalogue debt.

| Website: | https://www.fashionworld.co.uk/ |

| Phone number: | 0345 071 9018 (8am-7pm) |

| Email: | [email protected] |

| Chat: | Fashion World chat |

The available times of Fashion World are Monday to Friday, 8 am to 7 pm. When emailing Fashion World, be sure to include your name, the first line of your address, and your postcode. Have your account number to hand when phoning in case you are asked for it.