Halifax Mortgage for Debt Consolidation Reviews & Remortgage

Debt can sometimes feel like a heavy load. One way to make it lighter is by using a remortgage to pay off debt. This article is here to help you understand Halifax Mortgage for Debt Consolidation. We’ll explore:

- The meaning of debt consolidation.

- The real cost of a bad debt consolidation loan.

- How remortgaging fits in with debt consolidation.

- What the Halifax Mortgage for Debt Consolidation is.

- If it’s a good deal for you.

We know that dealing with debt can be tough. Every month, we guide over 170,000 people with money matters. We understand your worries, and we are here to help.

Let’s learn more about Halifax Mortgage for Debt Consolidation.

What Is the Halifax Mortgage for Debt Consolidation?

Halifax offers remortgaging packages to suit different people and needs. They do allow remortgaging to assist in debt consolidation.

The type of deal you receive will depend on personal circumstances, your debts and the value of the property you want to remortgage.

What Does Remortgaging Have to Do with Debt Consolidation?

So, where does remortgaging come into debt consolidation?

It is true that most debt consolidation is done with unsecured personal loans and balance transfer credit cards. But you can consolidate debts with secured loans, namely mortgages.

By remortgaging a property, you may be able to free up a tidy sum of money that can be used to pay off your debts. This means you will be consolidating your debts into your new mortgage arrangement.

And one such option is the Halifax mortgage for debt consolidation.

Note that remortgaging your home to consolidate your debts is a risky move. You could end up losing your home if you can’t keep up with repayments. Always have this in mind when seeking Halifax mortgages.

Here’s an overview of the benefits and downsides of using a mortgage for debt consolidation to help you decide if it is the right option for you.

| Benefits | Downsides |

| Mortgage interest rates are often lower than rates on credit cards or personal loans, allowing you to save money. | If you can’t meet the mortgage repayments, your home could risk foreclosure |

| Instead of juggling multiple payments, you’ll only have on monthly payment to manage | Extending short-term debt over the term of mortgage means you’ll pay more interest over time |

| By consolidating and paying off multiple debts, your credit utilisation ratio can improve, potentially improving your credit score | Refinancing a home to consolidate debt can come with significant costs and fees |

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Is the Halifax Mortgage for Debt Consolidation a Good Deal?

There is no way to say how good a deal you can get with Halifax because what you are offered is typically personalised. Their fixed rate deals are currently 2%, which is somewhat lower than the 2.33% market average.

However, Which.co.uk conducted extensive research on Halifax mortgages. Most Halifax mortgage customers found the process to be smooth and transparent, and they were happy with the overall service.

But the area they scored Halifax lowest in was their value for money.

This is not that surprising as there are even better rates available from other renowned banks.

At the time of writing, Lloyds Bank and Santander both have some exceptional mortgage deals and rank top of the USwitch ratings – much better than Halifax. Yet, these deals will also be subject to your circumstances.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Halifax Mortgage for Debt Consolidation – Your Questions Answered!

Below I have rounded up some of the most common questions asked about debt consolidation mortgages from Halifax:

What Type of Mortgages Do Halifax Offer?

Halifax offers many types of mortgages including, interest only mortgage, offset mortgage, fixed rate mortgage, tracker mortgage, Buy to Let mortgage and shared ownership mortgage.

How Much Can I Get?

The amount you can get from Halifax through remortgaging depends on multiple factors, not limited to how much you currently owe, the property and your credit report.

You might be able to borrow more than you already owe, but you won’t be able to borrow more than the property’s current valuation.

What Is the Minimum House Value?

Halifax will protect themselves by only lending on properties with a value of £40,000 or more. If your property is not worth £40,000, you won’t be able to use a Halifax mortgage for debt consolidation.

How Can I Apply for a Halifax Mortgage?

You can apply over the phone or at their branches and receive the assistance of a Halifax mortgage advisor. You can also apply on the Halifax website. But take note, if you do this, then you won’t receive insight and advice from a Halifax professional.

Halifax Mortgage Contact Details

| Phone number: | 0345 850 3705 |

| Website: | Halifax Mortgage website |

| Request a mortgage appointment | Book your appointment here |

| @HalifaxBank | |

Will I Receive an AIP?

When remortgaging, Halifax doesn’t typically provide an Agreement in Principle (AIP), also known as a Mortgage Promise.

But if you want one, you can request Halifax to provide AIP. This will also mean having a credit check completed on the remortgaging applicants at this stage.

How Long Does a Halifax Debt Consolidation Mortgage Take?

The typical timeframe to get your remortgage deal with Halifax is one to two months. However, this is a guideline only, and it can take longer if there are problems during the application or unforeseen circumstances.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Can I Take My Debt Consolidation Mortgage Elsewhere?

Some of the Halifax mortgages are portable, which essentially means you can move the same mortgage to a different property. This is good to know if you plan on moving. But always check to see if the mortgage you apply for is portable.

Before You Apply for a Halifax Mortgage!

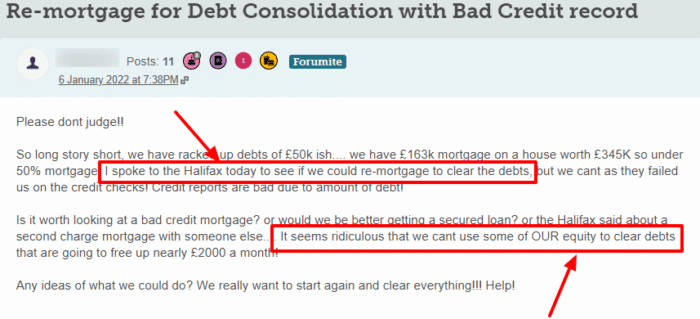

Remortgaging with debt is not always easy because the application depends on your debt-to-credit ratio.

You should seek the advice of a mortgage advisor who specialises in remortgaging for debt consolidation first.

They will help you figure out if this is a good debt solution for you. You may also benefit from other debt solutions such as IVAs, DROs, etc.

Also, don’t forget to check your credit file for mistakes that could cause an unforeseen rejection. Use a credit reference agency’s free trial to do this – and don’t forget to cancel before the trial ends.