Debt Calculator – Find Out How Much

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you eager to find out how much debt you owe? No need to worry; you’ve come to the right place.

Each month, over 170,000 people visit our site for clear advice on debt issues. So, you are not the only one with concerns like this.

In this helpful piece, we’re going to talk about:

- How to use a Debt Calculator to find out how much you owe

- The steps to take if you find your debt is too big

- Ways to work out how long it will take to pay off your debt

- Understanding interest and extra costs

- How to choose which debt should be paid off first

We know that having debt can make you feel scared; many of us have been there too. But we also know that learning about your debt is the first step to dealing with it.

So, let’s get started.

How do I Calculate My Debt?

The most common and quickest way to sum up your debts is by using debt calculators.

There are six main types of debt calculators:

- Mortgage calculators: For calculating mortgage loan repayments

- Simple debt calculators: Determine monthly loan repayments for personal loans, car finance, etc

- Credit card loan calculator: Calculate the length of time and total interest paid if only making minimum repayments

- Debt snowball and avalanche calculators: Used to pay off multiple debts

- Debt to income ratio calculator: For calculating your financial health by comparing total debt to total income

- Debt consolidation calculator: For determining potential savings by consolidating various debts into a single loan

A debt consolidation calculator is a tool that will show you how much debt you owe and how much time it can take for you to get debt-free.

You can also use these calculators, to sum up the debts you have. The best thing about these calculators is that they consider the interest rates associated with each debt as well.

To calculate the total of debts, you will need to add up the amounts you owe.

For example, £1000 + £2000 + £1200 + £300 = £3500.

Like this, you can easily tell how much debt you owe. However, if you want to know about the practical debts you owe, you need to follow this formula:

Total Debts – Available Cash/Liquid assets = Net Debts

So, for instance, keeping the same aforementioned example in mind, £3500 is the amount of debts liable upon you, and you have £500 available in cash and liquid assets. Hence, the net debt will be considered as £3000.

This formula is used by keeping the fact in mind that you can pay a certain amount instantly. Thus, that amount should be deducted when calculating the Net Debt.

All of this can be done within seconds by a debt calculator!

Which Should Be Paid Off First?

A basic rule of debt paying is that debts with a higher rate of interest or APR should be paid first (avalanche method).

As discussed above, if you don’t take care of debts with higher interest rates, e.g., credit cards, etc., these debts will charge you compound interest on the repayment amount.

Plan out your monthly repayment schedule and then figure out which debts should be prioritised and which should be seconded. Or use a credit card loan calculator.

» TAKE ACTION NOW: Fill out the short debt form

Just What is Too Much?

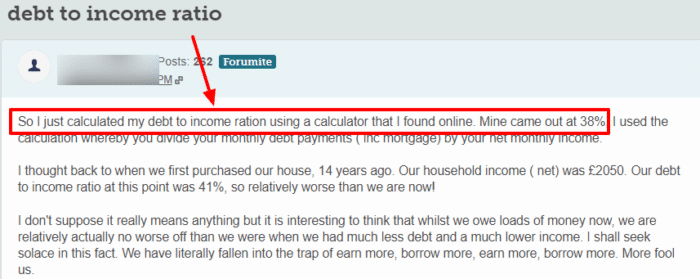

The best way to get the answer to this question is by using the DTI formula.

The debt to income formula calculates how much of your income goes towards paying your debts. To calculate the DTI, you need to follow these steps:

- Calculate the total amount of your monthly payments of debts, e.g., credit card dues, loans, and other amounts. (Make sure you list all the amounts and details of the debts correctly)

- Sum up your monthly income

- Divide the total of your monthly debt by your monthly income

- Multiply it by 100

Total Monthly repayment of debts x 100 = Debt to Income ratio

Monthly Income

Now, let’s understand what this formula means.

The answer to this calculation represents the percentage amount of your income that is going towards paying the debt.

A higher percentage means that a higher amount of your income is going towards paying the debts, leaving you with less money to spend.

The smaller the percentage, the better it is for you. Being an expert on personal finance, I would say the answer to this equation should never exceed 25%.

A healthy DTI ratio percentage rate stands between 5-15%. This is the simplest way to see how much debt is too much.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Understanding Interest & Additional Charges

The interest rate is a very important factor in debt calculation and its repayment.

With higher interest rate debts, it will be hard for you to achieve a life free of debt. The interest rate or the annual percentage rate (rate APR) can cause heavy damage if it is not managed properly.

To simply understand why high-interest rate debt is dangerous, you need to understand the concept of compound interest.

If the debt is not eliminated, the interest will slowly form a situation where you will have to pay interest upon the interestable amount.

To keep a handle on the situation, you can use my free interest calculator. Use this tool to make sure you understand how interest affects your monthly bills and overall financial health.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

How Can I Pay It Off?

Paying off your debt might not be as difficult as it sounds. There are many ways that you can use to pay back or even cancel your debts and have a debt-free life.

Let’s discuss a few options below.

Pay Back in Instalments – Debt Management Plan

This is the most suitable and easiest way for people with a fixed monthly income. You can adapt this approach and effectively clear all the loans you are liable to pay.

Make a budget statement for your debts and divide up a part of your income from which you have to pay back the due amount. In this way, you’ll have fewer chances of overspending while paying your debt off gradually.

Individual Voluntary Arrangement

The IVA is a legal and formal agreement that is held between a debtor and a creditor. It mentions all the details and information about the debt and its payback period.

Please remember that this is a formal and legal agreement, which is drafted by a professional accountant or a lawyer. Any breach of this contract may lead to legal action.

Debt Consolidation Loan

Consolidation here means to combine. These loans are taken through a bank to pay back your creditors and consolidate your debt towards the bank.

You will have to pay a lower interest rate to the bank, hence saving you from additional costs. Use a debt consolidation calculator for more information on arithmetic workings.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Long Will It Take to Clear?

It really depends upon the amount and type of debt that you have to repay. So, for every person, the answer to this question is different.

However, don’t worry. I’ve still got you covered. You can either use the Barclay loan repayment calculator or use this method as well:

- Calculate your total debts

- Divide them in monthly instalments

- Fix a part of your income for repayment

- Calculate the total months after which the debt will be cleared