How much debt is too much? UK Stats

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debt? You have come to the right place. Each month, over 170,000 people visit our website looking for guidance on debt matters.

In this article, we’re going to help you understand:

- The difference between good debt, bad debt, and toxic debt.

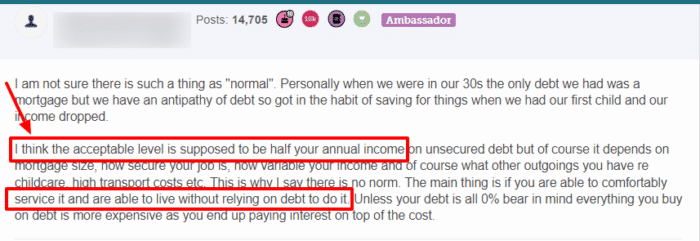

- How much debt is generally seen as too much.

- Ways to manage and maybe even write off some of your debt.

- When it’s time to start worrying about your debt.

Our team knows how it feels to be worried about debt; some of us have been there too. That’s why we’re here to help you learn more about debt, how much is too much, and what you can do about it.

Debt & Income

Good

» TAKE ACTION NOW: Fill out the short debt form

Bad

Toxic

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Figuring out your debt load

Carrying a large amount of debt, especially relative to your credit limit, can hurt your credit score as it indicates higher credit utilisation and potential lending risk.

Keep in mind that high interest can dramatically impact your ability to repay a debt.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

When should you start to worry?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.