High Court Enforcement Officer Powers – Know Your Rights!

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you feel worried about a bailiff coming to your home? Are you scared about your things being taken away? It can be quite a tough spot to be in, but remember, you have choices. This article is here to help you understand those choices.

Every month, more than 170,000 people come to our website for advice on debt. So, you are not alone.

In this simple guide, we will help you understand:

- The powers of a High Court Enforcement Officer.

- The steps you can take if a bailiff is expected at your home.

- What a High Court Writ means.

- Which items a High Court bailiff can or can’t take.

- How to deal with bailiff fees.

Below, you can learn more about your rights and how to feel more calm about dealing with bailiffs. Remember, we can’t stop the bailiffs from doing their job, but we can help you understand your rights and make the best choices for you.

Let’s get started.

What is an HCEO?

A High Court Enforcement Officer (HCEO) is a type of enforcement officer – commonly known as a bailiff – who works to enforce orders from the High Court.

High Court Enforcement Officers usually collect debts amounting to more than £5,000. But some claimants transfer County Court orders for less to the High Court for a faster debt recovery process as long as the money owed equals £600 or more.

What is their power?

With a High Court Writ, High Court Enforcement Officer powers include permission to visit the residential or commercial property of the individual or business that owes the money.

» TAKE ACTION NOW: Fill out the short debt form

They’re allowed to request a full payment, offer a payment plan on some occasions or seize goods. If they seize goods, they will later be sold to raise funds to pay off the debt.

But it’s important to note that these professionals don’t always have these rights or powers. They only have the power to act on behalf of the High Court in this way with a valid Writ of Control. Otherwise, they cannot come to your home to enforce debt collection.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is a Writ?

A High Court Writ or High Court Writ of Control is a type of order issued by the High Court. It gives the High Court bailiff permission to enforce debt recovery.

Without a High Court Writ, the High Court Enforcement Officer wouldn’t be allowed to collect the High Court debt.

Before you get a Writ from the High Court, you will have had a CCJ issued against you by your creditor.

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

However, for the High Court to get involved, you have not stuck to the terms of your CCJ.

What goods can they take?

A High Court bailiff can take any goods that the debtor owns to clear the debt – with some exceptions.

There are strict rules on what can’t be removed from your property. These items include:

- Anything that belongs to someone else – this includes things that belong to your children

- Pets or service animals

- Vehicles, tools, or equipment that you need for your job or to study up to £1,350

- A mobility vehicle or any vehicle with a valid Blue Badge

- Anything permanently fitted to your home – kitchen units, etc.

Bailiffs also can’t take things that you need to live. These items can be anything that you use for your ‘basic domestic needs.’ They can take some of these things, but must leave you with:

- A table with enough chairs for everyone in your home

- Beds and bedding for everyone in your home

- A phone or mobile phone

- Any medicine or medical equipment that you need to care for someone

- A washing machine

- A cooker or microwave, and a fridge.

If you think that a bailiff has taken something that they shouldn’t, you need to complain immediately. I go through the complaints process below. You can also contact a debt charity for some advice. I have listed several charities that offer free advice at the bottom of this page.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do they have to give notice?

Yes, a High Court Enforcement Officer must give debtors seven clear days before they can turn up at your door. They will do this by sending you a letter notifying you to get in touch to pay the debt or expect a visit.

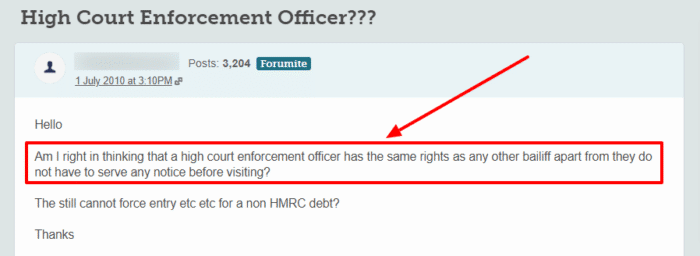

Contrary to what you may read online, High Court bailiffs must give the same notice period as other types of enforcement officers. Here is an example of the myth that High Court bailiffs can turn up without warning:

Source: https://forums.moneysavingexpert.com/discussion/2567253/high-court-enforcement-officer

Don’t always believe what you read on forums, and instead, fact-check the details on MoneyNerd, Citizens Advice or a debt charity website.

What times can they visit?

A High Court Enforcement Officer can come to your home between the regulated hours of 6 am and 9 pm.

Under no circumstances can they attend your home or business premises to collect a debt outside of these hours.

Can they enter my home?

You’re not obligated to let any bailiff into your home, but they can enter through open or unlocked doors if they choose to.

If you don’t want them to come inside, you should keep your doors locked and communicate with them through the letterbox or through an upstairs window.

But remember, the bailiffs could seize possession of goods that aren’t inside your home, such as a vehicle owned by the debtor outright (not on an HP agreement or equivalent) that is parked on a driveway or on the street.

Can an officer force entry?

There are limited situations when a High Court Enforcement Officer can use reasonable force to enter your property. They can do this to recover certain types of fines or debts, but reasonable force doesn’t mean breaking doors or physically harming you.

What does it really mean?

When a High Court enforcement agent uses reasonable force to gain entry to a property, they do this by bringing a locksmith with them and getting a locksmith to open a locked door.

They don’t force entry by breaking windows or kicking down doors, which is what some people assume.

What can an officer not do?

A High Court bailiff cannot enter your home in some situations.

They cannot:

- Use force to enter your home, such as physically harming you or pushing past you to gain entry.

- Enter a home where vulnerable people or children under 16 are the only people present.

- Gain entry through any other means that a door, i.e. they cannot climb through open or unlocked windows

Ownership of goods – who has the burden of proof?

When a High Court bailiff visits your home to seize goods, they might want to take goods that are not owned by you. In these situations, it’s your responsibility to prove that the goods are owned by someone else.

For example, a partner may have bought a new computer. You could prove this by showing evidence that your partner bought the computer. It’s not always easy to prove an asset isn’t yours, especially if you claim it’s owned by someone else you live with.

Can you stop bailiffs?

You might be able to stop High Court bailiffs but this won’t make your debt go away. You can apply for a stay of execution of the Writ of Control and have the judgment set aside, which essentially means that the whole process needs to start over.

But this is only possible if you weren’t aware of the situation due to not receiving important documents and letters. And it’s only really possible if you have a realistic chance of defending the claim you owe the money.

If you want to explore this option further, it’s best to speak with a UK debt charity.

How much are their fees?

Spoiler alert – they’re very expensive!

High court bailiffs use a four-stage collection process and they can add fees to your debt on each of these stages. They can also add fees for additional services required.

The first stage is called compliance where the High Court bailiff notifies you of their involvement and requests a swift resolution. A £75 charge is added at this first stage.

This is followed by two stages where the bailiffs will visit your home, but it’s possible only one visit will be needed. The first visit costs £190 plus 7.5% of the total debt if it’s above £1,000. The second visit is a fixed fee of £495.

If the bailiffs need to seize goods and sell them, they can charge a fixed fee of £525 plus another 7.5% of the total debt for debts of more than £1,000.

A wide range of other High Court bailiff fees is possible, such as fees for storing goods, auctioneer costs or costs for the use of a locksmith if they had to force entry.

Are HCEOs regulated?

The High Court Enforcement Officers Association has a Code of Best Practice that is based on the National Standards issued by the Ministry of Justice.

These guidelines apply to anyone working as or on behalf of a HCEO.

The guidelines cover a broad range of behaviours and procedures. The rules require that, among other things, HCEOs:

- Provide relevant ID on request

- Act within the law at all times

- Respect confidentiality

- Do not exaggerate the powers that they hold

- Act in a professional, calm, and dignified manner

- Do not discriminate.

If you think that a HCEO has broken any of these rules, or any other rule in the Best Code of Practice, you can make a complaint. I go through this process below.

How to complain

If you think that your HCEO has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the High Court Enforcement Officer Association’s (HCEOA) Code of Best Practice.

Make your first complaint to the HCEO’s company or agency so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the HCEOA. They will investigate your complaint thoroughly and provide you with a report if your complaint is upheld. If your HCEO’s behaviour was very poor, they may be fined, and you could even be owed compensation.