Can HMRC Debts Be Written Off?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you want to know if HMRC debts can be written off? You’re in the right place. Each month, over 170,000 people come to us for advice on debt problems, so you’re not alone.

In this guide, we’ll explain:

- The different types of HMRC debts.

- What to do if you owe HMRC money.

- How you might write off some or all of your debt.

- Steps to take if you’re struggling with debt you can’t afford.

- How to get free support with your debt.

We know that owing money to HMRC can be worrying, as many of us have been in debt before, so we understand how you feel.

Let’s learn more about HMRC debts and what you can do about them.

Can you write off debt with HMRC?

It is possible to get some or all of your HMRC debt written off, but it’s not common. This may be achieved through using an Individual Voluntary Arrangement (IVA) or due to your health and financial circumstances.

For example, HMRC may be willing to forgive the debt if your health condition makes it harder to repay your debt obligations or if they believe your circumstances won’t change any time soon.

You will have a better chance of getting some HMRC debts written off compared to others.

An IVA, for instance, freezes your debts and allows you to pay them back over a set period (typically within 5 years). Any money you still owe to HMRC after this period is then written off. You may qualify for an IVA if:

- You can afford to pay something towards your debt, but not necessarily the full amount HMRC is asking.

- You have a regular long-term income.

- You have a lump sum to pay towards the arrears.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

An IVA is usually set up by an Insolvency Practitioner. Again, I suggest you contact debt charity services to connect you with a qualified one. They’ll work with you to put together a proposal to take to the HMRC for approval.

If you can’t keep up with HMRC payments, the insolvency practitioner can cancel your IVA. They may also apply to make you bankrupt as a last resort. This is why I insist you talk to an experienced advisor before you take an IVA.

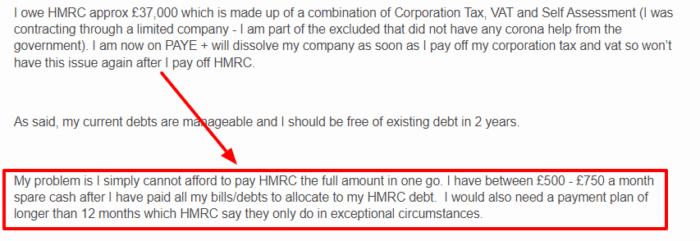

If you can afford to make some payments toward your HMRC tax arrears as this forum user says, you may qualify for an IVA. Get in touch with HMRC to discuss your financial circumstances so they can help you.

Can a tax debt be written off?

It is rare but not impossible to get HMRC tax debts written off. HMRC tax debts are usually recovered through a Time to Pay Arrangement (TTP) or by adjusting your tax code until the money owed has been repaid.

If you do not agree with these HMRC tax debt repayment options, then more forceful and serious action can be taken.

Time to Pay Arrangement (TTP)

A Time To Pay Arrangement allows you to pay back what you owe to HMRC in monthly instalments, typically over a period of up to 12 months. Some arrangements can be agreed over longer periods if you need more time to pay. It all depends on your individual circumstances.

The good thing about a Time to Pay arrangement is that it is flexible. It is not a formal contract, meaning you can amend it anytime as your circumstances change. You can shorten it if your income increase (or you get a windfall) and vice versa.

If you cannot pay your tax bill, you should contact HMRC to set up a Time to Pay arrangement. You may also set up a payment plan online if you don’t fancy contacting HMRC.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Individual Voluntary Arrangement

Another way of getting some of your HMRC tax debt wiped is if you use an Individual Voluntary Arrangement. This debt solution helps you pay off multiple debts together and writes off any remaining debt after the agreed repayment term ends.

HMRC might accept an IVA proposal for your tax debt alongside other debts.

» TAKE ACTION NOW: Fill out the short debt form

Can you go to jail for not paying HMRC?

You will not be sent to jail for not paying your HMRC tax dues. They have a wide variety of methods to reclaim the money and will not need to send you to jail. However, you can be sent to jail for tax evasion as this is a criminal offence.

HMRC Contact Details

| Post: | Pay As You Earn and Self Assessment HM Revenue and Customs, BX9 1AS, United Kingdom |

| Phone: | 0300 200 3300 +44 135 535 9022 outside UK |

| Relay UK: | Dial 18001, then 0300 200 3300. |

| Official app: | official HMRC app |

| Website: | https://www.gov.uk/government/organisations/hm-revenue-customs |