Can You Get Home Equity Loan Without a Job in the UK?

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Are you wondering if you can get a home equity loan without a job in the UK? You’re not alone. In fact, over 6,900 people visit this website each month looking for guidance on secured loans.

In this easy-to-understand article, we’ll answer the following questions:

- Do you need to have an income to be eligible for a home equity loan?

- Is an equity release loan based on your income?

- What should you consider if you don’t work and are thinking of taking out a home equity loan?

- What are the advantages and risks of a home equity loan if you are not working?

We know that understanding loans can be a bit tricky — you may worry about making the right choice. Don’t worry: we’re here to help you figure things out.

Let’s dive in!

Do you need to have an income to be eligible for a home equity loan?

For equity release, you don’t need to have a steady income. The monthly payments are not required with equity release mortgages, in contrast to standard mortgages. Instead, the loan and any interest that has accrued are normally reimbursed when the property in question is sold, which typically occurs following the passing of the last homeowner or the homeowner’s admission into a facility that provides long-term care.

When you get to a later stage in life, either after you have stopped working or when retirement is close around the corner, this can be a really helpful thing to have.

Your monthly income and outgoings will still be requested by your financial advisor, even if your income has no bearing on whether or not you are eligible for equity release.

The key reason for this is to guarantee that you will end up with the appropriate type of equity release plan and that the quantities will be sufficient to meet your current and long-term financial goals. However, this also gives your advisor the opportunity to investigate other possible courses of action and make sure that equity release is the best choice for you.

For instance, if you have spare money, you might find that alternative forms of financial investment are more appropriate for you, such as:

- Traditional residential mortgage

- RIOs, or interest-only mortgages for retirees

- Borrowing that is not backed by collateral, such as bank loans

It is important to keep in mind that even if making payments towards the plan is not required, lifetime mortgages all give you the option to do so.

Is an equity release loan based on your income?

An equity release loan is not determined by your income because affordability is not taken into consideration. This means that your income and expenditures do not play a role in determining whether you are eligible for the loan, the amount of money you are given, or the interest rate.

Instead, they are predominately determined by two additional components.

- The value of your property

- The age of the youngest homeowner, generally 55 and over

The amount that you are allowed to release is determined by a proportion of the value of your property. This ratio is referred to as the Loan to Value (LTV).

Because the majority of financial products, such as traditional mortgages or loans, are tied to salary in some way, this might be helpful to people who are now unemployed and have a tough time discovering alternative methods of raising funds.

The age of the youngest homeowner is the primary factor that determines the maximum LTV that can be obtained. Generally, the older the homeowner, the more money is available

Not only that, but all home equity loans have their own LTVs. Higher LTVs generally have a higher interest rate.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Things to consider if you don’t work and are thinking of taking out a home equity loan

When taking out an equity release while you are not working, there are a few factors you need to keep in mind. This includes determining the impact that equity release can have on means-tested benefits, the sort of plan you should have, and whether or not the release amounts suit your financial goals both now and in the future.

For example, if you receive any of the below benefits, taking equity release could impact your ability to claim them:

- Council Tax Reduction

- Universal Credit

- Child Tax Credit

- Housing Benefit

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Working Tax Credit

- Pension Credit

Because the one-time payment of money that you get as part of an equity release is considered a loan rather than income, you are not required to report it as part of your income.

However, if you have savings that are more than specific thresholds (which vary based on the benefit you receive), you run the risk of having your eligibility revoked. For example, for each £250 (or any part of £250) you have over £6,000, your Universal Credit will reduce by £4.35 in each assessment period.

This is why it is important to work with your financial advisor to find the plan that is right for you.

This may, for example, include exploring a drawdown option.

What is a drawdown equity release

You are able to take a lump sum of tax-free cash with the help of a drawdown plan, and then you can deposit a pre-agreed-upon amount into a reserve facility.

You will only be charged interest on the amount that you take out of the reserve facility, not on the total amount that is being held there until you actually take it out.

Depending on the plan that you have, the typical minimum amount that you are allowed to withdraw is either £500 or £2000.

Many people find these useful for supplementing their income or pension through their older years.

What are the advantages of a home equity loan if you are not working?

While you are out of work, whatever the reason, taking equity release can provide you with a number of benefits, including the following:

- Supplementing your existing income

- Paying off your mortgage early

- Accessing funds when a mortgage or loan is not possible

Supplementing your existing income

Drawdown plans are a great way to add to your income when you are retired or out of work.

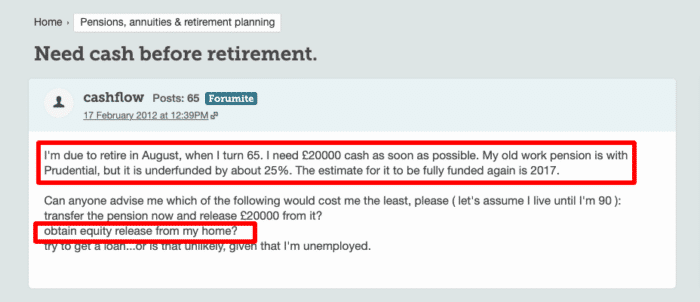

This could provide the additional assistance you require until you find work, reach the age of eligibility for retirement, or even sustain you throughout retirement, which is when income usually drops, as shown in the below post.

Paying off your mortgage early

Mortgage payments represent the single largest expense incurred by the vast majority of people throughout the course of their life.

You can get a lump payment via equity release, which you can then use to pay off your mortgage. You will not be required to make any monthly payments towards the equity release plan unless you choose to do so. This is in contrast to the mortgage, which requires monthly payments.

Instead, the interest is often compounded over time, and you return the lender when the final borrower either passes away or transfers into a facility that provides long-term care.

Access to funds

Standard mortgages and unsecured loans are both subject to affordability assessments which means that your eligibility is determined by looking at both your income, expenditures and debts. An equity release loan does not do this.

Instead, they look at your age and property value. They are also generally available to people with poor credit, such as a county court judgment (CCJ).

Home equity loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What are the risks of equity release if you do not work?

If you are currently unemployed and considering getting an equity release, the most significant risk you face is the possibility that your benefits would be negatively affected. However, it is also very important to examine whether the finances will be sufficient to maintain your standard of living.

Your equity release advisor will ask you a number of questions during the meeting known as the Fact Find. These questions will include specifics on your income and expenses, as well as what can be expected throughout your retirement.

When you do not have a job, the advisor will want to know whether you are able to work and are looking for work, or whether you will not be working again in the future.

If you are currently looking for work, the money you have saved will need to be sufficient to see you through until you find a job. On the other hand, if you decide not to work in the future, you will need to have sufficient funds to support you until you reach retirement age and potentially even beyond.

References

- The Money Advice Service. (2020). What is equity release? Available at: https://www.moneyhelper.org.uk/en/homes/buying-a-home/what-is-equity-release

- Equity Release Council. (2019). Equity release explained. Available at: https://www.equityreleasecouncil.com/what-is-equity-release/

- Which? (2019). Equity release schemes offer homeowners monthly salary in retirement. Available at: https://www.which.co.uk/news/article/equity-release-schemes-offer-homeowners-monthly-salary-in-retirement-abBAK8s2maN4

- Gov.uk. (2020). Benefits calculators. Available at: https://www.gov.uk/benefits-calculators