How Long Can You Be Chased for a Council Tax Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with debt in the UK can feel like a big worry. Luckily, you’re in the right place. Each month, more than 170,000 people visit our website for advice regarding their debt issues.

This article will help you understand:

- What happens if you can’t pay your council tax.

- What council tax bands mean for you.

- How to ask the council to forgive your council tax debt.

- How not paying council tax may affect your credit score.

While it may seem like you’re alone in this struggle, it’s worth mentioning that the average council tax debt among those seeking support from Citizens Advice has remained stable at £1,100 over the last year.1

We’re here to help you find the best way for you to deal with unpaid council tax from years ago. It’s never too late to start solving your money problems.

How Long Can You Be Chased for a Council Tax Debt?

Is council tax arrears a CCJ?

No. You’ll get a liability order for non-payment of your council tax but not a CCJ. Plus, it won’t affect your credit score.

Council tax debt collectors

If you have never paid your council tax debt, you may have to deal with a debt collection agency not the council. Dealing with debt collection agencies in the UK is not a pleasant experience.

So, it’s important to know your rights and what a debt collector can and cannot do and the sort of council tax enforcement actions to expect.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens when I refuse to pay Council tax arrears?

The importance of priority debts can’t be stressed enough.

Plus, a debt adviser will tell you about your rights if you feel you’re being treated unfairly. They can also advise you on the council tax debt recovery process and how to deal with it.

» TAKE ACTION NOW: Fill out the short debt form

What is a Statute-Barred Debt?

In Scotland it’s the Prescription and Limitation (Scotland) Act 1973. And in Northern Ireland, it’s the the Limitation (Northern Ireland) Order 1989.

How do I know if a debt is statute barred?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

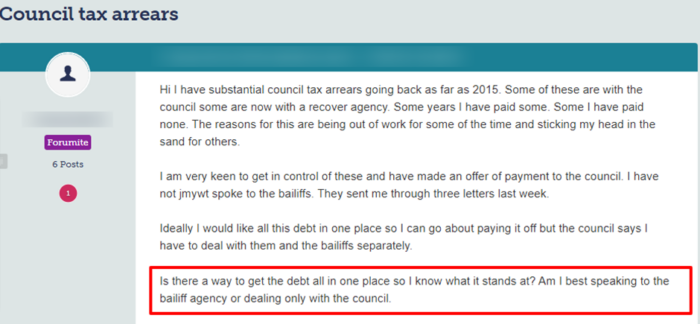

I’ve got unpaid council tax from years ago, what should I do?

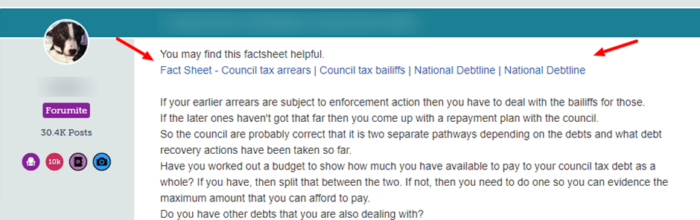

Check out this online message posted on a popular forum

Source: Moneysavingexpert

Council Tax Debt Solutions

If you’re struggling with council tax arrears, it’s crucial to understand your options. Take a look at these debt strategies that can help you.

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

What are the consequences of not paying council tax?

If you owe money to the council, they’ll want payment within the current tax year. As such, you could end up with a bailiff visit and they could seize some of your possessions.

Not only this, the council could take a fixed percentage from your wages which is known as an ‘attachment of earnings’.

The council tax penalties in the UK for non-payment are severe.

Can I be Sent to Prison for Not Paying the Money I Owe to My Local Council?

What is local council tax support scheme?

The Council Tax Support scheme was set in place to help people on low incomes. The scheme reduces their council tax bills.

You can apply for it whether you are working or not, and homeowners are also eligible.

You must be liable for council tax to qualify.

A council also has the power to reduce a council tax bill or a previous debt whether in part or in full.

It’s known as a Discretionary Reduction and can be set in place for people liable for council tax but experiencing serious financial hardship.

If you’re struggling with debt, I suggest you find out about what council tax exemptions and reduction you could be entitled to.