Unenforceable Debt – What You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you have debts that might not be enforceable? We’re here to answer any questions you may have.

Over 170,000 people visit our site each month seeking advice on debt matters, so you’re not alone.

In this easy-to-understand guide, we’ll explain:

- What ‘unenforceable debt’ means and how it can impact you.

- How to find out if your debt has become unenforceable.

- Whether all debts become unenforceable after 6 years.

- How long it takes before a debt is written off in the UK.

We know that you might be worried about debt, some of our team members have been there too. We understand your concerns, and we’re here to guide you.

Let’s work together to make sense of unenforceable debt.

What Does It Mean for a Debt to be Unenforceable?

If a creditor waits too long to take court action to recover a debt, under the Limitations Act 1980, after a certain time, the debt becomes ‘unenforceable’ or ‘statute barred’.

This means that the debt still exists, but the law can be used to stop the creditor from getting a court judgment in order to recover it.

In other words, the creditor is no longer able to take legal action to recover the debt because enough time has elapsed.

The exact time before the legal debt protection kicks in and the debt becomes ‘statute barred’ differs depending on where you are.

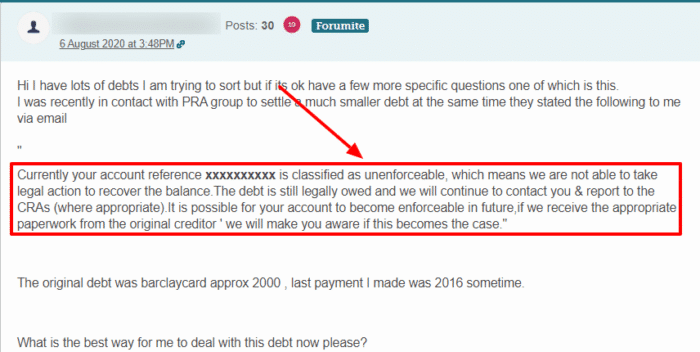

If a debt is unenforceable through the courts, your creditor may sell the debt to a collection (e.g. PRA Group) who will continue to pursue you for repayment.

If the time limit has passed and debt collectors are still contacting you, do not admit you owe the money. Contact National Debtline or StepChange for advice.

» TAKE ACTION NOW: Fill out the short debt form

How to Tell if a Debt Has Become Statute Barred?

When six years have passed since the first default notice or since the first ‘cause of action’, the debt becomes unenforceable.

According to the law, this means that while the debt does exist, it cannot be recovered through a court order.

If you have not made a payment at any time during the last six years, that usually means that the debt has become unenforceable.

One important piece of debt advice is to never acknowledge that a debt was owed to your creditor during or after the time limit.

If you do that in writing, the time limit of six years restarts for you from that minute on, and you’ll have to wait for your debt to become unenforceable.

Another scenario that could make debt statute-barred is if no contact has taken place between you and your creditor for six years.

If the debt is in joint names, there must be no contact with the lender from either debtor for the loan to be unenforceable.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do All Debts Become Unenforceable After 6 Years?

Sadly, no.

Credit agreements are of different types. The creditor has six years to chase most unsecured debts but has twelve years for some mortgage shortfalls.

I explain the different kinds of debts individually to understand their limitation periods:

1. Personal Injury Claims

If you’ve been in an accident and want compensation for your personal injury, you can go to court against the aggressor in order for them to give you money to help cover the medical costs and any potential wages lost.

The limitation period for personal injury claims is usually three years.

This means that since the time of the accident, you have three years to seek compensation for the aggressor’s negligence and enter into a credit agreement for the payment of these dues.

Keep in mind that you can also seek compensation for emotional injury during a traumatic experience. For this, the statute of limitations gives you three years after the acknowledge of your injury to recover your debt.

2. Mortgage Payments

For mortgage credit agreements, your lender has 12 years in which to recover mortgage arrears if you fall behind in payments.

If your house is repossessed and you still owe a mortgage payment, the time limitation for the recovery is six years for the interest on the mortgage; and twelve years for the main amount.

3. HMRC Debts

For HMRC credit agreements(e.g. income tax, capital gains tax, and VAT), legal action could be taken by the HMRC for up to 20 years (5 years in some cases).

So, a debt collector can possibly contact you within 20 years of the acknowledgment of your debt to HMRC.

If you want the exact information relevant to your experience, you should ask a lawyer and explain your circumstances.

Usually, a legal professional will give you free debt advice and tell you the time limit that applies to the debt that you owe.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Consumer Credit Act 1974 Loophole

The Consumer Credit Act of 1974 works to protect your rights as a borrower.

It covers most types of commercial lending in the UK and sets out what creditors must do when they are lending and collecting money.

Common examples of debts that are protected by the Consumer Credit Act are:

- Store cards.

- Credit cards.

- Payday loans.

- Store finance.

- Personal loans.

- Hire purchase.

- Catalogues.

In some circumstances, the Consumer Credit Act can help you to write off your debt (see below).

However, it is important to note that no ‘loophole’ exists. Some debt companies wrongly claim to be able to use the ‘Consumer Credit Act 1974 Loophole’ to wipe customers’ debt – but this is rarely the case.

The Office of Fair Trading has warned UK customers to be aware of such marketing tactics.

Settling Debts with a CCA Agreement

According to the Consumer Credit Act, you have the right to ask a creditor for a copy of your CCA agreement.

If the collector who is contacting you cannot produce the Consumer Credit Act agreement, it is likely that the debt is unenforceable.

Remember, debts that cannot be enforced are only protected from court action; the bad debt is still going on your credit report.

If you want to settle the debt, you have to negotiate.

If the collector cannot produce the agreement, you don’t have to pay your dues. However, if you want to strike the bad history off your credit report, you could offer a percentage of the original amount to be paid.

If eventually the CCA agreement is found but the six years time limit has been passed, you can again offer a percentage of the original amount as compensation and request the collector to update this late payment on your credit report.

To persuade them, you should explain why you couldn’t pay your arrears on time and your current financial status.

If they find this information convincing enough, they may write off your unpaid dues and remove it from your credit report.