How Long Does it Take to Get a Secured Loan? Quick Answer

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Trying to understand how long it takes to get a secured loan? You’re in the right place. Every month, about 6,900 people visit our website to learn about secured loans. We’re here to help you get the facts.

In this easy guide, we’ll talk about:

- What secured loans are.

- The good and bad sides of a secured loan.

- How a secured loan works.

- The steps to get a secured loan.

- The time it takes to get a secured loan.

We know that you might be worried about the possible problems of a secured loan. We understand your concerns, and we’re here to help. We want to help you learn more about secured loans in a simple and clear way. Let’s start this journey together and learn more about secured loans.

How long does it take for a secured loan to be approved?

The length of time it takes to get a secured loan approved is between two and four weeks. The timescale can vary considerably between lenders.

One of the biggest factors which will determine how quickly you receive a decision is your own administration organisation, as you will need to provide different documents. Another is if your asset being used as security needs to be revalued to help the lender decide how much they are prepared to lend. If it does, your application can take longer.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

The secured loan application process

Here is a breakdown of the secured loan application process:

- Taking the time to understand these loans, their pros and risks (you’ve started here!)

- Considering these loans against other credit options

- If you’ve decided a secured loan is what you need, searching options online and comparing deals

- Prepare your application to your chosen lender by preparing documents about income and debts

- Search your credit score to check there are no errors causing your score to be lower than it should be

- Getting an asset valued if required

- Lodging your application

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

When will I get my secured loan after approval?

Once your loan has been approved, you should expect to receive the loan in a couple of working days. Some lenders are able to transfer the money into your account within the same day as you receive a loan-approved notice.

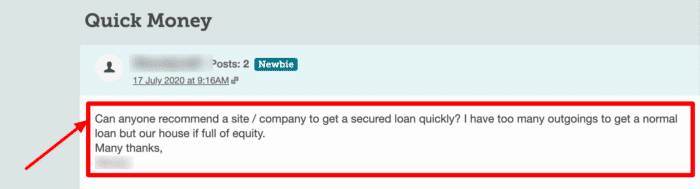

This forum user on MoneySavingExpert is looking for recommendations on where they can get a secured loan quickly.

Are secured loans easier to get?

Secured loans – including second charge mortgages – are considered slightly easier to get approved for than unsecured loans. But that doesn’t make it easy. You’ll still need to provide proof of income and meet affordability criteria, as well as have your credit score assessed.

Other financing options

It can be worth thinking about whether other credit options might be more suitable for you if a secured loan doesn’t suit your personal circumstances, such as credit cards, overdrafts, credit unions or Peer-to-Peer lending. All of these options come with risks, though, so it’s important to do your research thoroughly.

What is Loan to Value (LTV)?

LTV is a measurement within a risk assessment completed by lenders before agreeing to award mortgages. The calculation is used to determine the element of risk when lending a certain amount to you.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What do you need to provide for a secured loan?

To apply for secured credit, you will need to provide evidence of the value of the asset being secured, or you may be required to get a new appraisal. For example, you may require an up-to-date property valuation to work out how much equity you have.

You’ll also need to provide proof of income and details of ongoing debts and give permission for the lender or credit broker to access your credit history.