How Much Should You Offer to Settle a Debt? UK Settlement Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you having trouble paying your debts and thinking of making a settlement? You are in the right place to find out how much you should offer to settle a debt.

We understand that the idea of making a settlement offer can be daunting; you’re not alone. In fact, over 170,000 people visit our website each month for guidance on debt solutions.

In this article, we’ll cover:

- Understanding what a debt settlement is in the UK.

- Reasons why creditors might accept less than you owe.

- Who usually tries to settle a debt.

- How to offer a settlement.

- The impact of a settlement offer on your credit file.

Our team has handled many debt situations, so we know how tricky it can be. We will help you navigate the process with clear, easy-to-understand advice.

Read on to find out more about settling your debt.

How Much Should You Offer to Settle a Debt?

To get a debt settlement, you need to make a reasonable offer. The size of your settlement offer on your debt will depend on your circumstances and what you can afford to repay.

From experience, the standard settlement offers on debt are usually close to 75% of the debt’s worth. So if you owe £10,000, offering £7,500 might become acceptable.

However, the exact amount your creditor will accept could vary greatly depending on the following:

- Your financial situation

- The nature of the debt

- The creditor’s policies

- Your negotiation skills

Naturally, the bigger your offer, the more chance you’ll have of it being accepted.

How to Make an Offer?

You can make a settlement offer on your debt yourself by negotiating with creditors. Call the creditor or collection agency and ask to discuss a settlement.

You can then provide them with a figure you want to pay in writing to get the debt cleared through ‘partial settlement’.

It is wise to provide information about why you are offering this and maybe state that this is the maximum you can offer.

Some people get anxious when speaking with creditors or don’t trust their negotiating skills. In these cases, you may get someone else to make a debt settlement offer on your behalf.

It may be a friend, relative, or even a reputable UK debt charity. There are even companies that will provide this service for a fee.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When Should You Pay the Amount?

It is essential that you do not make the payment before getting it in writing that you have a settlement offer accepted.

For example, if you are told over the phone that they will accept your settlement and then pay without written confirmation, the creditor could claim later they never formally accepted. The amount you just paid will go towards paying off the debt, but it will not wipe the debt.

Similarly, if you get a debt settlement offer acceptance letter, make sure you make the payment before any end date that the creditor gives. If you make it after this date, it may no longer count as a settlement payment.

Keep in mind that once the creditor accepts your full and final settlement offer and you pay the money, the agreement is legally binding. This means that they agree to write off the rest of the debt so you owe zero balance. But they will mark the debt as partially settled, and that’s how it will appear on your credit file.

Should You Keep Evidence of Payment?

Absolutely. If you have received a settlement confirmation letter, you should keep this as proof of your payment. This is in case the creditor claims later they never agreed to the settlement or that they claim they didn’t receive the payment on time.

» TAKE ACTION NOW: Fill out the short debt form

How Long Does Settled Debt Stay on Your Credit File?

Your settled debt status will remain on your credit file until it naturally drops off. This means any creditor will be able to see that you had a partially settled debt for six years after it was settled.

Why Would Creditors Accept Less?

Creditors may accept less than the amount owed to them for several reasons. For example, if the creditor can get near the full amount quickly instead of instalments that go over many months or even years, they will likely accept the offer.

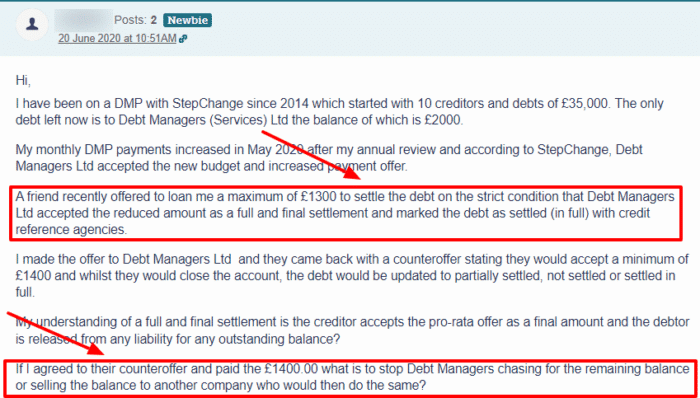

In addition, your creditor may be forced to accept your full and final settlement offer if you tell them that the money won’t be available forever because you have financial hardship. This typically happens when someone else offers to put forward a lump sum to help you pay off the debt. They have to accept, or the offer goes away.

Another reason relates to who owns the debt. Some debt collection agencies buy debt for well below its value, meaning they still make a big profit if you offer less than the money owed.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What If They Don’t Accept the Offer?

If they don’t accept your full and final settlement offer, you might want to make another offer. However, if your previous offer was said to be all you can afford and you now offer more, there is a good chance that the creditor will not believe you.

It may or may not harm any future chances of getting a settlement accepted. Sometimes it is better to make your best offer and get the debt over with.

If your maximum settlement offer is rejected, I suggest you search for other debt solutions to pay off some of the debt gradually. This should be a crucial part of your debt management plan.

After so many months of paying part of the debt off, you might want to offer a new settlement figure. Because you’ve already paid off some of the debt or maybe saved more, you now might have your debt settlement offer accepted.

If you need debt advice on how to make a full and final settlement offer, you may want to consider talking with a debt charity or personal insolvency practitioner. Get in touch with: