Debt Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

We all know how hard it is to compose a technical document. Writing a debt letter might not be the easiest job. Thankfully, we’re here to help.

I explain all you need to know about debt letters and also share a tried-and-tested debt letter template to help you save time and stress.

How to Write a Debt Letter?

To write an effective debt letter, you should follow these important points:

- Use of formal language

- Write in an authoritative tone

- Explain your demands

- List all the relevant details

- Do not threaten

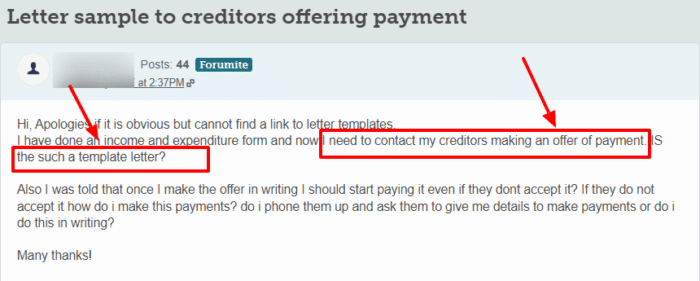

There are different types of debt letters, such as debt collection letters, debt payment messages, and many more.

Let’s discuss each of the 3 most commercially compliant debt letters individually:

1. Debt Repayment Letter

This letter is addressed to the creditor from the debtor, stating some crucial information regarding the repayment of debt.

The sample letters are mostly based on these steps.

- Start with your/business name, address, and date of writing

- Refer to your creditor business/debt collection agency name

- Mention all the information related to your dues

- Write down your proposition for the repayment of money. You might like to include the amount of money you deem right to repay and the period of days you will be able to make the payment.

- While signing off, you can mention your contact number and email or simply write, “Contact us at _____”

Remember: this letter is an official document and might be held as a piece of evidence if, by chance, the matter proceeds in court.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

2. Debt Consolidation Letter

Debt consolidation means to compile your debts against one creditor. This process is done by taking a lump sum money from a bank or a person to pay other creditors.

It is a powerful way to get rid of multiple monthly payments and high-interest bills, for instance, amounts created from credit cards and hire purchase agreements.

This letter is written to institutions such as banks and other creditors who offer consolidation loans for unpaid money.

- You can write your name/business name and the date

- Start by addressing the bank or the individual

- Request a proposal for a loan, mention the total sum you need and give a reflection of your financial situation, discuss the interest rates and other details

- Mention your contact details and sign off the letter

3. Bad Debt Write-off Request

In accounting terms, ‘Bad Debts’ refer to money which has no chance of being repaid.

This letter is a request towards the creditors to remove the amount of money liable upon you or at least review it.

This might be more appropriate to send while you are facing financial constraints and downfalls.

- Start with your name/business name, address, and date of writing

- Refer to your creditor/agency

- Carry out all the information regarding your debt towards them

- Explain your financial situation, the barriers to payment, and your request for the removal of dues

- Sign off the letter with appropriate contact details and regards.

Please make sure that this is a request you will forward to your creditors. Hence, it should be composed in a soft and pleasant tone. However, I will suggest you not adopt a tone which demands pity.

We’ve got a template for requesting debt write off you can download here.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Can I Write Off My Debt?

You can request the creditor to write off the dues you owe them. If they are willing to compromise on that, you might be free of that specific debt.

Here is a template letter you can use:

8 September 2020

Reference # 1234

To: XYZ Limited.

Subject: Removal of dues

Dear Sir/Madam, I regret to inform you that I am unable to pay you the money I owe, due to the recent accident I had, it is not viable for me to work and earn. I have been receiving welfare checks thanks to the county court judgment, they have been able to support my therapy and medical expenses. I would urge you with the utmost humility to please review writing off the debts I owe.

Regards,

Mr/Ms. X

Contact us at 12345678

Bank account # 12345678

*These sample letters are for informational purposes only*

Another effective way is to seek professional management debt advice. This might allow you to create a functional way to easily write off your dues by paying them.

You can seek advice from an independent charity such as StepChange or Payplan.