How to Get a CCJ Removed From Your Credit File

For free and impartial money advice you can visit MoneyHelper.

For free and impartial money advice you can visit MoneyHelper.

Are you worried about a County Court Judgement (CCJ) on your credit file? We understand your concerns. After all, a CCJ can make things tough for you. But don’t worry; we’re here to help you understand how to get a CCJ removed from your credit file in 2023.

Every month, over 170,000 people visit us to get advice on debt-related problems. So, you’re not alone in this journey. In this article, we will help you with:

- What a credit file is and why it is important.

- How a CCJ can affect your credit score.

- Why you get a CCJ and how to stop it from happening.

- Understanding the laws about debts.

- Ways to write off some of your debt.

We have a lot of experience with these issues. We know the cost of removing a CCJ, and we want to share our knowledge with you.

Dealing with a CCJ can be hard. But remember, there is always a way out. So, let’s start working on this together.

Will a CCJ affect my credit score?

Yes, a CCJ can affect your credit score.

Once you have missed a few payments or defaulted on an account with your original creditor – which negatively impacts your credit score, too – and your debt is sold to collectors, it will appear as a second collection account on your credit file, and the original entry may be marked as ‘sold’ which doesn’t look good!

If they don’t add a second entry to your credit file, the entry for your original debt can be changed to add the debt collection company’s information.

These collection accounts will negatively impact your credit. They are visible for 6 years and will impact your ability to get credit or use some credit products during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

You also need to be aware that any debt solutions that you use will also be visible on your credit file for 6 years, and your credit score may be affected. However, once these 6 years are over, your debt solution will no longer be visible, and you may find it easier to get credit again.

» TAKE ACTION NOW: Fill out the short debt form

Can You Stop a County Court Judgment From Being Given?

When you receive notice that a CCJ is being sought against you, you will be sent a county court claim form pack. Inside this pack are several forms. One of which is the counterclaim and defence form. You can fill out this form and return it to the court, providing any evidence you have of why you don’t owe the debt. The court will then take this evidence into consideration when deciding whether to issue the CCJ or not.

In some cases, the court might decide that a hearing is warranted, to get more information from both you and your creditor. In this case, you can appear in court and present your case, and also provide any documented proof of why you do not owe all or part of the debt.

How to Get A CCJ Removed

Our partners at the CCJ Removal Service have a ton of experience with getting CCJs removed.

They will cover the whole process for you – listening your story and advocating for you every step of the way.

The Process

Step 1:

- Establish your legal grounds for removal.

Step 2:

- Mediate with your claimant to establish the terms they’d agree to “Set Aside” the judgement under.

Step 3:

- A barrister drafts the agreement between the parties to get your CCJ removed.

Step 4:

- The court removes or “sets aside” the CCJ from your public record.

It’s a surprisingly simple process.

Fill out our form to get help from our partners at CCJ Removal Services.

Does the Statute of Limitations apply to debts?

Yes, the Statute of Limitations does apply to debts.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

Your creditors then have 6 years after the first CCJ ended to apply for another one.

Getting a County Court Judgment Removed From Your Credit Report

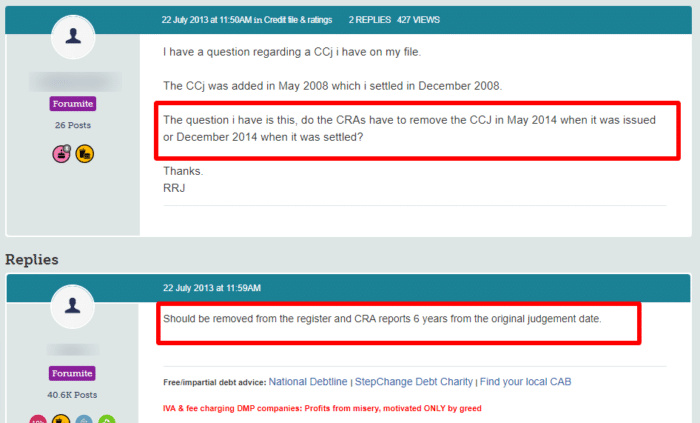

Once a CCJ has run for the full six years, it will automatically be removed from your credit file, even if you never paid the debt. Put simply, for a satisfied CCJ removal is automatic. However, if you paid the debt within 30 days of the CCJ being issued, or you can prove to the court that you do not owe the debt that the CCJ was issued for, you may be able to have it removed from your credit file.

If you want to ask the court to set aside the CCJ because you don’t actually owe the debt, you would send the court a completed CCJ removal form N244. You would also need to pay the CCJ removal cost of £275. Once you send this form and fee to the court, it will review the CCJ and remove it from your credit file if it decides that this is warranted.

However, in some cases, the court might simply change the CCJ on your credit file. Your credit report will still show that you were issued with a CCJ, but that you did then pay the debt back in full. This can actually be a good indicator of your creditworthiness. As it shows any potential lender that you take your financial obligations seriously, and have solved the financial problems that resulted in you being issued a CCJ in the first place.

What is a ‘satisfied’ and an ‘unsatisfied’ status?

All CCJs are listed as ‘satisfied’ or ‘unsatisfied’ on the Register of Judgements, Orders and Fines.

Satisfied means that you have paid in full. Unsatisfied means that you have not paid in full.

If you think that this is wrong or it has been more than one calendar month since you paid off your debt, you can give the court evidence that you have paid your CCJ and have the record changed.

All satisfied entries are kept on the register for 6 years.