N244 Form for CCJ – Where to Send and What to Do?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to understand a form called N244, and how it links to a County Court Judgement (CCJ)?

You’re not alone. Every month, over 170,000 people visit our website for guidance on dealing with debt. In this easy-to-read article, we’ll share some answers:

- What a Form N244 is used for.

- Good reasons to set aside a judgement.

- Where to send the N244 form.

- How to complete an N244 form online.

- How much an N244 application costs.

Dealing with debt can be quite scary, and unfortunately, it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, you’re not alone. We’re here to help you figure things out.

What is a Form N244 Used For?

An N244 form CCJ is an application notice that needs to be completed if you want to set aside a County Court judgement.

This form is also required if you want to get a new payment arrangement, or you want to apply to get an enforcement process suspended.

You can get an N244 form from the court office that issued the CCJ.

Don’t get this form mixed up with an N245 form. An N245 form is required when changes to the terms of a payment arrangement need to be made.

What Should be Included along with N244?

In addition to the form itself, you need to include supporting documents for N244.

You can strengthen your case if you can back it up with evidence. For example, copies of bank statements can help your case if you plan to dispute the amount claimed.

You will also need a detailed financial statement to prove you cannot afford the payments.

Where Do I Send it?

Once you have completed an N244 form, submit it to the relevant court office.

The N244 form submission process is incomplete until you’ve let the claimant know you have done this.

If you don’t get a form from the court office, it is available online in PDF form from the government website, along with notes for guidance.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can You Complete an N244 Form Online?

You can download and complete an N244 form online before printing it off and submitting it to the relevant court office.

Make multiple copies of the form, and your supporting documentation, so that you have enough to submit a copy to each party and to the court.

You should also make a copy for yourself.

» TAKE ACTION NOW: Fill out the short debt form

Do I have to attend court?

Yes, you may have to attend court to dispute or set aside the CCJ.

This usually takes place at your local hearing centre in front of an impartial judge. Sometimes the claimant or their representative will also be present.

During the set aside CCJ hearing, the judge will determine whether you have an “arguable” defence. However, they will make a final decision on whether or not your defence is correct.

More hearings may be needed as part of the normal CCJ process for a defended claim to make a final decision.

You may use HM Courts and Tribunal Services to defend your claim.

But keep in mind that if the court thinks you don’t have a sufficient defence against the claim, the judgment will stand.

How Much Does an N244 Application Cost?

There is no charge for an N244 form CCJ. However, you may have to pay a fee of £275 when submitting the form.

In England and Wales, you may be able to get help with court fees if you have no savings and you have a low income or receive certain benefits.

For example, the court may reduce the fee if you are unemployed or can demonstrate hardship.

You may also qualify for legal aid even if your income is higher. Use form EX160A (Court and Tribunal fees) to check if you’re eligible and apply for help with your N244 form fees.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Steps to complete the form

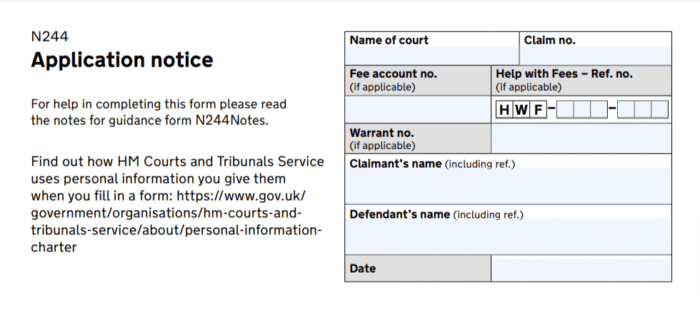

Case Details

Follow the form N244 guidance below to complete your form correctly.

Name of Court: Write the name of the court where the case was heard, or where it’ll take place.

Claim no: This can be found on court documents

Fee account no: Leave blank

Help with Fees: Leave blank unless you’re applying for help with court fees.

Warrant no: If the claimant applied for a warrant of control, you will find the warrant number on an enforcement notice. If not, you can leave this box blank.

Claimant’s name: This is the name of the company that obtained a CCJ against you. If they have a legal representative, enter their reference number in brackets after their name.

Defendant’s name: Write your full name

Date: This is the date you filled this form out

Application Details

Question 1: Write your full name

Question 2: Put an ‘X’ in the ‘Defendant’ box, and write ‘N/A’ in the box by ‘If you are a solicitor whom do you represent?’

Question 3: State the order you’re applying for and the reason why

Question 4: This question refers to the CCJ. Put an ‘X’ next to ‘Yes’ if you’ve received help or advice from a solicitor or agency

Question 5: Most people are expected to attend a hearing. You don’t have to attend a hearing for the following reasons;

- all the parties agree to the terms of the order being asked for

- all parties agree not to attend a hearing

- the court doesn’t think it’s appropriate

Remote hearings are available when at least one of the parties is legally represented.

Question 6: Leave this blank if you don’t know

Question 7: Write ‘N/A’ unless you have been allocated a trial date or period

Question 8: Leave blank unless you know your case is being dealt with by a Master, District Judge or Judge

Question 9: Write the claimant’s name here

Question 9a: Write the claimant’s address here

Evidence

Question 10: Tick the relevant box.

The two relevant options for setting aside a judgement are ‘the statement of case’ and ‘the evidence set out in the box below’.

Include as much supporting information as possible. Again, based on my own experience, this will increase your chance of getting your judgement set aside.

Statement of Truth

The final section is the Statement of Truth. Sign this statement and fill in your details.

N244 Form CCJ Details

| Contact Details for Courts and Tribunals | https://www.gov.uk/find-court-tribunal |

| N244 Form | https://www.gov.uk/government/publications/form-n244-application-notice |

Good Reasons to Set Aside a Judgement

In special circumstances, you can use the N244 form to ask a court to set aside a judgement. You need to have a good reason in order to get the judgement set aside.

Good reasons for setting aside a judgement include:

- You missed a court hearing

- You failed to submit court papers due to extenuating circumstances

- You didn’t receive the claim because it was sent to the wrong address or due to problems with the post

- You submitted a response to the claim on time, but the claimant ignored this or moved to court too quickly

When a CCJ is set aside, it means that the judgement is, effectively, cancelled. As a result, it is removed from your credit history. However, that doesn’t mean that the debt suddenly disappears or that the court action is halted.

Setting aside a CCJ simply implies that the claimant and the debtor are returned to their original position just before the judgement.

So, if you were planning to dispute the debt claim when it was first issued but could not, you now have a second chance to do this.

Court Hearings

If a court judgement or order has been granted against you because you’ve missed a court hearing date, you can apply to get this set aside so that a new hearing date is allocated.

From my experience, you have a higher chance of getting your judgement set aside if you submit the N244 as soon as possible, your chances of success at the original hearing were high, and you have a good reason for missing it.

Court Papers

Debtors can receive a CCJ if they fail to submit court papers on time.

However, this might happen for plenty of reasons, and it is not always the debtor’s fault. As I see it, it is up to the creditor to follow the proper claimant process and send you the right court documents for CCJ.

Furthermore, if the claimant doesn’t follow the correct process, there is a chance the judgement will be set aside.

Statute Barred

You can successfully get a CCJ set aside if you can prove your debt was statute barred at the time the claim was made.

To meet the criteria, statute barred debts must be at least 6 years old.

Additionally, in the past 6 years, it must have remained unacknowledged and left unpaid, and a CCJ must not have been granted against you.

A CCJ is removed from a debtor’s credit history once it is set aside.