How Long Can Energy Companies Chase You for Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Worried about how long energy companies can chase you for debt? You’ve come to the right place for answers. Each month, over 170,000 people visit us for guidance on debt worries.

This guide will answer your questions:

- How long can an energy company charge you for unpaid bills?

- What happens if your energy bill is more than 12 months old?

- Can energy debt be written off after 6 years?

- Can you be taken to court by an energy supplier?

- Will unpaid energy bills affect your credit score?

According to Citizens Advice, disabled people, single parents, and low-income families earning less than £29k are expected to be the most affected by energy debt this winter, with many facing difficult choices like heating or eating.1

This can be concerning, but we’re here to help you understand how to handle debt collectors and ways to avoid having your electricity cut off.

Let’s dive in.

Bills which are more than 12 months old

Can providers chase you for an energy bill over 12 months old?

Under Ofgem ‘back billing rules’, an energy supplier can’t chase debts which are more than 12 months old if the reason that they are chasing the debt is down to their own mistake or omission.

A mistake could be that the bill was based on an inaccurate reading and therefore the amount is in question.

An omission could be that they didn’t send you a bill at the time.

In order to have debts over 12 months old written off, you must be able to show that the supplier failed to calculate the bill correctly or did not serve the bill in time.

You are obliged to pay any old or outstanding bills which do not fall under the above categories.

Can my electricity be cut off without warning?

No, gas and electricity companies can’t cut you off without warning. You must be offered a range of payment methods to help you keep up with your bills.

You can be cut off, but only as their last resort and you must be given notice before they do it.

- Electricity suppliers need to give you seven working days’ notice in writing that you are going to be disconnected for non-payment

- Gas suppliers need to give you seven days’ notice in writing that you are going to be disconnected for non-payment.

These are the minimum notice periods that companies have to offer. Some companies may give longer notice periods if it’s their policy.

You could contact your water company provider to find out if you need to.

You should contact your local council if you think that you might be disconnected from your gas or electricity supplier.

They might be able to help you avoid this by putting you through a local welfare assistance scheme.

If you have children living with you, contact social services. They may be able to reach out to your supplier and give you more time to pay.

Under The Children Act 1989, social services may even be able to make a payment to stop you from being disconnected.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if you don’t pay your bill?

If you don’t pay your energy bill and you don’t have a prepayment meter installed, it is often difficult for an energy company to cut off your electricity or gas supply, even if they wanted to.

However, your electricity provider could pass your information on to a debt collection agency.

They could also get a court order to install a prepayment meter in your home or, if you already have a smart meter, they can remotely switch this to a prepayment setting.

In many cases, you will be charged for administrative fees.

A similar process may happen if you don’t pay your gas bill.

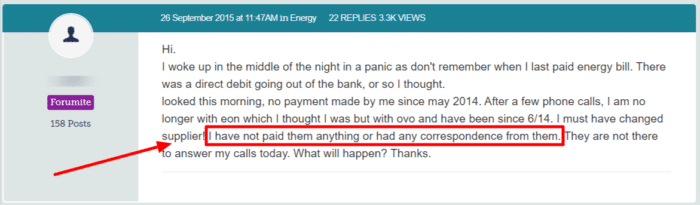

But sometimes we don’t pay without even realising it! Take this person who suddenly realised they hadn’t paid their energy bills.

They will probably find that they are back billed for 12 months of usage but will be able to negotiate a repayment plan.

It’s not their fault that their energy supplier hasn’t contacted them!

Debt Solutions

Dealing with energy debt can be challenging. But don’t worry, there are different debt solutions that can help you.

These are:

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

Will it be written off after 6 years?

If you do not pay the debt at all, the law sets a limit on how long a debt collector can chase you. After 6 years of non-payment, your debt has become statute-barred.

The 6-year timer starts on the date of your last unpaid bill or your last written acknowledgement of it.

After 6 years have passed, the debt is not enforceable.

This means that your energy company can’t chase you for the debt through the courts and there is no legal way for them to force you to pay. Your energy company can contact you and request that you pay but you can’t be forced.

The debt is not technically written off and still exists, there is just no way for you to be made to pay it.

Keep in mind that your debt can’t be statute-barred if your energy company has already filed a County Court Judgement (CCJ) against you.

If a CCJ is filed within the 6-year window, then your debt will always be enforceable and your energy company can force you to pay your arrears.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long can water companies backdate bills?

Under the statute-barred debt rules, water companies have 6 years to backdate bills. This could be for water bill arrears, or to correct an undercharge.

This means that they can charge you for up to 6 years of unpaid water and sewage bills.

Each water company will have different policies for back billing and missed payments so you should contact your provider and find out what your options are.

You may be able to negotiate a repayment scheme to make your debt more manageable, or even work with a hardship fund to make some of the payments for you.

If you rent your home, double-check the terms of your lease. You may find that your landlord is actually responsible for the backdated water bills and not you.

Can I get it written off?

Yes, you can get your energy debt written off if your bill is more than 12 months old and the bill is in error.

Where the bill is accurate and you are struggling to pay your energy bill, there is still a small outside chance that you could get your debt written off, or at least part of it.

If your income and outgoings mean that there is no money left over to pay the debt, you can write to your energy company explaining the situation and ask them to help.

We have created this free template letter which you can send to your energy company in order to ask them to help in this way.

Your energy company may ask you to fill in a form which asks you to confirm your income and outgoings. They may also ask for proof of your financial position. If you can prove that you are simply unable to pay, the energy company is obliged to recognise this, and not make attempts to extract money that you don’t have.

Keep in mind that energy bill forgiveness or complete debt cancellation is quite rare.

Even if they don’t completely write off your debt, they may still waive late payment fees or charges, or they may be able to offer you a payment plan which you can afford within your means.

» TAKE ACTION NOW: Fill out the short debt form

Where bills are causing you distress

Missed payments can lead to overwhelming bill reminders and even harassing communications from your creditors.

You can see the government guidelines for water companies whose customers have fallen behind with payments here. You can refer your water company to this guide if their approach is causing you distress.

An example of a practice which causes distress, and is recognised by the government as being unacceptable, is where there is too high a frequency of letters (or other communications) asking you to pay, or reminding you to pay.

Legally there is a fine line between reasonable requests by energy and/or water companies for you to pay bills and harassment.

The best way to get out of this issue is to pay off your bills as soon as you can.

You can contact your companies and ask for a repayment plan. You can then look to pay off your priority debts as quickly as possible because this will make your finances easier to manage.

What does OFWAT do?

The Office of Water Services (OFWAT) is a governmental regulatory body that regulates water companies and helps protect their consumers.

OFWAT has a mandate that focuses on customer protection and empowerment. For example, they have taken some steps to protect customers from unnecessary harassment by water companies.

They have stopped water companies from chasing under-charged customers for debt for more than 16 months. This means that for some business customers, water companies can backdate bills up to a maximum of 16 months instead of the 6 years as given by the Limitation Act 1980.

If you have any queries about your water bill, it may be a good idea to contact OFWAT for some advice.

If you can’t pay

If you are in a position where you simply are unable to pay, as long as you communicate this to your energy company promptly and openly, and are willing to provide evidence to back up your claim (that you cannot pay), it would never be in anyone’s best interest (including the interests of the supplier) to take you to court.

The first thing to do if you cannot pay is to contact your energy company directly and inform them that you are unable to pay your energy bill either in full or in part.

Your energy company may ask you to provide evidence of your income and outgoings and if it is obvious you cannot pay, they should offer you a payment plan which is within your means.

Your bill can be passed to a debt collector

If you don’t let your energy company know that you are struggling and instead simply let the bills lapse, then the energy company may pass the debt onto a debt collector.

A debt collector is just a specialist company focused on debt collection, they have no special powers, they are just specialists at dealing with debt, so there is still no need for alarm if this happens.

The best thing to do is to keep communication with the debt collectors prompt and transparent.

If you are open and honest with them, the debt collectors should assist you in finding a way to pay back the debt in a way that you can manage.

Will it affect my credit score?

Yes, any missed payments to your utility providers will negatively affect your credit score.

Any payments that you miss will be visible on your credit file for 6 years. You may find it difficult to secure credit while your missed payments are visible in your file.

This is because you are now flagged as someone who may have trouble paying off their debts, making you a ‘high-risk’ customer in the eyes of your prospective creditors.

If you live in a property with a prepayment meter, this will not be visible on your credit file. This is because you pay in advance for your energy so there is no credit needed.

Vulnerable people

If you are suffering from mental health issues or are suitably vulnerable and would find such entry into your home ‘severely traumatic’, you must let the energy company or the court know this, and the energy company may be prohibited from entry.

If you are experiencing severe financial hardship, you must let your energy company know and in some cases, you will not have to pay anything at all, even with a prepayment meter installed.

Bear in mind that the energy company will always try and find ways to make you pay because it is their job to collect money for their service.

It is up to you to stand your ground if you are unable to pay and be persistent in repeating this fact to them, even if they are suggesting you pay what you cannot afford.

For more information please read our article Prepayment meter debt 2022.

You can also read about your rights with regard to prepayment meters on the Ofgem site here.

Ofgem is the national independent energy regulator, in place to protect consumers, especially vulnerable people.

Can I get a debt solution?

As utility bills are unsecured debts, they can usually be included in a debt solution.

If you owe multiple debts or just can’t manage the debts that you have, a debt solution might be able to help you get back in control of your finances.

If you are considering a debt solution then you should check out my guide to know what your options are. You can get much more detailed advice by contacting a specialist.

You can get free debt advice or debt counselling services by contacting any of the following organisations: