Ovo Energy Debt Collection – Pay or Ignore?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you being chased by Ovo Energy debt? It can be a worrying time. Luckily, you’ve come to the right place. Every month, more than 170,000 people visit our site seeking advice on debt matters.

In this article, we’ll provide answers to key questions, such as:

- What happens if you can’t pay what you owe to Ovo Energy?

- Is it possible to lessen some of your Ovo Energy debt?

- Can Ovo Energy take you to court?

- Will an unpaid Ovo Energy debt affect your credit score?

- Can you switch energy suppliers if you have debt with Ovo Energy?

Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their bills in the first half of 2023.1 So, rest assured you’re not alone.

We know it’s a tough situation, but we’re here to guide you every step of the way.

What to do about your Energy debt?

Always keep in contact with the supplier when you fall into debt.

If you have any questions about the debt, one of their support team should provide support and advice.

Also, it’s the best way to determine whether the debt is yours and that it’s correct! Therefore, I find that asking the supplier for a proof of debt letter as soon as possible is a wise move when dealing with energy debts.

Note: Do NOT ignore the problem because it will not go away. In fact, Ovo Energy could refer your details to a debt collection agency! One of the agencies the supplier uses is IMFS.

Instead, contact Ovo Energy customer support as soon as possible.

Stay active

Don’t ignore any letters or correspondence you’re sent.

When you stay active, and in touch with the supplier, they may offer you a better deal. In short, the amount you owe could be reduced.

I suggest you:

- Hold onto all the correspondence you sent and received from the supplier

- Keep a diary of dates and times you spoke to someone from Ovo, a debt collection agency or a litigation agency

- Jot down the names of the people you talk to

Do NOT ignore debt collectors because the problem will not disappear.

What to do when a debt collection agency contacts you: ovo energy scams

When a debt collection agency contacts you, make sure they are a legitimate debt collection recovery company and that you owe the debt.

According to the Financial Conduct Authority (FCA), it’s up to the debt collection agency to prove you owe the money.

Also, it’s up to them to verify the amount is correct!

You can ask Ovo Energy for ‘breathing space’ if you owe them the money. It’ll stop debt collectors from contacting you while you sort out your debt!

» TAKE ACTION NOW: Fill out the short debt form

Are debt collectors allowed to force entry?

No, a debt collector cannot force their way into your property.

Plus, there’s a code of practice for debt collectors which they must follow.

However, until the debt is settled, they will return again and again. Ovo Energy uses IMFS debt collectors, but they may employ others!

My advice? Stay in touch with the debt collection agency and try to set up a realistic repayment schedule if you cannot afford to pay the amount in full!

Can they take me to court?

Yes. When the debt remains unpaid, Ovo could start legal proceedings to recover the amount you owe them.

It’s one of the consequences of unpaid Ovo debts. But this is done as a last resort.

My advice? Don’t ignore any correspondence you get from the provider or other official-looking documents!

Will an Ovo debt affect my credit rating?

Yes, your details will be sent to a credit reference agency if you don’t pay the amount you owe. The effects of unpaid energy bills on credit reports are damaging.

Ovo uses Experian, and when there’s a default notice on your credit report, it’ll negatively impact your ability to borrow money.

Note: A default notice stays on your credit report for six years.

What happens when you can’t pay what’s owed?

Contact Ovo as soon as possible. Stay in touch with the supplier and let them know you can’t pay what’s owed because of Financial hardship and Ovo Energy should up a repayment schedule you can afford.

Note: You must try to keep up with the new payment arrangements with Ovo Energy to avoid further trouble.

Energy Debt Solutions

Being chased by debt collectors can be quite concerning. But don’t worry, there are different debt solutions that can help you deal with them and pay off your bills.

These are:

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How long can energy companies chase you for debt?

There is a six-year debt rule in the UK.

As such, Ovo energy can pursue the debt for 6 years. If there’s a CCJ, the time limit starts from when the judgement is issued.

After this, the debt could be written off if:

- You didn’t make any payments to them over the six years

- You didn’t acknowledge the debt to them in writing

- A CCJ is not registered against you

When the above applies to the debt, it becomes ‘statute barred’. In short, the energy provider cannot pursue you for the debt by taking court action.

What if the debt is wrong?

If you feel your Ovo energy debt is wrong and you’ve received a letter or call from a debt collector, make sure you actually owe the debt!

You have the right to dispute incorrect energy bills.

According to the Financial Conduct Authority’s guidelines, a debt collection agency has to prove you owe them money and the amount is correct.

My advice? Ask Ovo for a ‘breathing space’. This puts everything on hold for 60 days. It gives you time to sort things out before they spiral out of control!

Next, check the Ovo Energy code of practice for helping customers who find themselves in financial trouble.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Who is Ovo Energy?

Ovo Energy UK is one of the leading energy suppliers in the UK and has been around since 2009.

They provide millions of households across the UK with power to their homes. They are a British-based company based in Bristol.

Note: SSE Energy is now part of Ovo Energy service provider.

Understanding Energy Tariffs and Their Impact on Debt

The energy provider offers customers several Ovo Energy price plans which I’ve listed here:

- Electricity only plans

- Dual fuel plans

- Fixed price energy tariffs

If you’re struggling with money and finding it hard to pay an OVO bill, it might be worth finding more affordable energy plans in the UK.

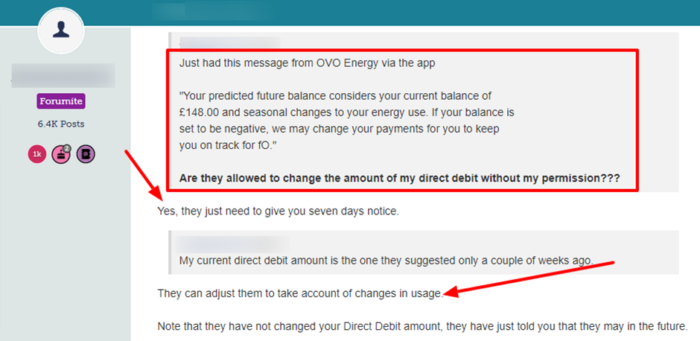

Check out this message posted on a popular online forum about OVO changing a customer’s direct debit:

Source: Moneysavingexpert

Are they going bust?

Ovo Energy plans to cut costs by cutting a quarter of its workforce.

This translates to 1,700 jobs out of 6,200 being laid off due to the energy crisis.

Many energy providers are suffering as a result of the pandemic and the rising cost of gas and crude oil over recent times. Ovo Energy cost-cutting measures are just one part of the energy crisis.

Ovo Energy Contact Details

| Ovo Energy head office: | 1 Rivergate Temple Quay Bristol, BS1 6ED |

| Ovo Energy official website: | https://www.ovoenergy.com/ |

Where else can I get support and advice about an Ovo Energy debt?

Some charities and organisations help people who fall into energy debt.

Always seek independent advice before doing anything else. But don’t ignore the letters and calls you get from a debt collection agency!

Here’s a list of charities and organisations worth contacting when getting help with Ovo Energy debt:

Never ignore any official-looking letters you get when you’re in debt. In addition, stay in touch with the supplier and the debt collection agency.

Ignoring them will not make the problem go away.

Plus, contacting charities assisting with energy debt could be invaluable.