JC International Acquisition LLC Debt Collection Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a surprise letter from JC International Acquisition LLC about a debt? Don’t worry; you’re in the right place to find help.

Each month, over 170,000 people come to our website to learn about debt. They feel confused and worried, just like you might feel now. We’re here to help you understand what’s happening and what you can do about the situation.

In this article, we will explain:

- Who JC International Acquisition LLC is and why they might be getting in touch with you.

- How you can check if the debt is really yours.

- What you can do if you can’t afford to pay the debt.

- How you can set up a plan to pay the debt in a way that works for you.

- How you can stop JC International Acquisition LLC from bothering you.

A significant survey completed by StepChange UK found that 83% of the 1794 clients included had at least one creditor who did not take their vulnerabilities into account1. So, we understand that being contacted by debt collectors can be scary.

Let’s find out more about JC International Acquisition LLC and what you can do if they contact you!

JC International Have Contacted You

If you’ve received a letter, call or even visit from JC International Acquisition LLC Debt Collectors, do not panic.

People find themselves in debt for all sorts of reasons. This might include losing a job, going through a divorce, or the emergence of problems beyond their control. It may be that you’ve been trying to pay off a number of debts and hit problems further down the line.

In this guide, we’ll discuss everything you need to know about JC International Acquisition and what your options are.

First, Take a Deep Breath…

The first thing to realise is you’re not alone, and there’s plenty of help at hand from people who will not judge you.

So try not to get too stressed at this point. It is, however, important to meet the problem head-on and you can do this by getting in touch with the creditor or the debt collectors chasing you to acknowledge their letter.

We’ll explain the best way to reply later in our guide.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do You Owe Money to JC International Acquisition LLC?

If you receive a letter from JC International Acquisition, then it is likely that you owe them money, but it’s not a certainty. Ensure you read the letter through a few times, it will be related to a debt you may owe, and it may not come to mind immediately.

The original debt could have been with another company and it is normal to be confused at first, which is why you should calmly check every detail.

It’s common for debt collection agencies to buy billions of debt annually at rock bottom prices – at an average of 10p to £1! 2 JC International Acquisition buy and collect debts from other companies, so you need to work through who you might have outstanding debts with.

You could look up your credit record and credit rating to see if anything is flagging.

Typical Debt Collection Process

It’s common to feel confused and concerned when you receive a letter from JC International Acquisition. However, don’t worry; this is quite common, as it’s part of the initial stage of the debt collection process.

Below, you’ll find a quick table outlining the typical debt collection process. Understanding it can help you manage your financial situation. If you’d like more information, please read our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

How do You respond to JC International Acquisition?

You should respond to the JC International Acquisition debt letter in the same way whether you know about the debt or you think there has been a massive mistake; you should first request proof you owe the debt!

It is JC International Acquisition’s responsibility to prove you owe the debt. This will clear up any mistakes they may have made, and it could get you out of paying if they have lost the proof. Even in the worst-case scenario that they do eventually provide proof, at least you will have bought some time.

What if your debt is statute-barred?

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable.

It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred! Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for a while.

If you think that your debt is statute-barred, you should know that writing to JC International about it won’t reset the 5 or 6-year timer.

You can use our free statute-barred letter template to structure your letter.

What Is a JC International Account?

If you owe money to JC International Acquisition debt collectors, they will create an account in your name. This account will include details about the debt and how much you owe. You might need to clear this account debt or face legal action.

There are situations where you will not have to hand over a penny. We will walk you through these examples later in this guide.

Where can you access your JCIA account?

You can access your JCIA account by heading to their account login page. You should have received login details through the post, so keep the letter safe for future reference.

I Can’t Afford to Pay the JC International Acquisition LLC Debt, Help!

If you can’t afford to pay back JC International Acquisition in one go, then you might want to ask about a repayment plan.

The good news is that JC International Acquisition LLC is known to offer its ‘clients’ a repayment plan as an option. This monthly payment arrangement will enable you to spread the cost of the money owed across a time frame that works for you. You may be charged interest for this.

There are several insolvency options depending on the total amount you owe and your personal circumstances.

We recommend speaking to a debt charity before you start your application for a debt solution.

Their advisers will be able to walk you through your options in detail and find out which option which will work best for you. There are several organisations that offer this type of free financial advice and free debt counselling services:

» TAKE ACTION NOW: Fill out the short debt form

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible.

You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Can You Make Payments to JC International Acquisitions LLC?

If you do agree to a payment plan to spread out your debt repayments, there are a few payment options for JCIA.

You may be able to pay over the phone or online using a credit card. Some debt collectors have online portals you use to make payments online.

How to Negotiate a Client Payment Plan with JC International Acquisition

To arrange a payment plan to repay the debt over time, you will need to speak directly with JC International Acquisition staff. This can be daunting.

Whether you get help or stand strong along, the most essential pre-call task is to work out your budget. Take a look at your essential outgoings and income to work out how much disposable income you have left to pay back.

If you do not do this you could end up struggling with debt for a long time. Agreeing to pay or more (either voluntarily or by pressure) may cause other debts to materialise.

JCIA Holdings LLC Are Pressuring Me…

If you are receiving lots of phone calls from JC International Acquisition LLC, or maybe their debt collection field agents are turning up at your door to discuss a payment plan, there are some tricks you can use.

It is your legal right to ask for any agreement to be put in writing for you to consider. You can take 30 days to assess their offer and start negotiating. This may give you time to source further free debt advice and make a decision.

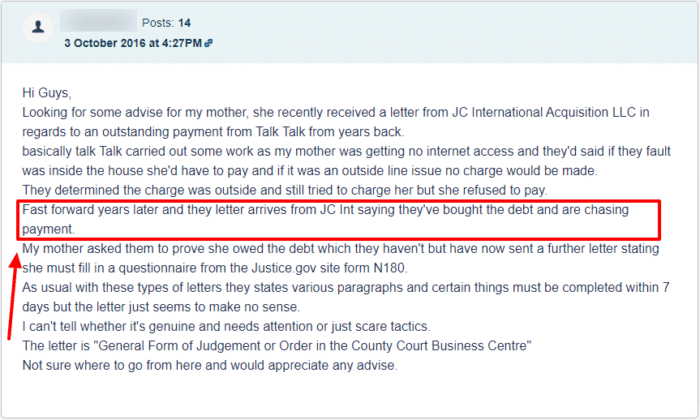

Read A Real JCIA Experience

The below experience found on a debt collection agency forum highlights how JC International Acquisition LLC will make people feel scared and vulnerable.

Using complex forms and terms is not allowed, and they must clearly explain the processes they are using with customers. These rules apply to all debt collectors.

This person should speak to a debt charity for some advice. If the debt is years old, it could be statute-barred and, therefore, not enforceable.

We discuss statute-barred debts in detail below.

Can You Avoid Debt Collectors?

The best way to deal with debt collectors is to avoid them altogether.

You can prevent your creditor from selling your debt to a collection company, like JC International Acquisitions, by keeping up with your repayments.

If you know that you are going to struggle to make some payments now or in the future, your best bet is to tell your creditor as soon as possible. If you are open with your creditor and give them a heads-up that you probably won’t be able to stick to your original payments, they might be less likely to send your information to a debt collector.

If you are in these early stages of missed debt payments, we recommend speaking to a debt charity. They will be able to offer you specialist and detailed advice and help you draw up a budget or even how to negotiate with your creditors to avoid debt collectors completely.

How to Complain About JC International Acquisition LLC

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Reporting misconduct by JCIA will help keep you protected from unfair debt collection practices and also help prevent it from happening again.

Make your first complaint to JC International so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, JC International Acquisition may be fined. You could even be owed compensation.

How to Prepare for a FOS Complaint Against JCIA?

There are no hard and fast rules about what to supply to The Ombudsman when complaining. The more evidence of JC International Acqusiition LLC breaking the rules the better. This could be recorded calls or call logs of their frequence, or even hard copies of letters.

You may be able to get some support with your application from a debt charity. We have linked some options at the bottom of this page.

Many of these groups will also offer free legal advice if you are in particularly difficult circumstances.

Contact JC International Acquisition LLC

| Address: | 5th Floor, MidPoint, Alencon Link, Basingstoke, RG21 7PP |

| Phone: | 0203 437 0310 |

| Email: | [email protected] |

| Website: | https://www.jcia.co.uk/ |

Email Address: [email protected] (this is the email address of a director by the name of Peter Copperwheat publicly listed on the Creditlink Account Recovery Solutions website. The other option is the contact form.)

JCIA Social Media: No active posts

You’re Now Equipped to Deal with JC International Acquisition LLC

The landscape of dealing with a debt problem has changed greatly over the years, and as you now know, lots of help is available. You should feel like facing JCIA confidently is possible.

Try and act calmly and face the problem head-on. And remember these wise words from Financial Expert Martin Lewis, who said: “I have yet to come across a debt case that could not be resolved.”

Make sure to use the letter guides we have linked throughout this article. They will make replying to the threats of all debt collectors less stressful.