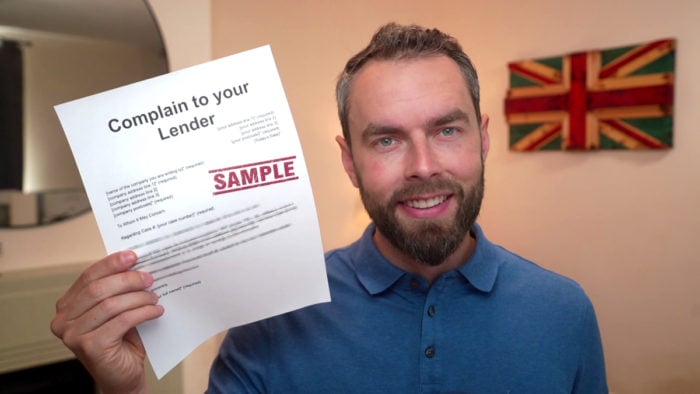

Complain to Your Lender – Sample Letter Template

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you seeking to write a letter to complain about irresponsible lending? This article will guide you in the right direction. Every month, over 170,000 people visit our website for advice on solving debt problems.

In this guide, we’ll explain:

- How to write a letter of complaint to your lender.

- When and why you might want to complain about a lender.

- What irresponsible lending is.

- How you can claim for irresponsible lending.

- What to do if you get no reply.

We know that writing a formal letter can be tough, especially if you’re concerned about a debt problem.

But don’t worry, we’re here to help. We’ve included a sample letter template to make things easier for you.

Complaint Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

I would like to make a complaint against your company. The details are set out below.

[explain the nature of your complaint]* (required)

If you fail to resolve my complaint within eight weeks, or if matters are not settled to my satisfaction, I will have no alternative but to escalate my complaint to the Financial Ombudsman Service. This could result in you being ordered to pay compensation if my complaint is upheld.

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save it in any document format you like.

Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

Why might you complain about a lender?

You might want to complain about a lender for an array of reasons, but some of the most common complaints are about:

- Harassing calls and texts

- Irresponsible lending

If you want to complain about a lender for another reason, you should read on and download the applicable creditor complaint letter template above.

What is classed as irresponsible lending?

Irresponsible lending, also known as unaffordable lending, is when a creditor gives you a credit agreement that you are not suitable for – and could plummet you into debt.

Creditors must only lend to people who can pay the money and any interest back on time.

They must carry out extensive checks to do this.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you claim for irresponsible lending?

Lots of UK lenders, especially payday loan providers, have been found to lend irresponsibly.

As a result, they have been hit with heavy fines, had their licenses stripped by regulators, and had to cancel the credit agreement.

If you use our lender complaint letter template to claim for irresponsible lending, you might get a loan refund.

How do you file a complaint?

You should always complain about a lender directly with the lender first.

You should do this in writing and keep a copy of the letter. It’s also recommended to use a recorded or tracked delivery service for proof of your complaint in case it needs to escalate.

If the creditor does not respond to you in a reasonable time or they do not respond in a way you would hope, you can escalate the complaint to the Financial Ombudsman.

You should not go straight to the Ombudsman.

Our free letter template for complaining about irresponsible lending is step one!

» TAKE ACTION NOW: Fill out the short debt form

How long should you wait for a reply?

You should expect a reply to your creditor complaint letter within eight weeks.

If you have not heard back by then, or they have responded without resolving the issue, you can escalate your complaint to the Financial Ombudsman.

Provide as much evidence and information about your complaint to the Ombudsman, and they will come to an impartial decision.

You might get a credit refund if your creditor gave you credit when they shouldn’t have.