Link Financial Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you stressed about a letter from Link Financial Debt Collection? Are you puzzled about where the debt came from or if you should pay it at all?

You’ve come to the right place. Every month, over 170,000 people visit our website for guidance on matters just like this, so you’re not alone.

In this guide, we’ll help you understand:

- Who Link Financial Debt Collectors are.

- If you really owe the money they claim.

- The ways you can stop them from contacting you too much.

- How to protect your mental wellbeing during this process.

- Your options to set up a payment plan or even write off your debt.

A significant survey completed by StepChange UK found that 30% of the 1794 clients included had experienced unfair treatment by a debt collection agency1. So, we understand that dealing with Link Financial Debt Collection can be scary.

We’re here to help you navigate this journey.

Do You Owe Money to Link Financial Debt Collection?

Link Financial will send a letter to your address telling you that you owe them or their client money – and they are the company employed to collect the debt.

These letters are known in the industry as LBA letters (Letter Before Action) because they give you a chance to pay or make arrangements to pay before further legal action is taken. Every debt collection company will use these letters.

They may follow this up with an email and frequent calls.

Keep in mind that these could be empty threats – sometimes debt collectors chase people for money that you don’t have to pay. This is why we always recommend verifying debts before you pay them off.

Check if you really owe the money

Are you sure you really owe the money? The first thing to establish is where the debt started and how much you really owe.

It is quite likely that the original debt if there was one, has been inflated by various charges and interest. It could be substantially more than you believe you owe.

You should write to Link Financial Debt Collectors and demand a copy of your original credit agreement. If they are unable to provide this, you have no obligation to make any payment to them.

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When Not to Request Proof

There are two occasions when you should not send Link a prove the debt letter. These are:

- When the debt collection agency already supplied proof in the LBA

- When your debt is statute-barred

A statute-barred debt is when a debt has become too old to be collected.

Debts become too old to be legally enforced when they are six years old (or five in Scotland), and the person responsible for the debt has not acknowledged or paid any of the debt in the previous six years.

We recommend consulting a debt advice company or charity to assert whether your debt is statute-barred. And if it is, use our free statute-barred templates to send a professional and clear message to Link.

Please note that statute-barred debts are not the same as wiped debts. The debt still exists, but because it is too old to be discussed in court as per

The Limitations Act 1980, debt collection agencies can never force you to make a payment on it.

You also need to keep in mind that some debts will be enforceable for much longer! Any debts owed to HMRC, for example, will not be statute-barred for up to 20 years.

If your creditor issued a County Court Judgement (CCJ) against you before the limitation period ended, this debt will always remain enforceable.

» TAKE ACTION NOW: Fill out the short debt form

How do you make a payment to Link Financial?

Not surprisingly, Link Financial has made it super easy for you to make a payment.

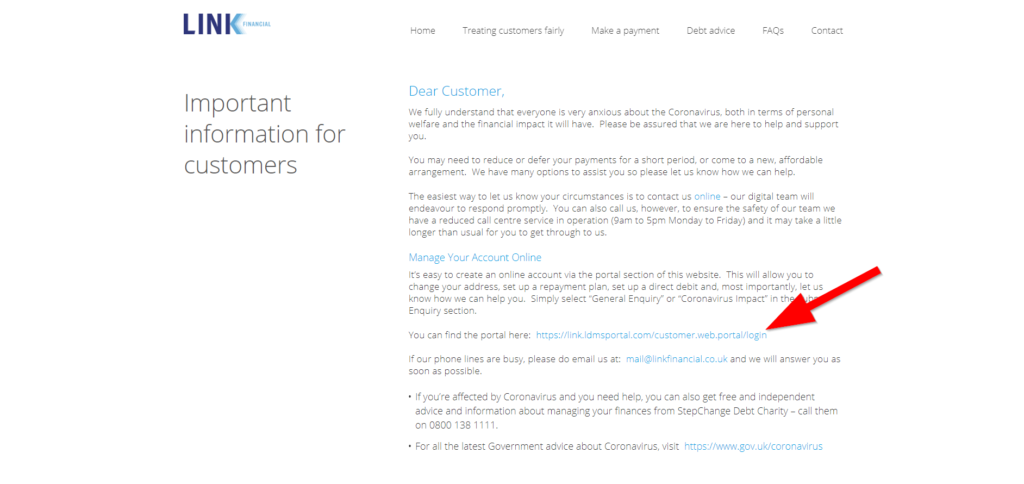

They are willing to accept debit cards or credit cards over the phone, or you have the option to pay your debts online.

To pay online, go to https://www.linkfinancial.eu/.

It’s really not so obvious how to make a payment online. Look for the light blue ‘make a payment’ text by scrolling down the page a little. Once you click this, it opens up the main part of their website. Then you have to click a link to the ‘portal’.

From there, you either need to register for an account or use existing details to log in. To register for a customer account, you will need your ‘link customer reference’, which you can get from an agent on the phone, or from an email or letter that they have sent you.

But do not make a payment on your account until you have analysed your options. Agreeing to their own repayment plans might not be the best or cheapest way to get out of debt.

For example, you might save lots of money by trying to get an Individual Voluntary Arrangement (IVA) or a Debt Management Plan (DMP) through an insolvency practitioner.

You can explore all these options and more on our debt options hub!

Ways to Write Off Your Debt

You might be wondering if there is a way to write off your Link Financial debt and make them go away for good. Link will not voluntarily write off the debt because either they do not own the debt, or if they do, they want you to pay so they can make a profit.

There are a few ways you can get out of paying Link Financial Debt Collectors. One of them is the aforementioned statute-barred law that states your debt is too old to be collected.

Your other options are debt solutions.

When to Complain About Link Financial Outsourcing Limited

If you have a complaint about Link Financial, you should first tell them about it.

Keep in mind that they are regulated by the FCA. This means that they have a code of conduct that they must stick to.

If you think that they have not acted properly or addressed your complaint sufficiently, you could make a complaint to the Financial Ombudsman Service (FOS).

If a Financial Ombudsman Complaint is upheld, the company may be fined and you may be owed some compensation.

When they become aggressive

Dealing with aggressive behaviour is an unfortunate symptom of debt-collection groups trying to recover money. You may receive angry calls from workers or experience threatening behaviour. But why is this? Why do collection group staff become so angry?

The reason is money.

Some debt recovery businesses will provide monetary incentives to staff if they can recover payments or get ‘customers’ signed up for repayment plans.

For this reason, debt recovery staff could become more irritable and aggressive, simply because they want some of your money too.

If Link Financial Debt Collectors have been aggressive to you, start keeping records of events and consider making a complaint.

You could also stop all contact with Link Financial Debt Collectors by entering into a debt solution and having a practitioner do it for you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When they contact you too much

Link Debt Collectors will call frequently to keep on top of you and try to build pressure so you give in and pay. But frequent calling can be classified as harassment, which is a criminal offence.

One way they can keep contacting you without any effort on their part is by using technology. Automating calls with a computer is now possible by simplifying adding your number to their database.

You can fight back against this by sending them your correspondence preferences in writing.

Keep a copy of this letter in case they ignore your preferences; it could be grounds to launch a complaint with the Financial Ombudsman.

When they don’t give you time

If you get hit with a Link Financial debt letter, the law states that they must provide reasonable time for you to assess your finances, make a budget and come up with a debt solution, either their own repayment plans or something else.

If they try to take legal action against you straight after telling you that you have a debt to repay, this might be worth complaining about.

Not giving you time could be a way to pressure you into their own repayment proposal, which could not be the best option for your situation.

When they tell others about your debt

Link Financial Debt Collectors are legally only allowed to discuss your debt with you.

They are not even allowed to reveal that you have a debt when calling, which is why they should ask for the name of the person they are speaking to (in case someone else picks up).

If they were to reveal you have a debt to another person, maybe a partner or work colleague, they have broken serious privacy laws.

Instances of this nature should bypass complaints directly to Link and should be referred to the Ombudsman.

Are Link Financial bailiffs?

If debt collection agencies threaten to be bailiffs who can come to your house and take away your items, they are lying!

Debt collectors can only do the administration aspect for debt recoveries, such as sending letters and initiating legal action. They do not have the powers that a bailiff has, which is someone who executes orders by a judge.

Our financial expert, Janine, says on debt collectors: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights.

They have no power to enter your home or take any of your possessions.’

There is a chance they could employ bailiffs to come to your door, but this can only happen if you lose a court case and continue to refuse to pay.

Please note, letting your debts escalate to this stage is not advised.

If you have allowed your debts to escalate you may require a debt solution to get them under control.

Main Differences Between Debt Collectors and Bailiffs

Understanding the main differences between debt collectors and bailiffs is essential to prevent unfair treatment.

Check out the table below for a quick and easy breakdown of the main distinctions between these two roles. If you’d like to learn more about your rights when dealing with debt collectors, please read our complete guide.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

Link Financial Outsourcing Telephone Number

Here you can find the latest contact information to get in touch with Link Financial. We’ve added some extra details about the company to help you track down specific departments during their opening hours.

| Company Name: | Link Financial Outsourcing |

| Other Names: | Link Financial |

| Post: | Link Financial Outsourcing Limited, PO Box 107, Caerphilly CF83 3GG |

| Contact Number: | 0800 064 4499 8.00 am to 8.30 pm Monday to Thursday, 9.00 am to 5.00 pm on Fridays and Saturdays |

| Company website: | https://www.linkfinancial.eu/ |

| Customer email address | [email protected] |

| Numbers they could call you from: | 02920853500 02920808685 |

They have been known to call debtors on these numbers. If you do not want to speak to them over the phone, you could block these numbers through your mobile phone provider.