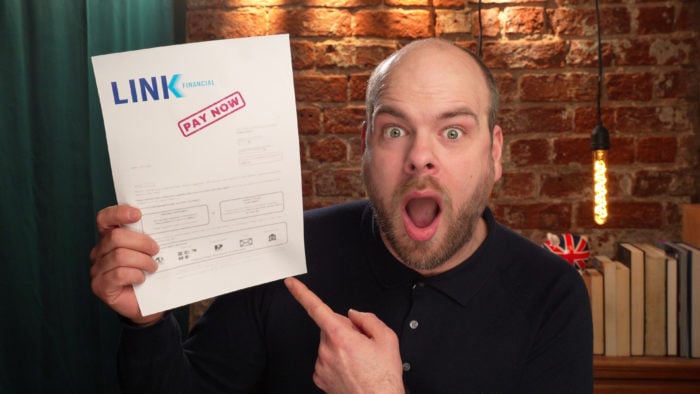

Link Financial Harassment? Here’s What to Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a surprise letter from Link Financial claiming you owe a debt, don’t worry. This article is here to help.

Every month, more than 170,000 people come to our website seeking advice on issues just like this one. You’re not the only one facing this situation.

In this friendly guide, we’ll explain:

- How to check if the debt really is yours (and if it’s not, you don’t need to pay!).

- If it’s possible to question or even disregard Link Financial.

- Methods to stop Link Financial from bothering you too much.

- Ways to arrange payments or even clear your debt.

Research shows that 64% of UK adults find interactions with current debt collectors stressful1. So, our team understands how worrying it can be when Link Financial is on your case. We are here to help.

Let’s find out how you can stop Link Financial from bothering you today.

Have you received a letter?

Responding to a debt letter from Link Financial is not pleasant, but you need to do it!

Typical Debt Collection Process

Link Financial initiates the debt collection process with letters and calls. Ignoring these communications may lead to the filing of a CCJ against you.

We’ve put together this table to help you better understand the debt collector process and manage your financial situation. For more information, be sure to check out our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Can they prove it?

If Link Financial have written to you about a debt that you supposedly owe, make sure you ask for proof before you make a payment.

Debt verification is a step that too many people skip! You have no obligation to pay a debt until Link Financial has proven that you are liable for it.

The importance of debt validation can’t be stressed enough, in our opinion. You don’t want to pay a debt that you didn’t have to.

You can use our free ‘prove it’ letter template to write to them and request proof that you owe the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Don’t pay if your debt is too old to be collected!

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use our free letter template to write to Link Financial and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

We don’t recommend writing about a debt that you think is statute-barred because this can be used to restart the 5 or 6 year timer on the debt. If you need to contact your creditor or Link Financial about the debt, phone them and don’t write to them.

How do I find out if my debt is statute-barred?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if I don’t pay?

What to do if you’re harassed

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Customer reviews

» TAKE ACTION NOW: Fill out the short debt form

Can they take you to court?

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

Unfair or improper practices

How do I complain?

If you think that Link Financial has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Fortunately, the steps to lodge a complaint against Link Financial are quite straghtforward.

Make your first complaint to Link Financial so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Link Financial may be fined. You could even be owed compensation.