Minimal Assets Process – How Does It Work?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you keen to understand the Minimal Assets Process (MAP)? Or maybe you’re worried about the impact of a trust deed on your life? You’re in the right place.

Each month, over 170,000 people just like you visit our website looking for guidance on debt solutions. We understand your concerns about debt and its effects.

In this easy-to-read article, we’ll explain:

- What the Minimal Assets Process is

- Who can use it

- The good and bad points of a MAP

- What happens if your money situation changes

- How to apply for a MAP

We understand how tough it can be to deal with money troubles, but don’t worry. Our team knows a lot about dealing with debt, so we can help guide you.

What is the Minimal Assets Process?

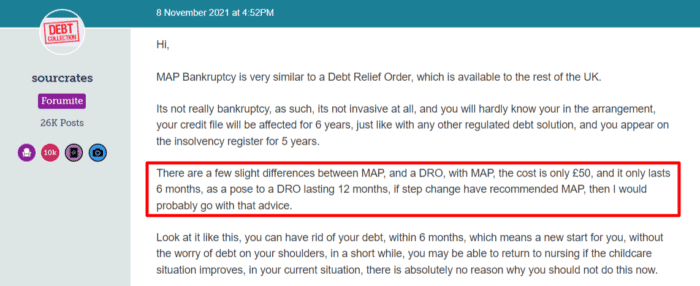

The Minimal Assets Process (MAP), formally known as LILA, is aimed at people who are on a low income, with little or no assets, who are looking to go bankrupt. It is only available in Scotland.

It is cheaper and less complicated than sequestration, but you have to meet certain criteria. It is very similar to Debt Relief Orders available to the rest of the UK.

Who is eligible for the Minimal Assets Process?

The criteria that you need to meet for the Minimal Assets Process includes:

- You have not been bankrupt in the last 5 years.

- You must live in Scotland or have lived there in the past year.

- You do not own a car that is worth more than £3000.

- You do not own your own home or any land.

- Your total debt is between £1500 and £25,000.

- You do not own other assets that total more than £2000, and no single item worth more than £1000, apart from a car.

- You must be on a low income, either through benefits (such as a jobseeker’s allowance), or low-income employment that leaves nothing left over after paying for your essential living costs.

- You must have sought advice from a qualified insolvency practitioner or money advisor.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I apply for a Minimal Assets Process?

You are not able to apply for a MAP on your own – the application must be made through a licensed money advisor. They will need a list of your income and debts to establish whether an MAP is the right solution for your personal circumstances. If it is not, then other options will be explored

If you are sure, and your money advisor agrees that a MAP is the best option for you, then your money advisor will begin the process. You will need to pay the £50 fee which will be sent to the Accountant in Bankruptcy.

You will receive a certificate as proof of your MAP and a trustee will be appointed, who will begin the process of contacting your lenders. Once they are notified you will no longer be contacted by the lenders.

» TAKE ACTION NOW: Fill out the short debt form

What if I do not meet the criteria for a MAP?

If you do not meet the criteria for a MAP, then there are other options that may be available to you. Each of these options have their own pros and cons to consider, and should be discussed with your money advisor.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What are the pros and cons of a MAP?

| PROS | CONS |

| You will not be required to appear in court. | A MAP stays on your credit file for 6 years, which will prevent you from getting further credit. |

| A MAP is usually discharged in 6 months, after which, the majority of the debt will be written off – leaving you debt-free as long as you have met all the requirements. | It could affect your current or any future employment. Your details will be on the record of insolvencies which are public records. You will also not be able to become a company director. |

| It is cheaper than sequestration, costing just £50 (that may be reduced if you are in receipt of certain benefits). | You may have difficulties getting a tenancy agreement which normally involves a credit check, and the MAP will show up on your file. |

| You will not have to pay anything towards your debts if you do not have any disposable income. | Your bank is likely to freeze your accounts, and you would normally be required to have a very basic bank account. |

| You will not be contacted by any debt collectors. No letters, phone calls or debt collectors knocking at your door. | If you don’t follow the conditions of the MAP the court may issue a bankruptcy restriction order which could prolong the terms for up to 15 years. |

| Most unsecured debts are included in MAP. | You may find it difficult trading if you are self-employed and rely on credit for goods. |