Mortgage with IVA – Is It Possible?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Debt in the UK is a constant problem for some people. Average credit card debt seems to rise, and people are going into debt to cover the cost of essentials. Some people are able to manage their debt, and either prevent it from becoming a problem, or paying it off entirely.

However, others end up buried in debt, with little light at the end of the tunnel. For these people, there are few options that leave them the freedom to be in control of their own debt, and decide how best to proceed. In many cases, it is best for people in this situation to take advantage of schemes that can provide a vehicle for getting back on top of debt, such as an Individual Voluntary Arrangement (IVA).

Can You Still Get A Mortgage If You Have An IVA?

The simple answer here, is yes. However, we need to caveat this by saying that your own financial situation will be the deciding factor.

If you can find a specialist lender that is willing to provide a mortgage, even though you are under a fairly fresh IVA, your application will be evaluated on your financial means. If you are meeting the repayments of your IVA and still have a positive cash deficit every month, it is very likely you will get a mortgage.

Something to note here though, is that specialist lenders will often charge more interest. This is because they are taking a greater risk, by providing a mortgage for a person who has already proven they are liable to get into debt problems.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Could An IVA Impact Your Eligibility For A Mortgage?

Here, we need to give a surprising answer. Having had an active IVA, and completely paying back your debt, will actually likely improve your chances to be approved for a mortgage. You will have proven that you are a responsible person and take debt seriously. Mortgage lenders will see this as a plus.

However, applying for a mortgage while you are still under an IVA with an active payoff plan, is not going to be as easy. An active IVA says that you have had, and continue to have problems with debt. A mortgage is a huge financial responsibility, lenders want to see that you are prepared to meet this responsibility.

» TAKE ACTION NOW: Fill out the short debt form

How Do Lenders Deal With People Who Have An IVA?

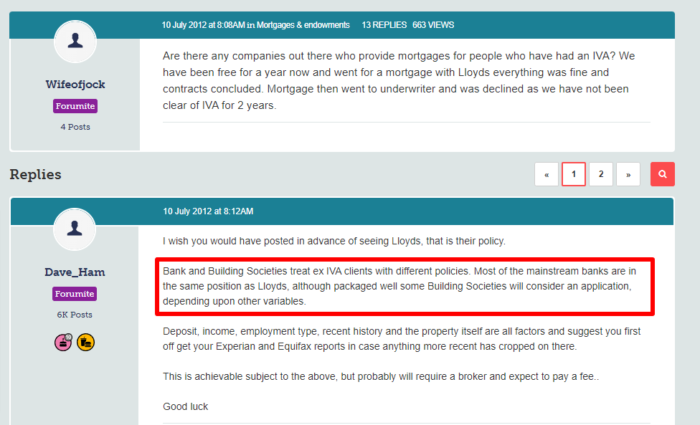

This very much depends on your circumstances. For example, if you have been under an IVA for some time, and have almost cleared your debt, a traditional bank or building society may well look on your application for a mortgage favourably.

However, the flip side of this is if you are under a fairly new IVA and still have a long way to go before you are debt free. In this case, you may still be able to get a mortgage, but you will likely need to find a specialist lender.