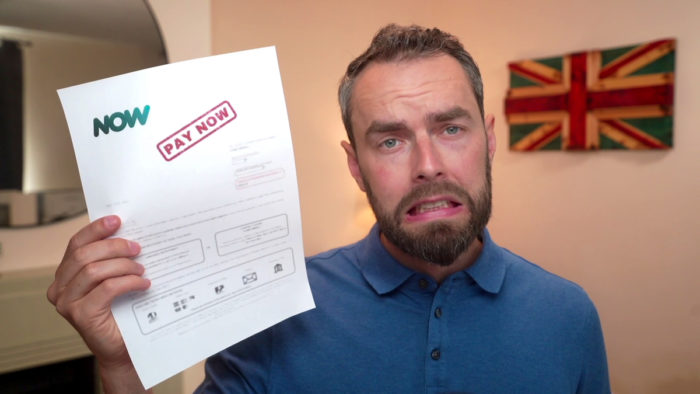

Now TV Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Missing a Now TV payment can be a worry. But don’t fret; you’re in the right spot to find help. This article is specially made to guide you through your next steps. Missing a Now TV payment is a common problem. In fact, over 170,000 people turn to our website each month for guidance on similar money troubles.

In this piece, we’ll cover:

- What Now TV is and what happens when you miss a payment.

- The steps to take if you can’t pay your debt.

- The way to get your service back if it’s been stopped.

- How to get in touch with Now TV.

- How to manage a debt to Now TV, which is owned by Sky.

Our team knows how it feels to miss a payment, as some of us have been there as well. We understand your worry, but remember; there are ways to sort out your money troubles and lead a better life. Let’s get started and find out what to do if you’ve missed a Now TV payment.

What happens when I miss a Now payment?

When you owe one or more payments, your membership could be suspended until the overdue amount is paid. Contact NOW support and let them know.

If you can’t pay the monthly amount, your account remains suspended because it is a ‘pay as you go’ service.

You’re not tied into a NOW contract when you sign up.

Payment options for NOW

You can only use a credit or debit card to pay for NOW passes. Unfortunately, the company doesn’t accept Direct Debit payments.

When you link a debit or credit card for monthly payments, the money is taken out on a ‘continuous’ basis. This is known as ‘continuous debit/credit card payments‘.

If you don’t stay on top of the payments, it can drain an account. What’s more, it is harder to stop a continuous debit/credit card payment. The instruction must be cancelled first!

In short, you must tell your card issuer either by phone, letter, or email. It’s your decision, not the company you’re paying!

Your card issuer must follow Financial Conduct Authority (FCA) guidelines for continuous payments.

Two million people have signed up to Sky’s NOW streaming service. But unfortunately, many forget to cancel their continuous payments to the company.

Another issue is having several accounts with multiple users on one NOW account.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

My NOW service is suspended, what can I do?

You should contact customer support and find out why they’ve suspended your NOW account.

There could be various reasons, which include:

- Not following their Terms and Conditions

- A failed credit or debit card payment (continuous payment)

» TAKE ACTION NOW: Fill out the short debt form

I checked online and found that many NOW subscribers experience problems getting in touch with customer support. This is true even when they go through the recommended NOW channels on the website.

Their Live Chat doesn’t appear to be much better either. So, it’s a question of perseverance and frustration when you need to speak to someone!

If you haven’t watched any NOW programmes, you can’t owe any money even when your continuous credit/debit card fails! Remember, this is a Pay as You Go service – when you don’t pay, you won’t have access to the service.

Will a debt collection agency get involved?

As Sky now owns NOW, yes. If you’ve signed up for other Sky services, your details could be sent to a debt collection agency especially when you’ve set up Direct Debits for different services like Sky broadband and Sky mobile.

I strongly advise you to avoid this happening if you can. It’s much easier to deal with Sky support than with a debt collector!

Also, your details could be sent to credit reference agencies. This can cause further damage to the credit score and remain on your credit report for six years. This could make it harder or impossible to get future credit, borrow money, or get a mortgage.

If you need debt help, contact a not-for-profit organisation for free advice!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Managing a Sky-owned NOW debt

Sky is well-equipped to deal with debt management.

When you miss a NOW payment and a Direct Debit for another Sky service fails, your best bet is to use their dedicated billing and debt management services on their website.

Next, seek impartial debt advice from a charity!

There’s a section with frequently asked questions worth checking out on the Sky website. That said, it’s all pretty complicated because:

- NOW is a Pay as You Go service – when you don’t pay, you don’t have access to the service.

- All other Sky services are paid for by Direct Debit – when a payment fails, customer support contacts you and lets you know.

According to the NOW website, you need to click on the “manage your broadband payment details when you miss a payment.”

If you can’t pay for the service for whatever reason, you won’t be able to access it. Your account remains suspended until you pay.

My advice is to make sure your debit/credit card details are up to date.

When a continuous credit/debit card payment fails, you won’t have access to NOW TV. Getting help from customer support seems challenging too.

Now TV Contact Details

| Contact us: | https://help.nowtv.com/article/how-to-contact-now |

| Website: | https://www.nowtv.com/ |