Orbit Debt Collection Ltd – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a letter from Orbit Debt Collection Ltd, you might be feeling confused and worried.

Don’t worry! You’ve come to the right place for help. Every month, over 170,000 people like you visit our site for advice on debt issues.

In this article, we’ll help you understand:

- Who Orbit Debt Collection Ltd are, and why they’re contacting you

- If you really need to pay the debt they claim you owe

- How to stop their calls or letters if they’re bothering you

- If they can cut off your water

- How you might be able to write off some of your Orbit debt

Our team knows what it’s like to deal with debt collectors. Believe it or not, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1. We’re here to share our knowledge so you can manage your situation with confidence.

So, take a deep breath, and let’s get started.

Get Orbit Debt Collection to Prove the Debt

» TAKE ACTION NOW: Fill out the short debt form

Earlier, I mentioned that there is something you should do before paying your Orbit Debt Collection debt. It is also a useful tactic if you are not sure how you will find the money to pay because it gives you some time.

Orbit Debt Collection must provide proof of the debt. If they don’t provide proof when they ask for payment, you can send them a letter asking for it.

Getting proof from Orbit works slightly differently to most companies as they’re a water provider. Water companies are legally obligated to supply water to any property that is occupied for residential purposes. Water companies do not make contracts with consumers as the relationship between both parties is governed by legislation i.e. the obligations are legal, not contractual.

That means it’s not so simple as sending a ‘prove it’ letter to Orbit in order to find proof of your debt. You can’t get a copy of a signed water bill agreement as no such agreements exist.

Instead, you should speak to Orbit directly. They can be contacted at https://www.orbitservices.co.uk/.

Sometimes You Don’t Have to Pay Orbit Debt

There is a situation that will prevent you from having to pay your Orbit Debt Collection debts. This is when your debt is statute-barred.

So, what is a statute-barred debt?

Statute-barred debt is an old debt that the courts will not enforce.

If you have not made a payment towards your debt for 6 years (5 in Scotland) or written to your creditor about your debt during this time, it is statute-barred. This means that there is no legal avenue for your creditor or a debt collection company to pursue to make you pay.

The debt does still technically exist, but you can’t be forced to pay it.

If Orbit Debt Collection keeps asking about an old debt, you can send them a statute-barred notification letter informing them that the debt cannot be collected. This letter should also make clear that further request for payment is harassment.

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

But not all types of debt become statute-barred! HMRC debts, for example, can be enforceable for decades. Any debt with a County Court Judgement (CCJ) attached to it will also never become statute-barred.

If you are unsure, I recommend speaking to a debt charity. They will be able to tell you if you are liable for the debt or not. I have linked some at the bottom of this page.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can Orbit Have My Water Cut Off?

But don’t make this an excuse not to pay. Not paying your Orbit Debt Collection debt when you need to can have big consequences.

Research shows that the average unsecured debt has increased by 25% year-on-year, rising to £13,9412, which means that companies like Orbit won’t stop trying to pursue what is owed to them and can even take legal action to recover it.

Ways to Escape Your Debt Problems

Not everyone can afford to pay their Orbit Debt Collection payment in one go. Some people with low incomes, multiple debts or are currently unemployed will struggle to pay off their debt.

The good news is that Orbit is known to be sensitive to these situations and is ready to agree on Ordib Debt Collection payment plans that meet your needs. You may even be able to negotiate lower interest rates or a brief payment holiday to get your finances back on track.

But sometimes, you will need to go for a debt solution.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Stop Collection Calls?

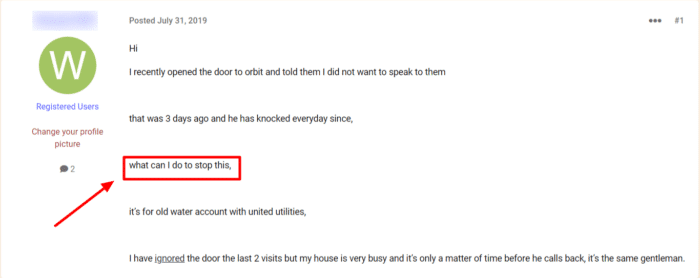

You can also request that they stop house visits. Debt collectors are not bailiffs and have no additional authority to be at your home. If you ask them to leave, they need to.

This person should ask the debt collector to stop coming to their house. If they don’t stop, they can make a complaint.

But just how to stop debt collection calls? If you know that you owe the debt, the easiest way to stop all contact with Orbit is to pay them.

Know Your Rights

When collecting a debt, companies like Orbit must abide by certain rules; however, it’s not uncommon for debt collectors to “get creative” and try to operate outside their permitted boundaries. It’s key that you know your rights and those of the debt collectors contacting you to prevent being taken advantage of.

Here’s a quick table summarizing what debt collectors can and can’t do.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Making a Complaint

If you think that Orbit Debt Collection has behaved inappropriately or not stuck to the Financial Conduct Authority’s (FCA) guidelines, you can make a complaint.

You should first raise your issue with Orbit directly. This will give them the opportunity to fix the issue themselves. But you can escalate matters if you feel that your complaint was not taken seriously.

The Financial Ombudsman Service (FOS) has a detailed complaints procedure. Once you have told them about the issue, they will investigate. If your complaint is upheld, Orbit may be fined, and you could be owed some compensation.

Orbit Debt Collection Ltd Contact Information

| Website: | https://www.orbitservices.co.uk/ |

| Post: | PO Box 92 Malton YO17 1BN |

| Telephone: | 441653604434 Mon – Thu 9am-8pm Fri 9am-6pm Sat 9am-1pm |