Paying Back Tax Credits in Instalments – Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Struggling to pay off tax credit debt in one go? You’re not alone, and help is at hand.

This article will cover everything you need to know about paying back tax credits in instalments. Over 170,000 people visit our website for guidance on debt solutions every month, so rest assured that you’re in safe hands.

In this article, we’ll talk about:

- What to do when you have tax credit overpayment.

- How to pay back tax credits in instalments.

- The length of time you have to pay back tax credit overpayment.

- Any changes you can make to your repayments with HMRC.

- What to do if you’re struggling with unaffordable debt..

We understand the worry that comes with tax credit overpayment, as some of us have been in your shoes, dealing with overpayment and finding ways to manage it. We’re here to help you through it.

Let’s dive in and find out more about how you can pay back your tax credit debt in manageable instalments.

How to pay an overpayment?

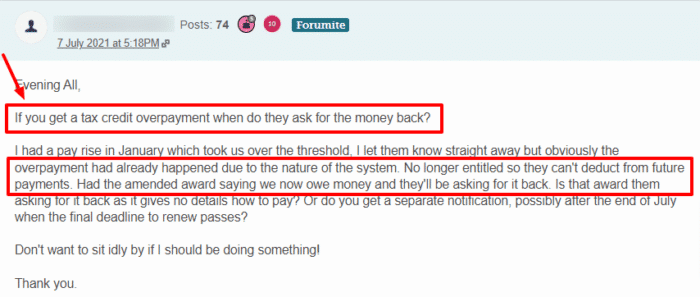

When you first receive a letter from HMRC informing you of your tax credit overpayment, it’ll have details about the overpayment as well as information about how they want you to pay them back.

If your tax credit payments are still in place, then usually, HMRC will take the tax credits you owe from your future tax credit payments.

This would mean that you would receive reduced payments from HMRC until your tax credit debt has been paid off.

You will be required to pay HMRC directly if:

- You no longer receive tax credits

- The overpayment made was for a joint claim, and now, you’re making a single claim

- The overpayment was for a joint claim, and now, you’re making a new joint claim but with a different partner.

If you’re having trouble finding the details of your overpayment by HMRC, then you can call the tax credits helpline to find out information about it.

The HMRC tax credits helpline is 0345 300 3900, with the timings being 8 am to 8 pm on Monday to Friday, 8 am to 4 pm on Saturday and 9 am to 5 pm on Sunday.

When you make any such call to HMRC or any other organisation, make a note of the date and time when the call was placed.

Also, ask and take note of the person who spoke to you over the phone. You may need this information later on if a problem arises with your HMRC overpayment.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I pay in instalments?

You can pay tax credit overpayments in instalments. To create an instalment plan, you need to call the tax credits helpline.

You should suggest a realistic amount that you are able to repay each month. After the conversation, you should make a note of the date and time of the call, in addition to the name of the person you spoke to at HMRC.

| Phone number (UK) | 0345 300 3900 |

| Phone number (outside UK) | +44 2890 538 192 |

| Phone number (Welsh language) | 0300 200 1900 |

| Relay UK | Text 18001 and call 0345 300 3900 |

If you can’t hear or speak on the phone, you can use Relay UK. First, text 18001 with what you want to say. Then, call 0345 300 3900.

Bear in mind that entering into a repayment plan with HMRC generally does not directly affect your credit rating. But if you do not keep up with repayments and HMRC takes further action (e.g. CCJ), this could hurt your credit score.

Can I make a payment online?

If you need to pay your tax credit overpayment directly, you can do so online. To do so, use the details below and use your tax credit reference number as the payment reference.

The payment should normally be completed within 1 to 2 days, including weekends and bank holidays.

| Sort Code | Account Number | Account Name |

| 08 32 10 | 12001039 | HMRC Cumbernauld |

How long do you have to pay it back?

If you need to pay HMRC directly, you will have to begin repayments within 30 days of the date on your overpayment letter.

If you plan to pay in instalments, it is crucial that you agree upon an instalment plan with HMRC during this time.

Remember, If the repayment is not made within the specified time frame, HMRC could charge interest and penalties on the outstanding amount.

Universal Credit (UC)

If your tax credit benefits have been replaced by Universal Credit, then it’s quite likely that HMRC may have asked the Department for Work and Pensions (DWP) to lower your Universal Credit payments in order to repay your tax credit debts.

Please note that they are allowed to do this without communicating it with you first.

You will receive a letter from HMRC detailing what your tax credit debts are and how much of an amount is being taken off from your UC every month.

If you’re unable to manage your finances and would like a smaller amount taken off of your UC, then you can contact your local jobcentre and request this.

You should be able to secure smaller amounts being taken off for a longer period of time.

» TAKE ACTION NOW: Fill out the short debt form

Changing the Terms of Your Repayments

If you’re not satisfied with the way in which you’re paying HMRC, you can call the tax credits helpline to get the terms changed.

You can ask them to change:

- The amount of money you pay in each instalment

- The duration for which you’ll need to keep making payments

- The way in which you pay the debt back

If you’re not comfortable with the terms of HMRC, it’s definitely worthwhile to contact them and attempt to change them.

If you’re being charged interest on your overpayment(s), then it’s a good idea to make larger repayments if you can. As a result of this, you’ll pay less money in interest and, thus, save money in the long run.

If it would be difficult for you to take care of essential living costs, you can call the tax credits helpline for assistance.

It’d be a good idea to ask them to stretch the repayments over a longer period of time. This would result in the amount being taken off your tax credits each month lowering.

If you’re paying through direct recovery, you can call and ask HMRC to lower or raise your repayments for your tax credit debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

It’s a good idea to assess your finances and calculate how much you can afford to spare each month to contribute towards your overpayment.

Do this by subtracting your essential living costs from your monthly income. Your disposable income should be what you can contribute towards your tax credits debt.

Please note that any other debt repayments you may have must also be included within your essential costs.

Also, note that you can also contact HMRC if you’d like to repay the overpayment with a single payment.

The key is always to be communicative and present. Always be aware of the fact that if you ignore HMRC’s letters, then you might be visited by bailiffs at your home.

HMRC also has the authority to take money straight from your bank account if you owe HMRC more than £1,000 and if you’d be left with more than £5,000 in your account.