PayPlan Debt Solutions Reviews & In-depth Info

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re dealing with debt and are considering a solution, you might be thinking about PayPlan Debt Solutions. It’s normal to worry about making the right choice, and we’re here to help you make sense of it all. Each month, over 170,000 people come to our website for advice on debt solutions.

In this article, we’ll cover:

- What people say about PayPlan in reviews.

- What debt services PayPlan offers.

- How you could possibly write off some debt.

- How to make a complaint about PayPlan.

- Important information about the company and their contact details.

We understand that dealing with debt can be stressful, which is why we want to give you clear and honest information. Some of our team have faced similar situations, so we know how tough it can be. Let’s dive in and find out more about PayPlan Debt Solutions and how they might be able to help you.

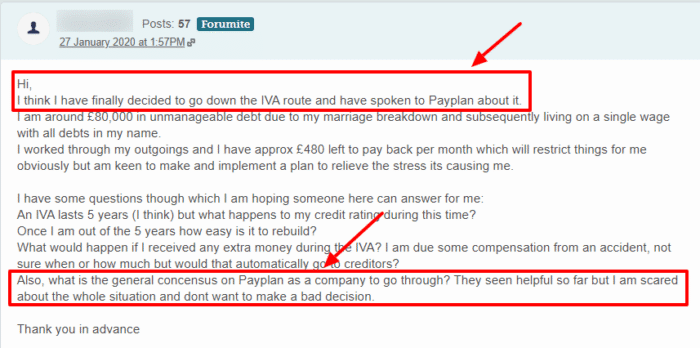

What Do People Say?

It can be useful, too, to see how other customers have rated their experience with a company. This can provide reassurance that other people are in the same position as you got help.

Take a look at PayPlan’s Trustpilot reviews here: https://uk.trustpilot.com/review/www.payplan.com?languages=en

What Services Do They Offer?

PayPlan offers information about a large selection of debt services on their website, more than many other Debt Management Companies.

From free debt advice to bankruptcy, the solutions and services explained on their website include:

- Free debt advice: Non-judgemental and expert free debt advice

- Individual Voluntary Agreements (IVAs): A type of debt solution that allows you to ‘write off’ some of your debt.

- Debt settlements: Final settlements by clearing your debt with one big payment

- Debt Management Plans (DMPs): An informal arrangement with your creditors

- Sequestration: Bankruptcy for Scottish residents

- Debt Relief Orders (DROs): A form of insolvency for people with high debts and low asset value

- Trust Deeds: An IVA equivalent for Scottish residents

- Debt Arrangement Scheme: A government-backed debt-repayment scheme for those in Scotland

- Bankruptcy: A method to clear your debts by applying to the court

Scottish Solutions for Dealing with Debt

PayPlan provides information on its website about Debt Solutions specific to Scottish residents, such as Sequestration and Trust Deeds.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

In-Person

PayPlan doesn’t offer in-person services. So you can’t just go into their offices to discuss your debt situation. However, they offer online debt assistance via a live chat service. You can also contact them by phone or by email.

Information correct as of 10/08/23 (PayPlan)

How to complain?

It’s reassuring to know that a company has a complaints procedure in place.

However, should you need to make a complaint about PayPlan in the future, then you can use the details below to either write to them or call them.

John Fairhurst

Totemic House

Caunt Road

Grantham

Lincolnshire

NG31 7FZN

UNITED KINGDOM

+4408000094148

If PayPlan does not respond to your complaint, then you should contact the Financial Ombudsman Service. They will be able to handle your complaint and seek an amicable resolution.

Information correct as of 10/08/23 (FCA)

Company information:

After researching on Companies House and the PayPlan website, we found the below details on the business:

Date of incorporation: 15 February 1993

Company status: Active

Company number: 02789854

Company type: Private limited Company

Website: https://www.payplan.com/

Address:

Totemic House

Caunt Road

Grantham

Lincolnshire

NG31 7FZ

UNITED KINGDOM

Opening Hours: Mon to Fri 8 am–8 pm, Sat 9 am–3 pm

Phone number: +4408000094148

Information correct as of 10/08/23 (CompaniesHouse)

FCA registration:

It’s important to check whether companies are registered with the FCA. This is because The Financial Conduct Authority (FCA) is the conduct regulator for financial services firms and financial markets in the UK. PayPlan has a listed registration with the FCA. The details and link are below:

FCA regulated: Yes

FCA status: Authorised

FCA regulated activities: 1) Consumer Credit – Debt Adjusting, Debt Administration, Debt Counselling, Providing Credit Information Services

FCA reference number: 681263

Trading names: PayPlan / PayPlan Plus / Totemic Limited

Place of business:

Totemic House

Caunt Road

Grantham

Lincolnshire

NG31 7FZ

UNITED KINGDOM

Information correct as of 10/08/23 (FCA)

» TAKE ACTION NOW: Fill out the short debt form

Data protection registration:

Why is this important? Data protection registration means that a company is registered with ICO, the UK’s independent authority set up to uphold information rights in the public interest. The privacy of your data will be protected.

PayPlan is registered with ICO. Find the details here:

Registration No: ZA121290

Data controller: Totemic (2014) Holdings Limited

Address:

Kempton House

PO Box 9562

Grantham

Lincolnshire

NG31 0EA

Information correct as of 10/08/23 (ICO)

Insolvency Practitioner Directory Listing

The Insolvency Practitioner Directory contains information on Insolvency Practitioners who have agreed to include their details. If you decide upon a form of Insolvency with PayPlan, they’ll refer you to one of their sister companies.

Two IPs are registered in the directory under PayPlan’s sister companies. They are registered under the following details:

IP Name: Mr Nicholas Timothy Payne

Contact Information: [email protected]

IP No: 9418

Licensing Body: IPA

IPA Registered Address: Kempton House, Dysart Road, GRANTHAM, Lincolnshire, NG31 7LE

Information correct as of 10/08/23 (InsolvencyService)

IP Name: Mr Andrew Smith

Contact Information: [email protected]

IP No: 19210

Licensing Body: IPA

IPA Registered Address: Totemic House, Springfield Business Park, Caunt Road, GRANTHAM, Lincolnshire, NG31 7FZ

Information correct as of 10/08/23 (InsolvencyService)

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

PayPlan Contact Details

| Address: | Kempton House, Dysart Road, PO Box 9562, Grantham, NG31 0EA |

| Contact number: | 0800 280 2816 Mon to Fri 8 am-8 pm Sat 9 am-3 pm |

| Website: | Payplan |

| Twitter: | https://twitter.com/PayPlan |

Below you can find some of the most popular questions about PayPlan debt solutions.

How can I contact them?

One of the easiest ways to contact PayPlan is to call their freephone number which is operational from Monday to Saturday.

Apart from PayPlan, you may consider alternative debt solutions providers, such as National Debtline, MoneyHelper or StepChange. These leading UK debt charities offer free debt advice and can even negotiate a debt management plan with your creditors on your behalf.