PO Box 300 Northampton NN1 2TX – Who’s Contacting Me?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

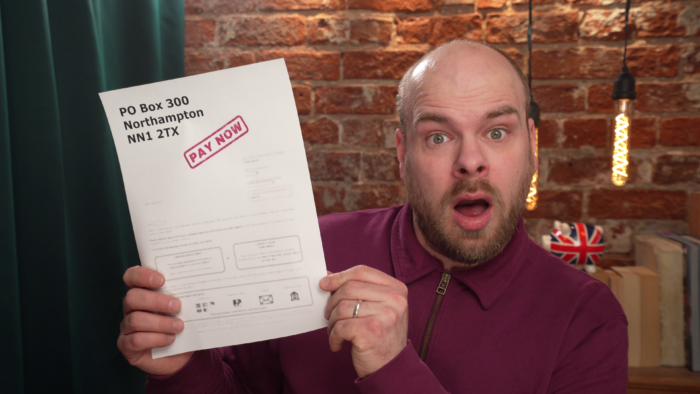

Have you received a letter from PO Box 300 Northampton NN1 2TX? It’s probably from Northampton County Court Business Centre, and they might be getting in touch about a debt.

We know this can feel scary, but you are not alone. Each month, over 4,600 people come to our website for guidance on situations just like this.

In this article, we will guide you through:

- Finding out who’s contacting you from PO Box 300 Northampton NN1 2TX.

- Understanding what to do next if you’ve received a letter.

- Checking if your letter is real or fake.

- Learning about a county court claim letter and a County Court Judgment.

- Working out if you have to reply to PO Box 300 Northampton NN1 2TX.

Many of us have been in your shoes. We understand how it feels to be worried about not being able to pay a debt and being scared about further court action.

Let’s take this journey together and get you the information you need.

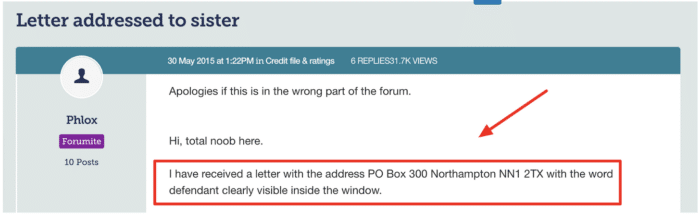

Is your PO Box 300 Northampton NN1 2TX letter fake? (Must Read!)

The UK Government website states that some rogue debt collection agencies are sending fake letters trying to impersonate the county courts.

These fake letters are written to make debtors think that they’re already in a legal battle, or worse, that a court order has already been issued to make them pay.

Source: https://forums.moneysavingexpert.com/discussion/5251299/letter-addressed-to-sister

Ultimately, this is an illegal scare tactic.

If you have received any letter supposedly from PO Box 300 Northampton NN1 2TX, you need to verify this first. You can do so by contacting Northampton County Court directly or checking your claim reference on the online system.

There are some tell-tale signs that one of these letters is fake, such as demanding payment immediately and not providing a form to defend the claim.

Learn more about the bad and the ugly of debt collection agencies and how to deal with them on MoneyNerd. Start with our main debt collector guide.

What is a county court claim letter?

Suppose your PO Box 300 Northampton NN1 2TX letter is real, which means you’ve received a county court claim letter.

This is to notify you that another party is trying to make you pay a debt through legal action.

This shouldn’t have come out of the blue. The claimant is supposed to have tried to avoid legal action before starting a claim. If they didn’t, you could get any subsequent court order cancelled.

» TAKE ACTION NOW: Fill out the short debt form

Claims are mostly made by lenders who haven’t received loan and credit card repayments, or by utility companies chasing gas and electricity bill arrears. Let’s not forget the growing number of private parking firms trying to recover unpaid parking tickets.

If the claimant is successful, you’ll be legally obligated to pay the debt as instructed by a judge. To do this, the court issues a County Court Judgment (CCJ).

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do you have to reply to PO Box 300 Northampton NN1 2TX?

Ignoring your county court claim letter from PO Box 300 Northampton will result in the court order being issued anyway.

You have 14 days to respond, but 16 days are offered to account for postal deliveries.

The judge won’t be able to take into account your personal circumstances if you don’t reply. This allows the claimant to ask for repayment in any way they choose, which is almost always 100% of the debt at once.

Ways to respond to Northampton County Court

Instead, you should respond to Northampton County Court Business Centre by:

- Admitting you owe the debt

- Contesting the amount you’re claimed to owe

- Defending the debt entirely

How to defend against the claim

Defend against the claim entirely by completing Form N9B and sending it back to the court.

But before you make a full defence it’s important to seek advice, which is available from debt charities like StepChange.

Alternatively, you can accept you owe money but contest the amount by completing both N9A and N9B forms. Both must be returned to the court in this situation.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How to admit the debt

You can admit the debt by providing your financial circumstances and offering a repayment plan to the claimant.

This is possible by completing Form N9A which should be sent within the letter. It’s also called the Admission Form.

This form isn’t sent to the court; it’s sent to the claimant or their solicitor using the address provided on Form N1.

If the claimant rejects your repayment proposal, the judge will intervene and decide on a fair repayment structure.

What happens if you lose the Northampton County Court defence?

If you lose your defence of the claim, a judge will issue a CCJ and tell you how to repay. They can:

- Tell you to pay everything immediately (Judgment Forthwith)

- Tell you to pay over multiple repayments (Judgment by Instalments)

If you disobey the orders, the claimant can use debt enforcement action, which usually means bailiffs.

If the debt is valued above £600, they can escalate the debt enforcement to High Court Bailiffs. These bailiffs are usually quicker and charge more expensive fees, which are added to your debt.

Do you send forms to PO Box 300 Northampton NN1 2TX?

If you’re sending a form to the court and not the claimant, it must be sent to the address provided. It’s possible that the return address isn’t PO Box 300 Northampton NN1 2TX.

It’s more likely to be:

St. Katharine’s House

21-27 St. Katharine’s Street

Northampton

NN1 2LH