Pros and Cons Of Bankruptcies

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about paying off your debts? Are you thinking about bankruptcy as a solution?

If so, this guide is for you. Every month, more than 170,000 people visit our site to learn about debt solutions.

In this easy-to-understand guide, we’ll cover:

- What is bankruptcy

- The process of going bankrupt

- Working out if bankruptcy is right for you

- How to apply for bankruptcy and what it costs

- The impact of bankruptcy on your life and credit score

It’s quite common to feel concerned about debt. In fact, in 2021, Citizens Advice helped approximately 280,000 individuals in England and Wales with debt.1

Some of us have been in your shoes. With our expertise, we’ll help you learn more about the pros and cons of bankruptcies in the UK in 2023.

Why Do People Choose Voluntary Bankruptcy?

Wiping debts and having a fresh start are the most common reasons for people to choose to declare bankruptcy.

A fresh start is commonly seen as one of the main benefits of bankruptcies.

You should always consider your own circumstances when determining whether declaring bankruptcy is a road you’d like to explore. While it can help to solve a debt problem, it does come with some disadvantages.

Being aware of the pros and cons of bankruptcy is essential.

Disadvantages of bankruptcies

There are serious cons that come with the bankruptcy process.

The legal process does come with certain implications that you might not be comfortable with.

Let’s go through the disadvantages of bankruptcies as you may find they are not suitable for your own personal situation or life moving forward.

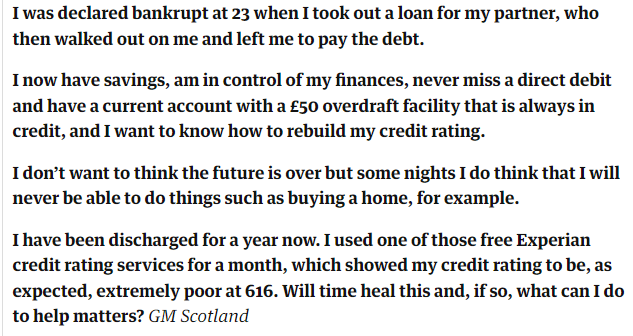

Negative Impact on Your Credit File

Your credit file will have a record of your bankruptcy added, which remains in place for six years.

Your credit score will suffer, making it very difficult to obtain credit. Rebuilding your credit score may take a significant amount of time.

[https://www.theguardian.com/money/2015/mar/20/how-do-i-rebuild-my-credit-rating-after-bankruptcy]

Public Record of Bankruptcy

Details of your bankruptcy status are made available to the public via the public bankruptcy and insolvency register.

Loss of Assets When You Declare Bankruptcy

You may have to sell or liquidate the non-essential assets that you own. This could include things such as your house and vehicles. These assets are sold to raise money for your creditors as a way for them to recoup the debt that you owe.

Loss of Your Home Due to Bankruptcy

If you own your home, you may be asked to sell it to clear your debts as part of the bankruptcy process.

You may even lose your home if you rent and have rent arrears. You may find it difficult to find somewhere else to rent as some landlords will refuse to accept someone who has been declared bankrupt.

Reach out to your local council if you’re at risk of being made homeless because of bankruptcy.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Bankruptcy Misconceptions

It’s natural to worry about the consequences of bankruptcy, but let’s address some common misconceptions to provide clarity.

Take a look at the table below for a breakdown of the facts.

| Misconception | In Reality… |

|---|---|

| Will I lose everything— my home, my car, and all my personal possessions? | Essentials for daily living and working (e.g. furniture, clothing, bedding, household items and work-related tools) are usually protected. High-value items and property with equity could be at risk. Your car could be at risk unless it’s necessary for work, school, or due to disability. |

| Will bankruptcy ruin my career? | Bankruptcy may impact certain career paths (like law or finance) and public roles, but for most people, it won’t ruin their career. |

| Will bankruptcy directly impact my spouse’s or partner’s finances? | Bankruptcy affects only your finances and assets. However, joint assets and shared debts will need to be considered. |

| Filing for bankruptcy will be publicly humiliating— everyone will find out! | While bankruptcies are public records, they are not widely publicised, so it’s unlikely that friends or neighbors will know unless you tell them. |

| Is it impossible to get credit following bankruptcy? | While it’s challenging to obtain credit after bankruptcy and your options are limited, it’s not impossible. However, interest rates will likely be higher, and borrowing amounts smaller. |

| Am I not allowed to start a business after bankruptcy? | While it’s challenging to obtain credit after bankruptcy and your options are limited, it’s not impossible. However, interest rates will likely be higher, and borrowing amounts smaller. |

| Am I not allowed to get a mortgage after bankruptcy? | Securing a mortgage post-bankruptcy can be challenging but feasible. You must disclose your bankruptcy status if undischarged, often occurring after 12 months. Expect to be seen as high-risk, needing a larger deposit and facing higher rates. |

| Bankruptcy is a quick solution | Bankruptcy is not the quickest way to start over. The process can be lengthy and stressful. The bankruptcy itself lasts for 12 months, but its impact on your credit rating lasts for six years. |

The Benefits of Bankruptcies

As with most things in life, there are benefits of bankruptcies to consider alongside the disadvantages. Weighing up both will help you to decide if declaring bankruptcy is an option that could be of benefit to you.

Reducing Your Debts

One of the most obvious benefits of bankruptcies is that many unsecured loans and defaulted debts can be written off when declaring bankruptcy.

This can leave you with a clean slate to begin rebuilding your life and improving your financial situation.

The total cost of what you owe may be reduced, which is another benefit of bankruptcies.

This is because creditors may be forced to accept less money than the amount you owe them. The creditors cannot change their minds and request more once the bankruptcy deal has been agreed upon.

Stopping Legal Action and Further Costs

Declaring yourself bankrupt can stop your creditors from taking you to court.

Your creditors will no longer be able to add any additional fees or penalties to your debt once your bankruptcy is declared.

No Further Contact with Creditors

The creditors that are included in the bankruptcy process will not be able to contact you. This reduces the amount of stress and pressure felt because of debt.

The benefit of bankruptcies is an appointed administrator will take care of your debts once the Bankruptcy order is approved.

They deal with all the correspondence with the creditors included, meaning you don’t have to. This gives a strong sense of relief to many.

Stress Reduction and Improved Mental Health

Stress reduction is a benefit of bankruptcies that can make a real difference.

Debt stress is a widespread problem in the UK. Mental health and debt are often closely related and a fresh financial start is considered one of the positives of bankruptcies.

Taking control of your debt instead of ignoring it and letting it get out of hand can have a positive effect on mental health.

[https://www.stepchange.org/about-us/who-we-help/sarah.aspx]

Reach out to a debt advisor if you’re experiencing mental health problems that are worsening due to your finances.

» TAKE ACTION NOW: Fill out the short debt form

How Much Does It Cost?

You’ll need to pay £680 when you declare bankruptcy.

It is possible to pay this fee by instalments, but you won’t be able to submit your application until the full amount has been paid.

There are certain grants available that can help pay the fee, depending on your circumstances.

What if I Can’t Afford It?

If you can’t afford the fee to go bankrupt and you can’t get a grant to help, you may be able to opt for a Debt Relief Order (DRO).

A DRO lasts for 12 months and during this time you make no payments towards your debts. Your interest is frozen and your creditors can’t contact you during this time.

After 12 months, your finances are reassessed and if they haven’t improved, any outstanding debts are written off.

If you are in Scotland and can’t afford the fees for sequestration, you may be able to apply for a minimal asset procedure (MAP) instead. This process is more straightforward than sequestration and only lasts for 6 months.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Long Can It Last?

Bankruptcy usually lasts for one year, but it can be longer depending on the circumstances.

After the decided bankruptcy period, most of the remaining debts are written off/cancelled. The bankruptcy status will remain on your credit file for 6 years.

Loss of Belongings When Declaring Bankruptcy

When you go bankrupt, your non-essential belongings become the legal property of an official receiver.

This is the person who is dealing with your bankruptcy.

The official receiver will sell your belongings and use the money to make payments to your creditors. This may also include items you obtain after being declared bankrupt.

You can keep belongings required for the basic needs of you and your family:

- Clothing and bedding

- Furniture

- Household items such as cooker and washing machine

- Things you need for your job

- A vehicle required to perform your job or to care for a dependent

Employability Impact

Bankruptcy can make it hard to gain employment.

It becomes particularly hard if you are applying for a job in legal or finance. Furthermore, jobs that involve money handling may not be forthcoming when hiring someone who has declared bankruptcy.

Current employers may choose to terminate contracts too.

In addition to employment issues, one of the cons of bankruptcy is you can’t act as a company director if you’ve been declared bankrupt.

You are allowed to work as a sole trader providing you operate under your own name or the name you used when you were declared bankrupt.

Debts Not Included in Bankruptcy

One of the disadvantages of bankruptcies is the fact that not all debts can be included or written off by being declared bankrupt. You will need to come up with a way of managing any remaining debts that aren’t possible to include.

The debts that can’t be included are:

- Student loans

- Child maintenance

- Criminal fines

- Social fund loans

- Court orders for injury compensation

- Family proceeding payments ordered by the court

- Fraudulent debts

- Mortgage payments if you don’t want to sell the house

- TV licence

- Any debts you accumulate after going bankrupt

Speak to a debt advisor listed below if you’re struggling with any of the debt repayments above. As they can’t be included in a bankruptcy, you will need to find a way of managing these debts.

A debt advisor will provide you with free information and help to guide you out of debt problems. Debt advisors to consider using include:

Bankruptcy and Your Bank Account

One of the disadvantages of bankruptcy is the effect it can have on your bank account. Bank accounts and building society accounts are normally frozen once the order is made.

When this happens you usually can’t:

- Have payments go in or out of your account

- Use your credit, debit, or cheque books – you may have to hand these over to your official receiver

If you owe the bank money, such as an overdraft or a bank loan, the bank can take this out of the available funds in your bank at the time the account is frozen.

The bank will inform the official receiver of the amount you have in your bank account. They will decide what you need for essential living expenses and this amount will be given to you. The bank will then decide whether you can keep your account or if it is to be closed.

If it’s closed, you may find it hard to get a similar bank account. You can apply for a basic bank account if your current account is closed after you declare bankruptcy.

You Must Follow a Set of Rules

One of the other disadvantages to bankruptcies is the rules you have to follow, called restrictions.

Failure to follow the rules can result in an extended period of bankruptcy or additional restrictions being imposed. The rules are:

- You can’t get credit for £500 or more. If you apply for this amount or more you must tell the lender about your bankruptcy status

- You must ask the court for permission to set up, promote or run a company

- You can’t be a company director

- You must not act as an insolvency practitioner

- You cannot act as a sole trader under a name different to the one on your bankruptcy order unless you inform all businesses you trade with about your bankruptcy.

It is a criminal offence to break these rules. Failure to follow these restrictions could result in a fine or even time behind bars.

Additionally, you must tell your official receiver if your income changes (up or down), if you get a lump sum of money or if changes are made to your expenses.

These changes may result in you being asked to increase or decrease the amount you are paying off your monthly payments to your creditors.

Previous Debt Activity Investigated

Once you’re declared bankrupt, the official receiver will examine your past financial activity. Things they look at include:

- How did you pay your debts in the few years before the bankruptcy, which ones you clear or paid before others that you knew you couldn’t pay

- What items you sell or gave away before going bankrupt

- How much you borrow or spent

- If you provided lenders with incorrect details in order to obtain credit

If the official receiver finds you broke any rules or restrictions before or during your bankruptcy, they could:

- Apply for a Bankruptcy Restriction Order

- Make a court order for you to attend a public examination

- Hold a court hearing that will determine if you’ve committed an offence

- Have your mail redirected to the official receiver instead of your home address

Debts Included in Bankruptcy UK

Here are some examples of the types of debts that can be included when declaring bankruptcy:

- Overdrafts

- Credit cards

- Utility arrears

- Catalogue and store cards

- Overpayments of benefits providing they weren’t obtained through fraud

You may find not all of your debts qualify.

If you’re still struggling with other debts, I advise speaking to an authorised debt advisor for help and guidance.

There may be other debt solutions that are preferable rather than declaring bankruptcy. If you do wish to declare bankruptcy, the debt advisor could work through the debts excluded with you to establish a plan for them.

Alternatives to Bankruptcy in the UK

UK bankruptcy differs from the US, where there are 3 types of bankruptcy, the UK has only one. However, there are alternative debt solutions in the UK such

- Debt consolidation

- Individual Voluntary Agreement

- Administration order

After considering the pros and cons of bankruptcy you might find that declaring bankruptcy isn’t the best option for you.

One of the above alternatives could work better, depending on your own personal situation.

Find more information about debt solutions and money management in the articles and guides I’ve suggested below. You do have options and opportunities to find workable solutions to your debt struggles.