Resolvecall Debt Collectors (Resolve Call) – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you holding a letter from Resolvecall Debt Collectors? Are you worried about paying for it? You’re not alone! Every month, over 170,000 people come to our website for information about their debt problems.

We’re here to help you. Here is what you will learn from this article:

- How to find out if the debt is really yours. If it’s not, you won’t need to pay!

- The ways to ask Resolvecall to leave you alone.

- The right ways to set up a plan to pay the debt.

- If there is a chance to wipe off your debt.

Nearly half of the people who are chased by debt collectors have faced harassment or aggression1, and some of our team have experienced this too. So we understand your worry.

We’re here to share our knowledge and help you figure out what the next steps are. Let’s dive in!

How Do You Ask Them to Prove the Debt?

To ask Resolvecall to prove the debt, all you have to do is write to them.

The purpose of this letter is to get them to actively tell you the details about the debt so you can either accept it or challenge it.

There is a chance that Resolvecall is not able to prove the debt, and they will close the case and not contact you again.

If you don’t know where to start, you can use our free letter template as a guide.

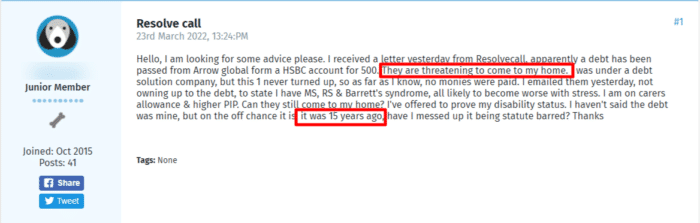

It is really important that you ask Resolvecall to prove that you owe the debt. In the example below, you can see that Resolvecall were trying to collect a debt that was 15 years old!

After 6 years in England and Wales or 5 years in Scotland, most unsecured debts become statute-barred. This means that they are too old for the creditor or a debt collection agency to take legal action to recover the debt.

The debt is not written off and still exists, but there is no legal enforcement mechanism available.

Keep in mind that this doesn’t cover all types of unsecured debt! HMRC debts will remain enforceable for much longer.

If a County Court Judgement (CCJ) was issued before the debt became statute-barred, it will always be enforceable.

Different Responses to Prove-the-Debt Letters

Resolvecall may respond to your letter in different ways. One way is by not responding at all and closing the case.

If they contacted you because your name matched someone who did owe the debt, they may write to you to say that the debt no longer applies, and they will not contact you again.

They may try to get around your letter by writing to you stating they have traced the debt to yourself. This letter may also request that you reply by a certain deadline.

However, if there is no proof that you own the debt within the letter, you should not reply to this letter. You may wish to report their actions if this occurs.

There is also the possibility that Resolvecall will reply with genuine evidence that you owe them the debt.

But what is classed as genuine evidence and proof?

This will be an original agreement between you and the company you owe, such as a contract between you and an energy supplier or creditor.

This contract should include your signature, which is why it is essential that you do not sign your letter asking Resolvecall to prove the debt as it could be forged.

There is no evidence to suggest Resolvecall have done this before, but it is better to keep yourself protected and withhold the signature.

If Resolvecall has provided evidence that the debt is yours but you can’t afford to pay, you could consider a debt solution that would stop Resolvecall chasing you for your debts.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What If You Owe the Debt?

If Resolvecall does reply with genuine proof that you owe the debt, you will need to make arrangements to pay off the debt.

When you owe debt to Resolvecall, paying it off is the quickest and easiest way to get them off your back.

If you’re struggling with debt and repaying is not possible because you simply do not have enough money to pay it, you should still make contact with Resolvecall and explain your circumstances.

StepChange found the average unsecured debt amount per client increased by 27% year-on-year to £16,174 2. Since it’s common for people to struggle to pay their debts, debt collection agencies normally set up a payment plan that enables individuals to clear the debt over time in manageable monthly or weekly instalments.

If you continue to meet the payments stipulated within the payment plan, Resolvecall will not be able to take any further action against you.

Just make sure that you get a copy of your payment plan in writing before you make your first payment. This will keep your records up-to-date and make it much more difficult for Resolvecall to challenge you about this debt later!

Before you negotiate a payment schedule with Resolvecall, make sure you know the exact amount you can afford to repay.

You need to be realistic about your finances at this point – agreeing to a payment plan that you can’t afford is only going to make your financial situation worse.

To do this, create a budget and plan for all your essential expenses against your income. Some UK debt charities can help you do this and may even be able to communicate with Resolvecall on your behalf.

What If They Come to Your Home?

Resolvecall employs staff to visit people who owe debt at their homes. You do not need to welcome these people inside if you do not want to.

If Resolvecall has not responded to your letter asking them to prove the debt, or if they have not told you about the visit, it could be classed as harassment.

Our financial expert, Janine, says on debt collectors: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

Reviews left by previous Resolvecall field employees on Glassdoor have said they received little training and were not even DBS verified. For this reason, it may be best to not invite Resolvecall field agents inside.

If they arrive and you are not home, reviews left by people chased by Resolvecall said the caller left a note asking them to call.

Again, without proof of the debt, you do not have to respond to this note. Moreover, nobody from Resolvecall can force entry into your home without a court order.

If you are home and want to know what the Resolvecall employee has come to say but do not want to deal with them directly, you should ask for them to write down what they are here for.

It is likely that these people are at your home to discuss ways to clear the debt and may want to come up with a repayment plan. If this is something you want to do, then you could do it with them in person or you could make arrangements to do it over the phone.

If you do invite them inside, they must leave as soon as you ask them to.

Your Rights With Debt Collectors

It’s important to understand your rights when dealing with debt collectors. That’s why we’ve created this table, which explains what they can and can’t do. To learn more about your rights, make sure to check out our detailed article.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

The Five Main Debt Solutions

- Snowball Method – if you can afford to make the minimum payments on your debt, then this method to become debt-free is almost definitely your best option.

The great thing about the snowball method is that it actually improves your credit score, whereas the other options will damage it.

- Debt Management Plan (DMP) – This informal debt solution has you paying less than the minimum every month and the lenders stop charging interest. Ideal for a short period if, for example, you have lost your job.

- Individual Voluntary Arrangement (IVA) – This solution works well if you owe over £6,000 to more than one creditor and need to protect your house from being repossessed. Your creditors can’t contact you for the duration of your IVA and any outstanding debt at the end of your IVA period is written off.

- Debt Relief Order (DRO) – Suitable if you have debts of less than £30,000, have barely any income and don’t own a house. Your interest is frozen on your debt and your creditors can’t contact you for 12 months. If your finances have not improved at the end of the year, your debts are written off.

- Bankruptcy – For many people, this is the fastest way to way to hit the reset button. Don’t be put off, there’s a lot of stigma around the word ‘bankruptcy’, however, it could be the right thing for you to do.

- Trust Deed – A debt solution for people in Scotland. It is an alternative to the IVA which is unavailable.

- Sequestration – The Scottish equivalent of bankruptcy.

- Minimal Asset Process (MAP) – A Scottish alternative to bankruptcy for those with debts but few assets. It is cheaper and more straightforward than sequestration and usually lasts for 6 months. After 6 months, most outstanding debt is written off.

We have a detailed post on what your debt options are here.

If you are considering a debt solution, we recommend that you speak to a debt charity for free advice. Their advisers can help you find the best option for you.

How to Put a Stop to ALL contact from them?

There are several debt solutions in the UK, some of which mean that you will no longer have to deal with Resolvecall Debt Collectors yourself and therefore they cannot visit your home.

There are pros and cons to all debt solutions so it is important to consider your options carefully. You should speak to a debt charity if you are considering a debt solution.

We have included some links above to a few organisations that offer free debt counselling services in the UK.

» TAKE ACTION NOW: Fill out the short debt form

Can You Make a Complaint Against Them?

If you think there is an issue, your first port of call should be filing a complaint against Resolvecall to their main office.

You need to give them the oppurtunity to sort out your problem before you escalate the matter!

If you believe that Resolvecall has violated any FCA regulations, you may choose to report the incident to the FCA or complain to the Financial Ombudsman Service (FOS).

If your complaint is upheld, Resolvecall may be fined and you could be owed some compensation.