Does A Secured Loan Affect Remortgaging? Full Guide

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Secured loans and remortgaging can seem quite puzzling. But don’t worry; we’re here to make things clear. Every month, over 6,900 people like yourself turn to us for guidance on these topics.

In this simple guide, you’ll find out:

- All about secured loans and remortgaging.

- How a secured loan might affect your chances to remortgage.

- The true cost of a bad secured loan.

- Why your mortgage provider might not allow more borrowing.

- What happens if you cannot pay back a secured loan.

We understand that you might be worried about these things, as many people are in the same boat. But remember, you’re not alone; we’re here to help you make sense of it all. Let’s start learning about secured loans and remortgaging together.

Can I remortgage if I have a loan?

It’s possible to remortgage if you have an existing loan. You will need to meet lender criteria to get approved for the remortgage.

This means disclosing all your existing debts so the lender can compare your income to your outgoings and decide whether a new mortgage will be affordable for you.

If you’re remortgaging for a lower interest rate to save money, this shouldn’t be an issue because your new mortgage will become more affordable. But if you’re remortgaging and want to borrow additional credit, this might not be as straightforward.

Does having a secured loan affect a remortgage?

Having a secured loan on your home won’t necessarily stop you from remortgaging for a better deal. But it could limit or stop you from remortgaging and borrowing additional money.

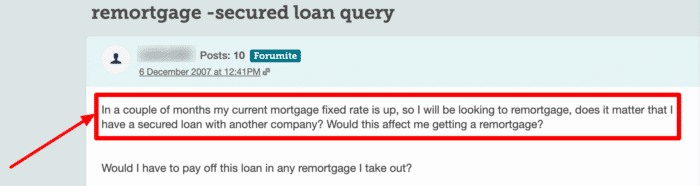

This forum user on MoneySavingExpert also wants to know whether they will be able to remortgage whilst they have a secured loan. It can affect it, but it is possible in some cases.

If the remortgage would make your mortgage payments cheaper, the lender is unlikely to object to the remortgage and reject your application, providing they still deem the mortgage affordable alongside your secured loan.

The lender will calculate your debt-to-income ratio to help determine if the mortgage will still be affordable. The mortgage company will have approved your mortgage prior to you taking out the secured loan, so, in my experience, it’s not always the case that the mortgage company will determine both loans affordable at once – even if the secured loan provider did determine this.

The Importance of Debt-to-Income (DTR) Ratio

Debt-to-income ratio (DTI) is the measure of how much of your monthly income goes to paying debt, including housing costs, personal loans and credit card payments. The lower your DTI, the better chances you’ll have of remortgaging.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Does having a secured loan stop remortgaging to borrow more?

It’s possible that a secured loan against your home can stop you from borrowing additional money through a remortgage. You could be rejected due to not enough home equity remaining in the property and/or because the new mortgage would be deemed unaffordable.

Not enough home equity

A secured loan is typically secured against a percentage of home equity rather than the property. Home equity is the value of a property that is owned outright.

How do you calculate home equity?

Home equity is easily worked out by finding the valuation of the property in today’s market and then subtracting all debt against the property.

For example, if a property is worth £200,000 and the owners have a £150,000 mortgage left to pay, their home equity would be £50,000 – or 25%. If the owners then took out a secured loan of £10,000 against some of their £50,000 home equity, they would be left with just 20% home equity.

Now, if the owners wanted to remortgage and borrow some more money, they may not be allowed to due to the limited amount of home equity they have in the property. They would only have £40,000 equity in the property, equating to 20% of its total value. Most mortgage providers only provide mortgages up to 80% of a property’s value, meaning you need at least 20% equity at all times.

Why won’t my mortgage provider allow additional borrowing?

The main reason the mortgage provider may not allow additional borrowing is that the homeowners will put themselves at risk of negative equity. If the property were to decline in value, they may end up paying back more than what the property is worth. Simultaneously, the mortgage provider may not get all the money back if they had to force the sale of the property.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Deemed unaffordable

The other reason a secured loan on a property could stop you from borrowing more through a remortgage is affordability. The lender may look at the repayments you would need to make on the secured loan and the larger mortgage and determine that these repayments are not affordable on your household income.

This might seem unfair, especially if you’re really good at budgeting and sticking to repayments, but the reason the mortgage company says no is to protect you.

Other things might also affect a lender’s decision-making when it comes to remortgaging, including broader economic factors such as unemployment rates or inflation, particularly when it comes to those with secured loans.

Alternative Options to Secured Loans

If you don’t already have a secured loan but are wondering what your options would be if you got one and then wanted to remortgage your property, it is worth considering other financing options, such as an unsecured personal loan or a credit card. These could potentially mean that you are more likely to be able to remortgage as opposed to if you had a secured loan, but make sure you do your own research.

What stops you from getting a remortgage?

One of the biggest obstacles to getting a remortgage is having a low credit score. If you have defaulted on other loans and liens of credit since taking out your mortgage, a mortgage company may not be willing to let you remortgage with them.

Even if you can remortgage with a poor credit history, you may not be offered the best interest rates that are advertised. This could even make remortgaging unworthwhile, especially as you will have aimed to secure cheaper interest repayments.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What happens if you default on a secured loan with a mortgage?

A mortgage always remains the senior lien of credit against the property it was used to purchase. Any other secured loan taken out against that property’s equity is junior liens of credit. The difference is important in the event that the secured loan doesn’t get repaid.

When a secured loan doesn’t get repaid, the lender can force the sale of the property to try and recover the money owed. This is a last resort to resolve the issue.

However, as the mortgage is the senior lien of credit, it’s the mortgage lender that gets to access any sale proceeds first. The mortgage lender will take as much money from the sale proceeds as needed to clear the debt and additional charges.

Will the secured loan lender get any money from the sale of the property?

Only the money that is left after the mortgage lender has cleared their debt and any charges can be accessed by the secured loan lender. This shouldn’t be a problem if the property has maintained or increased in value. But if the property value decreased and left the homeowner in negative equity, there may not be enough sale proceeds left to clear the secured loan – or multiple secured loan – debt.

For this reason, a secured loan company may not always foreclose on a property when the loan hasn’t been repaid.