Comprehensive Guide to Selling a Financed Car

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you want to know if you can sell a car on finance? Are you worried about what might happen if you do?

Selling a car on finance can be very tricky. It can even get you into trouble with the law. But don’t worry; we’re here to help. Each month, over 170,000 people visit our website for advice on debt solutions.

In this simple guide, we’ll talk about:

- What a Hire Purchase Agreement is

- If you can sell a car with outstanding finance

- What happens if you sell a car with finance on it

- How to sell a car on finance legally

- Ways to handle unaffordable debt and protect your credit rating

StepChange stress the need for professional debt advice, noting that 60% of adults in financial trouble hesitate to seek help.1 We understand your worry; making car finance payments can be hard. But remember, you’re not alone. We’re here to help you understand your options and find the best way forward.

Can I sell a car with outstanding finance?

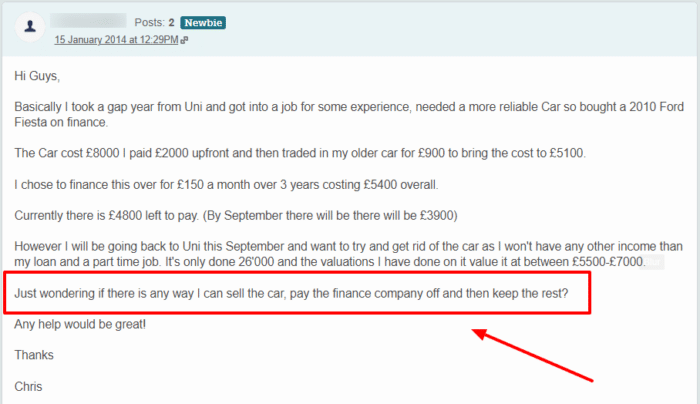

Are you wondering if you can sell a car with outstanding finance? You’re not alone!

Until the purchase agreement has been paid off in full, the dealer is the legal owner of the car. That means buyers cannot sell before the purchase agreement is finalised with the lender.

However, there may be other options that will allow you to sell. I discuss these later in this post.

Is it illegal to do so?

Selling your car under finance is illegal and may result in legal action being taken against you by the dealer or finance company. If you are trying to sell your car under finance to get out of debt or avoid paying it off, you could make your financial situation worse.

There are more suitable options!

» TAKE ACTION NOW: Fill out the short debt form

What happens if you sell it?

If you do sell your car with finance on it, there is a good chance you will get caught out and pay the price. The finance company or dealership can take legal action against you and you may be hit with a financial penalty.

Moreover, the lender will be able to repossess the vehicle as it is technically still their car. This will mean the person who bought the car from you might also take legal action against you to get their money back if you do not willfully do so.

A claims process like this can be stressful and cost you even more.

Can you go to jail for doing it?

In most cases, you cannot go to jail for selling a car on finance. If you sell it illegally it is still a civil matter. However, if you sold the vehicle to defraud an insurance company, you may be subject to a custodial sentence for fraud. Most people do not sell cars on finance for this reason and will not be sent to prison even if they are caught.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to get it done legally

You may not be able to sell your car with outstanding finance instantly, but there are still ways to sell it legally.

To sell your car with outstanding finance legally, you must first end your hire purchase agreement early. First, you will need to check the finance agreement to make sure it is possible to settle the finance. It probably is.

Then you should call the car finance company or dealership and ask for a settlement figure based on the car’s value. There may be an early settlement fee added to the final figure. If you can afford the early settlement amount, you will be given so many days to make the payment.

Once the payment is made, the vehicle is legally yours and you can do with it as you please – including selling it to another person or complete a part exchange to trade it in for a new car.

If your settlement figure was higher than what the car is worth due to fees and interest, selling your car could leave you with negative equity.

Do the maths first!

Buying a second-hand car HPI check

If you are considering buying a second-hand vehicle, it is worth conducting an HPI check on the vehicle as part of the process.

This will tell you if the vehicle has outstanding finance on it, and if so, you should avoid the seller. If you did buy one of these cars, it may be taken off you, leaving you out of pocket unless you pursue the seller with legal action.

Do not just ask to pay a lower price if it’s still on finance – avoid it completely!

Can I sell while repaying a loan?

If you took out an unsecured personal loan to buy a car and have used the credit to purchase the vehicle outright, the car is yours to sell. You could then use the money to repay some of the loan payments – but it may not cover the full loan amount.

It always helps to save some money saved up in cases like these, as the extra cash can help you pay off whatever’s left of the loan after selling the car. For useful budgeting tips, please take a look at the following table.

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

You may be able to get a loan settlement figure from the lender. Contact them directly to find out if you can settle.

An alternative option – returning the vehicle

If you were trying to sell the vehicle with outstanding finance because you could no longer afford the repayments and it might put you into debt, there may be an alternative solution.

If you cannot afford the settlement figure, you can look into the possibility of returning the car to the lender, known as a voluntary termination. You may not have the car any longer, but it will prevent any debts from materialising.

Generally speaking, buyers can return the vehicle if they have not yet paid back 50% of the value of the payments (all fees included). But be aware, you may be required to pay any remaining amount of the finance arrangement up to 50%.

I have a termination request letter template you can use for free!

If you have already repaid more than 50% of the personal contract purchase’s value, this may not be an option.

It will still be an option if the contract includes a voluntary termination clause. This is a clause added to let people return the car if they have already paid over 50% of the finance agreement’s value. Interest is not normally added either, but it can be.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Consider debt solutions instead

The car may not need to be sold to avoid debts if you offer any other lender a repayment plan. Alternatively, you could use one of the many debt solutions. Discover information about these debt solutions online for free by checking out this helpful solutions guide!

Will this affect my credit rating?

The Consumer Credit Act 1974 allows you to settle and terminate the HPA. The fact that you terminated the agreement can appear on your credit report, but it is unlikely to have a negative effect.

This is not the same as defaulting on payments that you still need to pay.