Setting Aside a CCJ – Simple guide, FAQs, Tips & More

For free and impartial money advice you can visit MoneyHelper.

For free and impartial money advice you can visit MoneyHelper.

If you’re looking for advice on setting aside a County Court Judgment (CCJ), you’re at the right place. Every month, over 170,000 people come to our website for guidance on their debt issues.

In this article, we’ll share with you:

- What a County Court Judgment (CCJ) is.

- How a CCJ affects your credit score.

- How to set aside a CCJ by filling an N244 form.

- What happens at a hearing to set aside a CCJ.

- How long it takes for a CCJ to be set aside.

We understand it can be worrying to figure out the correct steps for setting aside a CCJ. But you’re not alone. With our experience, we’ll guide you through this process.

Can a CCJ be set aside?

It is possible for some people to have their default judgment or CCJ set aside.

Setting aside your CCJ means the case will be re-evaluated, so you will need to provide good reasons in your application to set aside the judgment.

Don’t confuse this with having a CCJ removed from your credit report, which is what happens after six years.

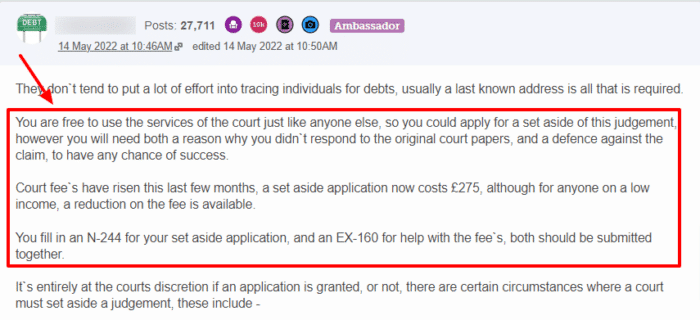

The most successful way of getting a CCJ or default judgment set aside is to prove you were not served notice about the claim before the date of the proceedings.

If the claimant did not provide notice of the court proceedings, you may be able to get a judge to set it aside.

This may happen if the claimant sent the notice to the wrong address, especially if you moved address around the date of the proceedings.

However, to save on court resources and avoid delaying tactics, you must also have a real prospect of successfully defending the claim.

If your application to set aside a judgment does not contain a good explanation why you do not owe the money, then the court will find no reason why the judgment should be set aside.

Another reason why you may get the court to set aside a default judgment or CCJ is that the claimant has not followed the correct process. For example, they may not have given you notice of your arrears using the correct communications, and thus not given you a chance to make a full payment before court action.

And another way you would be successful is if you could prove the debt was Statute Barred when the claim was made.

If it was already unenforceable at that time, the claim should never have reached the courts and you shouldn’t have been given an order to pay.

How to Get A CCJ Removed

Our partners at the CCJ Removal Service have a ton of experience with getting CCJs removed.

They will cover the whole process for you – listening your story and advocating for you every step of the way.

The Process

Step 1:

- Establish your legal grounds for removal.

Step 2:

- Mediate with your claimant to establish the terms they’d agree to “Set Aside” the judgement under.

Step 3:

- A barrister drafts the agreement between the parties to get your CCJ removed.

Step 4:

- The court removes or “sets aside” the CCJ from your public record.

It’s a surprisingly simple process.

Fill out our form to get help from our partners at CCJ Removal Services.

How to do it?

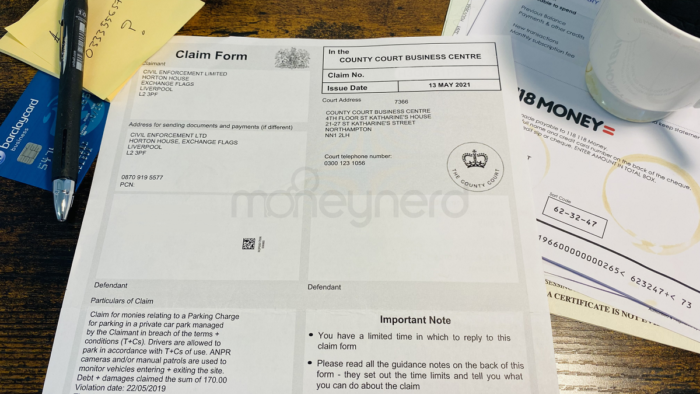

To apply to have CCJ set aside, you must complete form N244 and return it to the court.

When you fill in the form, you will need to provide valid reasons why you want the CCJ to be set aside. You should explain why you never replied to the initial claim, which may be because you never received it.

If you need help to fill in this form, there are guidance notes on the UK.GOV site or you can contact a charity for a free debt advice service. Find the notes on this page here.

There is a fee of £275 to apply to have CCJ set aside.

However, if you have a low income, there is financial assistance available to cover this fee through the UK Government.

Where to send Form N244

Form N244 should be provided to you by the court, but there are online versions on the UK.GOV website ready for download and printing.

You must submit your form to the relevant court with the fee, and you should make multiple copies.

You should inform the claimant that you have done this.

» TAKE ACTION NOW: Fill out the short debt form

What happens at a CCJ hearing?

There will likely be a new court hearing at a local centre to have the judgment set aside. This sounds more formal and scary than it really is.

In most circumstances, this is really just a private room with a judge and an authorised and regulated solicitor working for the claimant.

The judge will remain impartial throughout and decide on the outcome.

You may want to search for and contact a solicitor to represent you, but it is not compulsory.

The reason for the hearing is to determine if you as the defendant have a good enough reason to dispute the CCJ and be allowed to defend the CCJ (again).

If successful, the judgment is set aside and the case will follow the usual CCJ process with a new chance for you to defend yourself in court.

How long does it take?

The length of time it takes after you apply for CCJ to be set aside depends on court availability.

It could take longer if your case is complicated or there have been other disruptions to the process.

For more information on cancelling a CCJ, search for reliable charities and contact their team for friendly and confidential advice.