How to Spot a Fake County Court Business Centre Claim Form Letter

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you concerned about a letter from the County Court Business Centre? Do you want to know if it’s real or fake?

You’re in the right place to find out. Every month, over 4,600 people visit this site for help with court matters and debts.

This guide will show you:

- How to tell a real County Court Business Centre Claim Form from a fake one.

- What to do if you receive a fake County Court Claim Form.

- Who might send a fake County Court Claim Form.

- The risks of a fake County Court Claim Form.

We know that dealing with debts and court can make you feel worried, some of our team members have been in a similar spot.

Don’t worry! We’re here to help you make sense of it all.

What Is a Fake County Court Claim Form?

How To Spot a Fake County Court Claim Form

Why Were You Sent a Fake County Court Claim Form?

Who Sends a Fake County Court Claim Form?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The Dangers of a Fake County Court Claim Form

» TAKE ACTION NOW: Fill out the short debt form

Dealing With a Fake County Court Judgement Letter

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

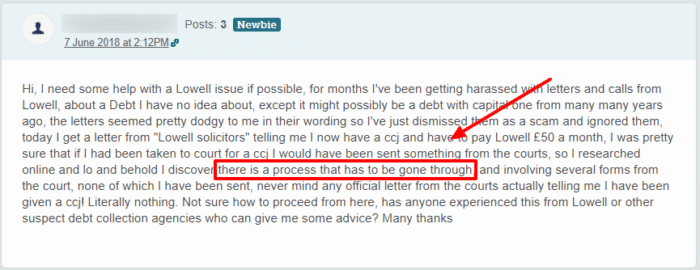

What should a Debt Collection Process look like?

Nobody wants to be chased for debt, but there are certain steps in the debt recovery process that need to be taken for it to remain legal:

- You’ll initially receive a letter to as you to repay the debt you owe (known as the letter of claim)

- If you don’t pay, you’ll be issued a default notice to warn you that your account will be closed and they’d like payment.

- If you still don’t pay, your creditor can apply for a CCJ

- If the CCJ is awarded, and you still don’t pay, your creditor can return to the courts and ask for further permission to enforce the debt with various means such as bailiffs, attachment of earnings or a charging order.

To avoid this from happening, you should take every step of this process seriously. The best way to avoid having a CCJ taken against you is by communicating with your creditors from the start.

It’s also worth noting that if your creditor hasn’t followed the process correctly, the CCJ may be thrown aside.