Statute of Limitations UK Debt

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about an old debt? Do you want to find out if you can still be chased for it? This is the right place for you. Every month, more than 170,000 people visit this site for solutions to their debt worries.

In this article, we’ll explore:

- The meaning of a debt that is over 6 years old, according to UK law.

- The conditions that make a debt ‘statute-barred’ or unenforceable.

- The steps to take if you are unsure about an old debt.

- The approach to handling debts you didn’t create.

- The ways to get free and fair advice about your debt.

A study by Citizens Advice found evidence of poor practices by debt collectors in the UK, including the collection of very old debt.1 So, we understand your concerns.

Don’t worry! We’re here to guide you, helping you make smart choices about your money.

What Does the Limitation Act 1980 Say About Unsecured Debts?

For unsecured debts (known as simple contracts), the limitation period is clearly stated to be six years.

This is clearly stated in Section 5 of the Act:

“An action founded on simple contract shall not be brought after the expiration of six years from the date on which the cause of action accrued.”

“The date on which the cause of action accrued” states the date the creditor would have the right to sue you with court action. For most unsecured debts, this date would be when you are sent a Default Notice.

Hence, the limitation period would start once you’re sent a default notice.

After that, you have to fulfil all conditions for six years for your limitation period to be completed.

Conditions for Limitation Period to be Valid

-

You haven’t made a payment towards your debt in six years. If it’s a joint debt, then your debt partner must not have made a payment towards the debt either.

-

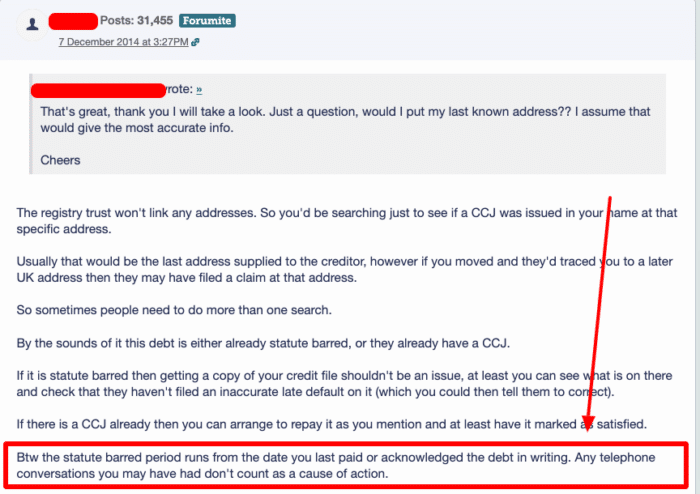

You (or your partner in the case of joint debt) have not acknowledged your debt in writing in the past six years.

- Your creditor has not filed a County Court Judgment (CCJ) against you.

» TAKE ACTION NOW: Fill out the short debt form

If all these statute-barred debt requirements are fulfilled, and it has been six years since your default notice, your debt will become statute-barred.

Any acknowledgement or payment are debt statute of limitations triggers and will start the clock again.

According to the Limitation Act 1980, your creditor cannot pursue you in court to recover the debt when your debt is statute-barred, as it would be breaking unsecured debt laws in the UK.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I be Chased for Debt After 10 Years?

Whether you’ll be being chased for your debts after ten years depends entirely on what type of debt it is and the circumstances surrounding it.

Let’s take a brief look at the debt types and limitation periods.

The Limitation Act of 1980 set the foundation through which a judgment is made about whether or not a debt is enforceable.

As I mentioned, the limitation period for most types of debts is six years.

This includes credit cards or store card loans, utility arrears, personal loans, payday loans, benefit overpayments, catalogues, overdrafts, and council tax arrears.

That being said, there are definitely some exceptions that the Act outlines thoroughly as well. Some of these exceptions to the Limitations Act are as follows:

Mortgage Shortfalls

Mortgage shortfalls have a limitation period of 12 years for the amount of money (the “capital”) you borrowed.

Keep in mind that the limitation period for the interest on your mortgage is still six years.

Personal Injury Claims

The limitation period for personal injury claims is a much shorter three years.

Other Types of Debts

Certain types of debts, such as income tax debt, VAT and capital gains tax debts, do not have any type of time limit or limitation period.

This would mean that HM Revenue and Customs holds the right to take you to court for your debts even after many years.

County Court Judgment (CCJ)

As mentioned, if your creditor takes out a County Court Judgment (CCJ) against you, no matter what type of debt it is, it cannot become statute-barred. There’s no time limit on a debt that has a CCJ taken out against it.

Criminal Fines

Criminal Fines have no limitation period, i.e., you could be pursued for any debts you may have regarding your criminal fines even after many years.

According to the Statute of Limitations, What can a Creditor do once a Debt is Statute-Barred?

The Statute of Limitations clearly states that once a debt becomes statute-barred, a creditor cannot pursue you in court for it.

Remember that while this does clearly mean that you won’t be pursued in court for it, it still means that your creditor may contact you outside of court regarding your statute-barred debt.

Use this to your advantage if the Financial Conduct Authority regulates your creditor.

FCA guidelines clearly state that it is unfair for a creditor to contact you for a statute-barred debt. Thus, if a creditor contacts you and you’re sure the debt they’re asking about is statute-barred, you should tell them this.

Write them a letter informing them that the debt is statute-barred and under the Financial Conduct Authority regulations for statute-barred debt, you do not intend on making payments towards it.

You should also request them to state in writing that they will not contact you about the statute-barred debt again. This should get them to stop. If it doesn’t, you can report them to the FCA.

You cannot do much if the FCA does not regulate your creditor.

Your best option could be to make arrangements to pay back the debt to get your creditors to stop contacting you.

If you cannot pay your debt, I suggest contacting an independent debt charity for advice, such as StepChange to help you with dealing with statute-barred debt collection attempts.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What are Some Things I Should be Aware of for Statute-Barred Debt?

The most important thing you must remember is that you should not depend on these laws to get out of your debt.

There’s a very low chance that your creditors will let your debt become statute-barred.

For example, it’s extremely unlikely that your local council isn’t going to pursue you for council tax debt for six whole years. Thus, you should always communicate with your creditors and do your best to get your debts paid.

Ignoring your debts in hopes that they will become statute-barred may land you in more trouble than you were initially in.

If you ignore your debts, the chances of it becoming statute-barred are fairly slim. However, the chances of your creditor taking out a CCJ against you are quite high.

Another thing to always be wary of is to identify your debt type and ensure you know the correct limitation period.

You may incorrectly think your limitation period is six years, whereas it could be 12 years. This is one of the many misconceptions about statute-barred debts.

Lastly, you must also remember that certain creditors don’t even need to go to court to extract money from you.

For example, HM Revenue and Customs can take money from your wages and benefits as payment for your debts.

Debunking Common Myths around the Statute of Limitations

In the UK, there are several common myths surrounding statute-barred debts. It’s important to understand these myths to understand the law clearly. Here are a few of them:

- Myth 1: Statute-barred debts are automatically written off after a certain period.

Fact: While it’s true that most debts become statute-barred after a specific period of time (typically six years in the UK), they are not automatically written off. The debtor needs to raise the statute-barred defence if the creditor tries to take legal action to recover the debt.

- Myth 2: Making a small payment or acknowledging the debt restarts the statute-barred clock.

Fact: Paying, no matter how small, or acknowledging the debt reset the statute-barred clock. The six-year period restarts from the most recent payment or acknowledgement date.

- Myth 3: The creditor must inform the debtor when the debt becomes statute barred.

Fact: The responsibility of determining whether a debt is statute-barred rests with the debtor. Creditors are not obliged to inform debtors about the statute-barred status of a debt.

It’s up to the debtor to be aware of their rights and raise the statute-barred defence if necessary.

- Myth 4: The debt collector can continue to pursue payment even if the debt is statute-barred.

Fact: Once a debt becomes statute-barred, the creditor cannot take legal action to enforce payment.

However, they can still contact the debtor to request payment. The debtor has the right to inform the creditor that the debt is statute-barred and request that they cease further contact.

- Myth 5: Statute-barred debts are removed from credit reports.

Fact: Statute-barred debts may still appear on credit reports even after they become unenforceable.

However, the debt status should be updated to reflect that it is statute-barred. Lenders and creditors should not use statute-barred debts as a basis for denying credit or taking adverse actions against the debtor.

What are the differences between statute-barred debts and written-off debts?

Many people confuse statute-barred debts with written-off debts. It is important to know the difference.

Statute-Barred Debts:

- Definition: A statute-barred debt is a debt that is no longer enforceable through legal action due to the passage of time. It occurs when the creditor has not acted to recover the debt within a specified period.44

- Time Limit: In England, Wales, and Northern Ireland, the limitation period for most debts is typically six years from the date of the last acknowledgement or payment. In Scotland, the limitation period is five years.

- Effects: Once a debt becomes statute-barred, the creditor loses the legal right to take court action to enforce the debt. However, the debt technically still exists, and the debtor can repay it voluntarily. Creditors can still ask for payment, but they cannot take legal action to enforce it.

- Importance of Acknowledgment: If a debtor acknowledges the debt or makes a payment, the limitation period restarts, and the debt is no longer considered statute-barred.

Written-off debts

- Definition: A written-off debt is a debt that has been declared as a loss or uncollectible by the creditor. It is a financial accounting term creditors use to remove the debt from their books.

- Creditor’s Decision: Writing off a debt is a decision made by the creditor based on their assessment that the likelihood of recovering the debt is low. It does not mean the debt is forgiven or ceases to exist. The debtor is still legally obligated to repay the debt.

- Impact on Credit Reports: A written-off debt can significantly negatively impact the debtor’s credit report. It signals to future lenders that the debtor has not previously fulfilled their financial obligations.