Student Loan Overpayment Debt Collection – Do I Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Did you get a letter saying you owe money because of a student loan overpayment? This can be a shock, and you might have lots of questions.

This guide is here to help. Each month, over 170,000 people visit our website seeking advice on debt matters.

In this article, we’ll explain:

- What a student loan overpayment is, and why you might have one.

- If you need to pay back the money straight away.

- How to sort out the overpayment if it wasn’t your fault.

- How this might affect your credit score.

- What might happen if you choose not to pay.

Unfortunately, nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1. We understand what you’re going through.

Don’t worry; we’re ready to guide you through the details. Let’s start by learning more about student loan overpayments.

What is a student loan overpayment?

A student loan overpayment is when Student Finance pays you more than you’re entitled to.

There are several reasons why you might be overpaid by Student Finance, such as:

- You changed course

- Your course length changed or your new course is shorter

- Your personal circumstances have changed, especially if you have children

- Your living arrangements have changed, such as moving in with parents

- You changed universities, such as moving from a London university to one outside of London

- You stopped studying at university before your course ended – but after receiving a new term loan

The latter is one of the most common reasons why people receive student loan overpayments. Dropping out of university after receiving a student loan payment will be classed as an overpayment.

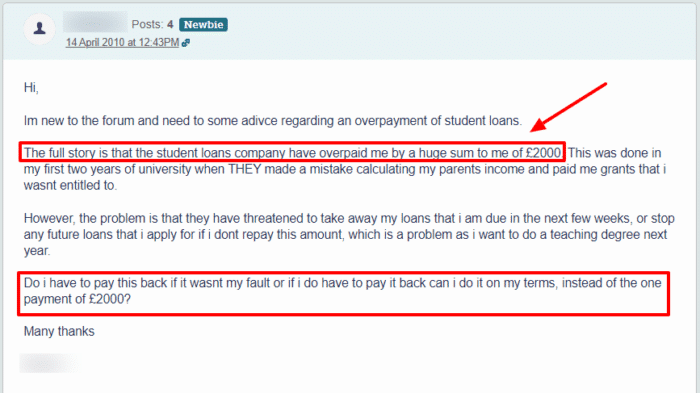

Unfortunately, many people have received a letter from Student Loan Overpayment Debt Collection and are unsure of their rights. By searching online forums, you’ll soon notice that you’re not alone…

Source: https://forums.moneysavingexpert.com/discussion/2404361/student-loan-overpayment-help

But don’t worry. We’re here to help you understand your options.

Your Rights With Debt Collectors

If you don’t repay your student loan overpayments, debt collectors will contact you and try to intimidate you.

To avoid any unpleasant situations, it’s important to know your rights. That’s why I’ve put together this quick table that explains what debt collectors are allowed to do. If you’d like to learn more, please read our complete guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

A word on student loan repayment overpayments

Student loan overpayment is a term that could be used in another situation.

When you’ve finished university and repaying your loan, there’s a chance you could end up repaying too much within the tax year. There are also many reasons this could happen.

You do get this money back if you make repayment overpayments to SLC, but you will need to communicate with SLC directly. Often they are aware of the overpayment and contact you about it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do I have to pay it back?

Yes, you will be obligated to repay the overpayment back to Student Finance.

You may be allowed to make your Student Finance repayments over several months or on a fixed repayment schedule.

» TAKE ACTION NOW: Fill out the short debt form

Do I have to pay back student loan overpayment if it wasn’t my fault?

You’ll still have to repay a student loan overpayment when it wasn’t your fault that you were overpaid.

This can be quite frustrating, but as we discuss below, there are ways to make the repayment more affordable.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do you repay?

How you repay a student loan overpayment debt depends on whether you’re still receiving student loan payments or not.

If you are receiving student loan payments still, the debt can be deducted from future payments made to you. But if this isn’t preferred you can still offer to pay off the student loan overpayment debt separately.

When you’re no longer receiving student loan payments, the overpayment debt needs to be repaid as a lump sum or over multiple instalments. This can be discussed and negotiated directly with Student Finance.

There is no minimum amount of income you have to receive before repaying an overpayment like there is with general student loan repayments. You could even be asked to repay a student loan overpayment if you’re currently out of work.

Further details can be found on this dedicated student loan overpayment page.

Will it affect credit score?

A student loan overpayment debt should not affect your credit score.

Despite what some online sources state, matters relating to your student loan don’t get reported to credit reference agencies.

Can you set up a repayment plan?

A student finance overpayment repayment plan can be set up when you cannot afford to repay the debt in one go.

SLC is willing to listen to your specific situation and is often accommodating to help you repay the debt in a manner that works for you.

As long as you’re being reasonable, there is no reason why you won’t be approved for a Student Finance overpayment repayment plan.

But if this support isn’t enough, there may be a way you can get further help…

What happens if you don’t repay?

You will be contacted and requested to pay If you don’t repay your student loan overpayment debt after the first letter.

This can escalate to a stressful student loan overpayment debt collection process, which is best avoided.

Can Student Loans send bailiffs?

Yes, the debt collection process could escalate to Student Loans using bailiffs. You can easily avoid this by communicating with SLC and letting them know about your situation.

Keep in mind that debt collectors and bailiffs are different. We recently spoke to the Mirror about them. While a bailiff may be permitted to take your possessions, a debt collector never can. All they are allowed to do is ask for a payment.

Does student debt ever get written off?

Yes, your student loans can be written off, but it’s complicated!

Keep in mind that it is very rare that student loans in the UK become statute-barred. This is because the payments come out of your pay automatically

Plan 1

- If you had your first loan payment on or after 1/9/2006: your loans will be written off 25 years after the April you first repaid.

- If you had your first loan payment before 1/9/2006: your loans will be written off when you’re 65.

Plan 2

All Plan 2 loans are written off 30 years after the April that you first repaid.

Plan 4

- If you had your first loan payment on or after 1/8/2007: your loans will be written off 30 years after the first April you repaid.

- If you had your first loan payment before 1/8/2007: your loans will be written off 30 years after the first April you repaid or when you are 65. Your loans are written off on whichever one comes first.

Plan 5

All Plan 5 loans are written off 40 years after the first April that you repaid.

Postgraduate Loans

All Postgraduate Loans in England and Wales are written off 30 years after the first April you repaid.

For postgraduate students in Northern Ireland, you are on Plan 1.

For postgraduate students in Scotland, you are on Plan 4.

Death

Student Loans Company (SLC) will cancel loans of someone who has died.

They will only cancel the loans on receipt of evidence that the person has died – this can include an original death certificate – and their Customer Reference Number.

Onset of Disability

If you are unable to work due to a disability, SLC may cancel your loan.

You will need to provide evidence that you are receiving disability benefits and your Customer Reference Number.

These benefits include:

- Disability Living Allowance

- Industrial Injuries Benefit

- Severe Disablement Allowance

- Personal Independence Payments.