TalkTalk Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you missed a TalkTalk payment? Don’t worry; you’ve come to the right place. Each month, over 170,000 people come to our site for advice on matters like this.

In this article, we’ll cover:

- How TalkTalk deals with missed payments.

- What to do if you can’t pay on the due date.

- Ways to possibly reduce some of your debt.

- The consequences of not paying TalkTalk.

- Where to get free debt help and support.

We’ve been in your shoes, as some of our team have also struggled with missed payments, so we understand how you might be feeling.

With our experiencer, we’ll help you understand your options.

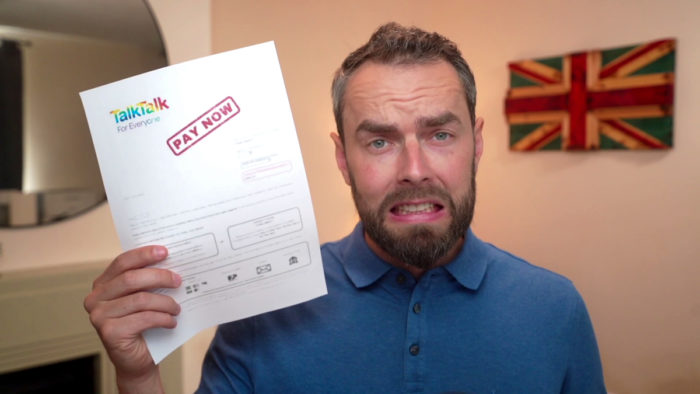

The consequences of not paying TalkTalk

If you don’t pay a TalkTalk bill, your account will be closed.

You won’t be able to use their services. In addition, your details may be sent to a debt collection agency.

This is something you want to avoid because dealing with these agencies can be a nightmare. They will start hassling you to pay – and they’re persistent.

My advice is to stay in touch with TalkTalk support from the moment you know you will miss a due payment date.

» TAKE ACTION NOW: Fill out the short debt form

Ignoring missed payments makes things harder to deal with later, and the ramifications can be a court judgement (CCJ).

Unfortunately, a CCJ will appear on your credit report for six years. So try to sort things out quickly to ensure it doesn’t get to court.

In addition to debt collectors, multiple missed payments could hurt your credit score, which may affect your ability to obtain credit in the future.

How TalkTalk deals with missed payments

You’ll receive a ‘payment reminder’ by email when you don’t or can’t pay a bill on time.

To make it worse, TalkTalk adds a late payment fee of £12.50 (though this is subject to change) to your next bill.

When you don’t pay after receiving the reminder, their support team will try to contact you again. But, in the meantime, you may lose your service or deal with a restricted service.

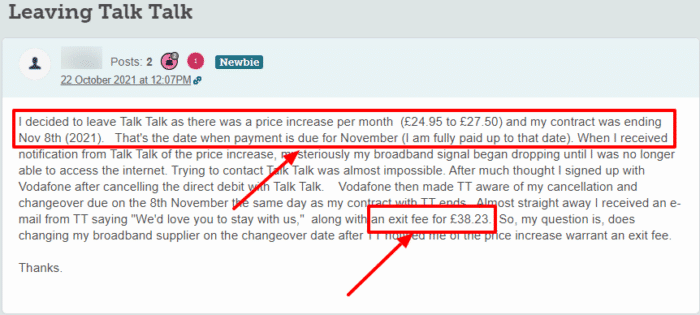

TalkTalk likes you to pay by Direct Debit.

But this can have a drawback too. Especially if there aren’t enough funds in an account to cover a scheduled payment.

As a result, you may have to pay unnecessary TalkTalk late payment fees and bank charges.

If you have cancelled your Direct Debit, and you do not pay your arrears, you may get hit with late payment charges on top of your TalkTalk bill.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are you struggling with finances and can’t pay?

I suggest you contact TalkTalk Customer Support when your circumstances change, and you’re struggling to make payments.

They may be in a position to offer a solution.

For example, you may be offered an extension on the payment due date. They may also offer a payment plan that is better suited to your financial situation.

When you ask for a TalkTalk payment extension, you get to pay what you can afford. But you must pay the total amount owed to TalkTalk by the date you committed to settling the amount.

If you can’t keep to your agreement, contact TalkTalk support for help and advice. The key is to stay in touch and not ignore the problem. It won’t go away!

Can you get a better deal from TalkTalk?

Yes, you may be able to get a better deal from TalkTalk. But it requires a bit of thought and preparation.

So I suggest you do the following:

- Put together a plan and have all your current billing and package information ready before you call TalkTalk

- Make sure you know what’s in your package – this includes the broadband speed the provider promised and what you actually get.

- Check whether you are paying for any extras.

- See if you’re paying for calls you never use (e.g. international calls).

- Check what TV channels are in your package and what you actually watch.

- Work out what you pay for extra calls, films etc.

- Check if you are still in a contract.

If you’re still in contract with TalkTalk, you should try to renegotiate a deal with the provider.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

TalkTalk Contact Details

Don’t try to cope on your own when you have money problems. The problem won’t seem so bad with the right kind of support. Plus, you’ll find it easier to get back on track with the right advice.

My advice is to do your best to make TalkTalk payments on time.

And if you can’t, contact their support team before a payment date is due. They could offer you a new payment date, an extension, and other advice.

| Website: | https://community.talktalk.co.uk/ |

Staying in contact with TalkTalk stops the problem from escalating.

It’s the best way to avoid debt collectors hassling you and being slapped with late payment fees.