TNC Collections – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprise letter from TNC Collections and are feeling worried? You’re not alone! Every month, more than 170,000 people come to our website for help with debt issues.

In this article, we’ll explain:

- How to deal with TNC Collections debt collectors.

- What legal powers TNC group services have.

- If you can write off some TNC debt.

- How to handle TNC Collections parking tickets.

Research shows that 64% of people in the UK feel stressed when dealing with debt collectors.1 Some of our team have also been there.

So we understand how you feel. With our experience, we’ll help you figure things out.

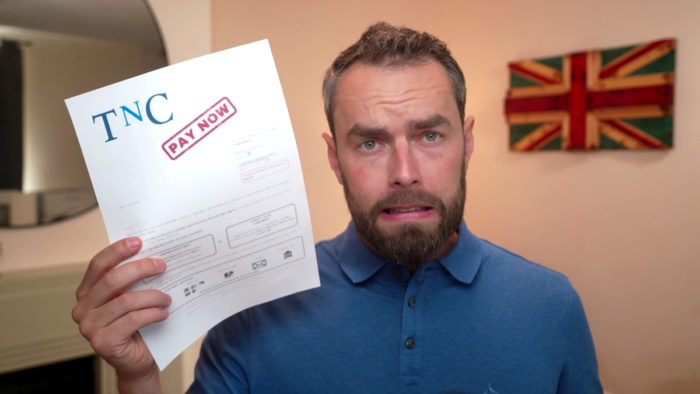

TNC Collections debt letter

TNC Collections will write you a letter asking you to pay or potentially face court action. This is known as a Letter Before Action and is standard practice in the debt recovery industry.

These companies could inform you that their client is willing to go to court if you don’t pay, but they may also just be using scare tactics to make you pay.

And sadly, there’s no way of knowing 100% for certain.

Should you pay a TNC debt letter?

You don’t have to pay a TNC Collections debt straight away.

You should first ask them to prove you owe the money and consider your options, which we’ll explain in this post.

Keep in mind that what you do may depend on whether they’re chasing you for an unpaid private parking ticket or another kind of debt.

» TAKE ACTION NOW: Fill out the short debt form

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Send them a prove-the-debt letter first

You can ask them to prove you owe the money by sending a prove the debt letter.

TNC Collections must provide a signed credit agreement or contract to do this, which can be difficult if it’s an older debt.

Without proof, you may not have to pay.

And if their client takes you to court, you can tell the judge that you asked for proof and nothing was provided.

With the average unsecured debt skyrocketing by 25% annually to £13,9412, it’s crucial to hold onto copies of all correspondence. You must have proof to protect yourself at all times.

Or check if your debt is too old to be collected

It’s also important to check if your debt is statute-barred. This is when the debt is too old to go to court.

However, some criteria must be met which we’ve detailed here:

- A debt could be statute-barred if you didn’t make any payments towards it during the time limit

- You didn’t write to a creditor admitting liability

- The creditor has not taken you to court over the debt

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will they take you to court?

If you owe the money and TNC Collections are chasing you for payment, you could be better off paying.

The debt collector could start legal proceedings against you, and a court judgement could be issued. You’d be liable for the debt.

Should you just pay the private parking ticket?

Private parking tickets may have to be paid if the car park operator followed the correct processes and takes you to court.

TNC Collections legal actions typically start out like this. But, they may or may not be willing to do this.

You should see if they followed the correct process and bring up anything they didn’t do correctly.

For example, did they send you the ticket in time? And did they offer a mandatory discount for paying earlier?

You can learn more about this in our Parking Charge Notice guide.

TNC Collections reviews

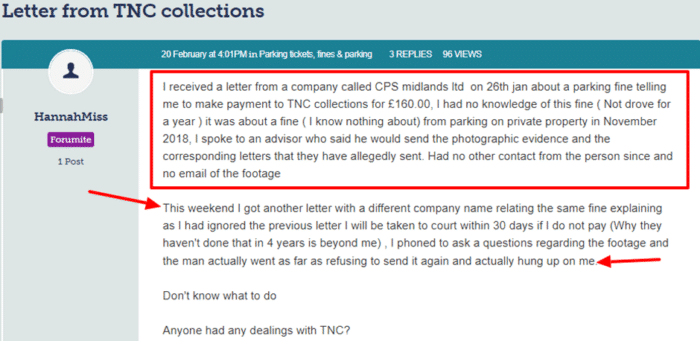

TNC Collections customer reviews often refer to an unpaid parking ticket.

TNC will demand that the fine be paid or they’ll begin court action. Here is what some people have experienced:

“I have today received a letter from TNC asking me to pay a charge of £140 which relates to an unpaid PCN issued by UK Parking Solutions. Who are TNC??? Are they debt collectors? Am I too late to appeal?”

- Sarahlovesshoes (Money Saving Expert Forum)

“Long story short – I got two tickets on the same road, 3 months apart which is run by P4 Parking LTD. There are no yellow lines/bays etc. I’ve ignored the tickets. Today I’ve received a letter dated 11/06/2019 from TNC parking services, threatening courts and the other usual stuff […].”

- Ishpisau (Money Saving Expert Forum)

What legal powers does TNC group services have?

UK debt collection practices are regulated and TNC must follow the law when they contact you.

Debt collection agencies like TNC Collections don’t have special legal powers. In short, their powers are the same as those of an original creditor.

TNC can send you letters, texts, and emails asking for payment. They can call you on the phone and visit your home, but that’s it.

Without a court order for you to pay, they can’t make you pay.

Can they come to your home?

TNC Collections have no right to come into your property.

Pretending they are enforcement agents – also known as bailiffs – is a major offence and should be reported.

That said, while debt collectors can visit your home, they just can’t force entry into it.

Also, Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Know Your Rights

There are many things debt collectors aren’t entitled to do, and knowing your rights can go a long way in these situations, as you won’t be taken advantage of.

Please check out our article on debt collector rights and take a quick look at the table below to better understand this.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Dealing with Debt Collections harassment

TNC Collections may repeatedly call, text, email and write letters.

They may do this multiple times per day or at unsociable hours. These are tactics aimed to wear you down and get you to pay quicker.

If you feel like you’re experiencing harassment, there are a few things you can do:

- You can provide TNC Collections with your contact preferences, including methods and times

- You can complain to TNC Collections (including if they ignore your contact preferences)

- You can escalate a complaint to the Financial Ombudsman Services – and TNC could be fined themselves

Make sure you follow the TNC Collections complaints process before contacting Financial Ombudsman Services complaints.

See what happened to one person who posted this message on an online forum.

Source: Moneysavingexpert

TNC collections parking tickets

The TNC Collections website mentions that they help private car park operators recover payment for parking tickets.

These are private car park fines issued to motorists for not paying or overstaying in privately owned car parks, such as car parks attached to supermarkets and hospitals.

They do not chase council parking tickets as enforcement of these fines follows a different process.

What’s the difference between a private and council parking fine?

A parking charge notice is more of an invoice raised by a private car park company to motorists who don’t obey their rules.

On the other hand, a penalty charge notice is an enforceable fine issued by local councils or transport authorities for parking contraventions on public land.

TNC Collections Contact Details

| Address: | Suites 358/359 Central Chambers, 93 Hope Street, Glasgow, G2 6LD |

| Phone: | 01242 214645 |

| Website: | https://www.tnccollections.com/ |