UK Search Limited – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

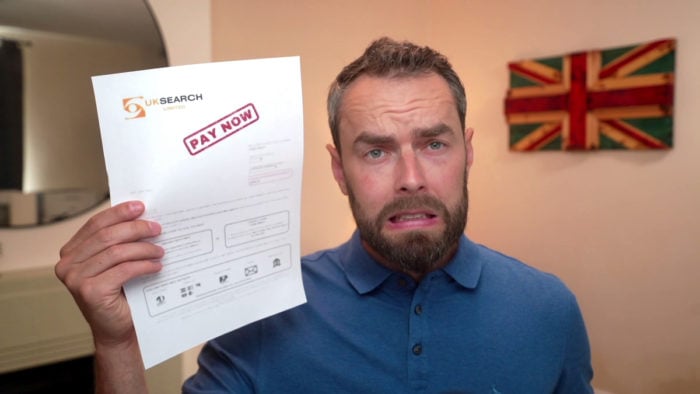

Have you received a surprise letter from UK Search Limited? You may be feeling confused and concerned.

Don’t worry; you’re not alone. Every month, more than 170,000 people come to our website seeking advice on debt problems.

In this easy-to-understand article, we’ll talk about:

- Finding out if the debt is really yours.

- If you can ignore UK Search Limited or say no to them.

- How to stop UK Search Limited from troubling you too much.

- Ways to plan your payments or even get rid of your debt.

Nearly half of people chased by debt collection agencies report experiencing harassment or aggression1, and even our team knows what it’s like to be chased by debt collectors.

It can be scary, but we’re here to help you deal with UK Search Limited. Let’s get started!

Have you received a UKSL debt letter?

UKSL might call you, send messages and leave aggressive voicemails, but they will prioritise sending you a Letter Before Action (LBA) if they have your address.

An LBA is a letter that demands payment for a debt by a deadline or threatens you with court action. These letters must be sent before a company (UKSL’s client) can take you to court.

Sometimes the threat of court action is real, and you might face legal action if you don’t pay. But they are also used to scare you into paying, which can be a highly successful tactic by any debt collection agency.

There is no way of knowing for sure whether their legal threats are real or empty – but there is something else you can do.

What to do when you receive a letter

Don’t ignore a UKSL letter, even if you think there has been a mistake, such as mistaken identity.

Instead, you should ask for proof that you owe the debt. This will help UKSL realise they’ve made a mistake if one has been made.

UK Search Limited is obligated to prove you owe the money before you have to pay. This doesn’t just mean saying you owe it because a company said so. It means providing you with a copy of the credit agreement or other contract you haven’t stuck to, signed by you.

Unless they provide this you don’t have to pay.

And if you are taken to court, you can show the judge that you asked for proof and it wasn’t provided. This can help you win in court because UKSL hasn’t followed the strict procedure.

MoneyNerd has made it easier than ever for you to ask UKSL for proof you actually owe the money. Download our free letter template now!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you pay if they proved it?

If UKSL proves the debt by sending you adequate evidence then you should probably pay.

If you’re struggling to pay the full amount, they will be willing to set up a payment plan.

If you ignore their letters after they provide proof you owe the debt, they could take you to court. There’s no way of knowing exactly what they will do. But it’s a risk to assume they’ll just give up.

» TAKE ACTION NOW: Fill out the short debt form

What if you can’t pay?

Stepchange reports a 25% year-on-year rise in average unsecured debt, reaching £13,941 in 20222, so it’s common to struggle with debt.

If that’s your case and you can’t afford UK Search’s payment plan, you could consider a debt solution.

There are several options for debt relief in the UK, so you will need to get some financial advice to find out which one will work best for you.

We have linked some charities at the bottom of this page that offer these debt counselling services for free.

Debt Management Plan (DMP)

A DMP is the only informal debt solution available. This means that it is not legally binding so you are not tied into the agreement for a minimum term or number of payments.

During a DMP, you make a single monthly payment that is distributed amongst your creditors. Usually, a DMP is in place until all of your debts are paid off.

Individual Voluntary Arrangement (IVA) or Trust Deed

An IVA is a formal agreement between you and your creditors. You agree to a monthly payment that is distributed amongst your debts, and your creditors agree not to contact you during or after your IVA.

A typical IVA will last 5 or 6 years, and at the end, any remaining debts are written off.

Keep in mind that IVAs are not suitable for everyone. You must owe several thousand pounds to more than one creditor and have some disposable income available.

You will need to look into a Trust Deed in Scotland, as IVAs are unavailable. They work in the same way as an IVA.

Debt Relief Order (DRO)

A DRO is a debt solution designed for people with few or no assets and a limited income.

For 12 months, you don’t make any payments towards your debts. Your creditors can’t contact you during this time, and they must also freeze any interest on your debts.

Your finances will then be reassessed and unless your situation has improved, you may be able to have your outstanding debts written off.

Bankruptcy or Sequestration

Bankruptcy, or sequestration in Scotland, may be your final option if you have debts but no realistic way of paying them off.

There is a negative association with bankruptcy, but it could be your only way of getting a financial fresh start.

If you are in Scotland, you may be eligible for a minimal asset process bankruptcy (MAP). A MAP is quicker, cheaper, and more straightforward than sequestration and is for those with few assets and limited income.

Can debt collectors come to your house?

Debt collectors are not the same as enforcement officers, who are also known as bailiffs.

They have no right to come to your home and cannot threaten to take away your items. If they do this, you should report them immediately.

That said, Janine, our financial expert, explained that while in some cases debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others.

Debt Collectors vs Bailiffs

Since debt collectors and bailiffs are not the same, it’s important that you have a clear understanding of each one’s rights so no one takes advantage of you.

Here’s what debt collectors and bailiffs can and can’t do. If you’d like to learn more about your rights when dealing with debt collectors, make sure to check out our detailed guide.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Complain About Search Ltd?

If you think that your debt collector has behaved inappropriately or broken any of the FCA’s rules and guidance, you can make a complaint against UK Search Limited.

First, make your complaint directly to UK Search so they have the opportunity to deal with the issue themselves. If you feel that they have not dealt with the matter appropriately, you can escalate matters to the Financial Ombudsman Service (FOS).

They will investigate your complaint and if it is upheld, Search Ltd may be fined, and you could be owed some compensation.

UK Search Limited Contact Details

| Address: | Unit 4 Gander Lane Barlborough, Chesterfield Derbyshire, England, S43 4PZ |

| Phone: | 01246 488 924 |

| Email: | [email protected] |

| Website: | https://www.uksearchlimited.com/ |