Village Investigations Ltd – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

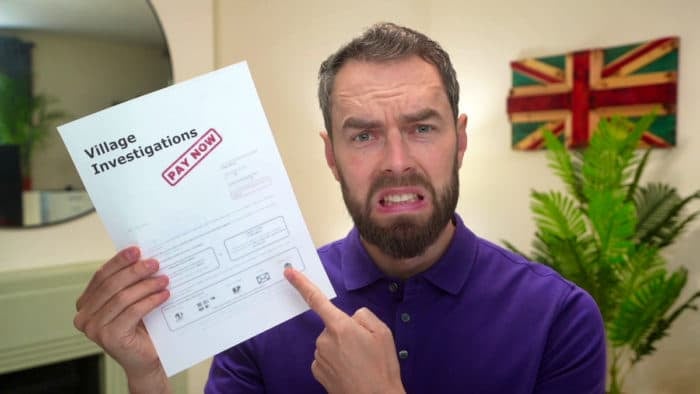

Have you received a letter from Village Investigations Ltd? Are you unsure if you should pay or not? You are in the right place.

Every month, over 170,000 people visit our website seeking advice on debt issues. You’re not the only one dealing with this.

This article will offer clear and easy information on:

- Who Village Investigations Ltd are.

- If you need to pay Village Investigations Ltd.

- How to deal with a debt letter from Village Investigations Ltd.

- Tips on how to deal with debt collectors like Village Investigations Ltd.

- How to find free debt support.

We understand that getting a debt letter can be worrying; some of us have been in your shoes. But don’t worry, we’re here to help. We’ll walk you through all your options in a simple and easy-to-understand way.

Remember, not everyone will need to pay Village Investigations Ltd. But, it’s important not to ignore them.

Have you received a Village Investigations Ltd debt letter?

Once Village Investigations Ltd has tracked you down – if required – they’re likely to send you text messages, emails and call you to ask for full payment. They are likely to listen to your payment plan offers as well. But the most important communication you could receive from Village Investigations Ltd is a debt letter, officially called a Letter Before Action (LBA).

This letter will ask for payment but it will also threaten legal action if you don’t pay by a deadline set by them. This can be a scary letter to receive, especially when you’ve never heard of Village Investigations Ltd or Vilcol before.

Ask Village Investigations Ltd to prove the debt!

You should request proof that you owe the debt that Village Investigations Ltd is requesting you pay. You can do this easily by writing them a letter back. They must respond with a copy of a signed contract or signed agreement before you are obligated to pay. If they ignore your request you can ignore any future communications from them.

But keep copies of your request in case the matter still goes to court. You can use our free template to create your prove the debt letter. It’s free to download and will save you time.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is your Village Investigations Ltd debt collectable?

There’s also a chance that the debt Vilcol are trying to chase isn’t even recoverable. Many older debts are banned from going to court, known as a statute barred debt. When a debt cannot go to the courts, a judge can’t order you to pay and you’ll never be made to pay by anyone, including bailiffs.

You should check to see if your debt is too old to be collected and if this legal loophole can get you out of having to pay. Do this before requesting proof of the debt!

» TAKE ACTION NOW: Fill out the short debt form

Do you have to pay Village Investigations Ltd?

You might have to pay Village Investigations Ltd eventually, but you don’t have to pay them just because you received a Letter Before Action.

This doesn’t mean you can ignore their letters. As stated above, there is always a chance you could be taken to court if you don’t react to their legal threats.

So, if you don’t have to pay and you shouldn’t ignore the letter, how should you reply to Village Investigations Ltd?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will Village Investigations Ltd take me to court?

Village Investigations Ltd won’t take you to court themselves, but their client may press ahead with court action if you don’t pay. Although, their client might have no intention of taking the matter further, especially if the amount owed is insignificant to them. Even when this is the case, Village Investigations Ltd may still threaten legal action to scare you into paying swiftly.

There’s no way of being 100% sure of the client’s intentions. And for that reason, you shouldn’t assume that you won’t be taken to court, even if you only owe a small amount.

Are Village Investigations Ltd bailiffs?

Village Investigations Ltd isn’t bailiffs working to enforce court orders. Their involvement in the debt collection process is limited to pre-court action. Whereas bailiffs can only get involved after a debt has been to court and a judge permits the claimant to use enforcement action.

Therefore, Village Investigations Ltd cannot claim that they can take your items to pay off the debt. If they do this, report them to the Financial Ombudsman Service. They could be fined as a result.

Village Investigations Ltd reviews

Most of the online reviews about Village Investigations Ltd are from clients rather than debtors. And they have mixed feelings about Vilcol’s services. Here is an example:

“Rude/arrogant/aggressive customer service, but generally competent and reasonable value otherwise”.

- Paul Wilkinson (Google review)

Village Investigations Ltd Contact Details

| Address: | 97 Ewell Road, Surbiton, Surrey , KT6 6AH |

| Phone: | 0208 390 9988 |

| Fax: | 0208 399 2959 |

| Email: | [email protected] |

| Website: | https://vilcol.com/ |