Vodafone Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re a Vodafone customer and your direct debit has failed, don’t worry; we’re here to help. Our website guides over 170,000 people every month on how to handle debt solutions, and we understand how worrying it can be to miss a payment.

In this article, we’ll cover:

- What happens when you miss a Vodafone payment.

- How Vodafone deals with a missed payment.

- Helpful tips to avoid overdue bills.

We know that missing a payment can cause a lot of stress, especially if you’re worried about not being able to pay the debt. We’ve been in your shoes, and we’re here to offer helpful, factual advice.

Let’s get started and find out what to do if your Vodafone direct debit has failed.

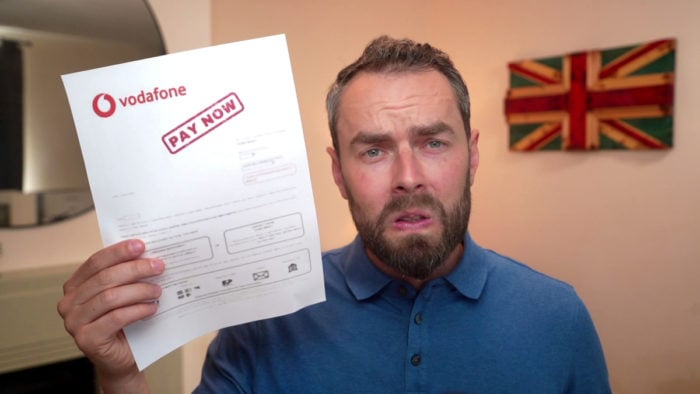

What Happens When I Miss or Fail to Pay?

You may miss a Vodafone payment because you forgot it was due. Don’t worry. Vodafone tells you the payment is overdue, which gives you time to make the payment. But when the amount is outstanding for a long time, things change.

Vodafone may cut off your phone. Again don’t panic. You still have time to pay and resolve the problem! But when you can’t, or you don’t pay the outstanding owed, Vodafone might cancel your contract.

How They Deal With It

If you are experiencing Vodafone payment issues, the provider marks your account in arrears. Examples being:

· When you’re 2 months late with a payment, the provider adds a 2 to your credit file

· If you’re 3 months late paying a bill, Vodafone adds a 3 to your credit file and so on

Moreover, Vodafone could add a ‘default’ notice to your account. The provider could do this if you don’t pay up within a specific timescale. They start their Vodafone debt collection procedure after this and may pass the details on to a debt collection agency, and you may end up with a County Court Judgement (CCJ).

Vodafone late payment consequences will impact your credit history and having a CCJ on your credit file are far-reaching. You’d have trouble getting a bank loan, credit card or mortgage, and the report remains on your file for six years.

» TAKE ACTION NOW: Fill out the short debt form

What can I do when my debt goes to a collection agency?

Vodafone tries hard to recover overdue payments. The provider calls you, they send letters and SMS messages. Don’t ignore any of the messages. When you don’t respond, your details are passed on for debt collection.

It means dealing with Vodafone debt collectors who will contact you incessantly. They’ll write to you, call you, and visit you at home. When you continue to ignore the debt, you could end up in court and get a CCJ for your trouble!

Vodafone uses debt collection agencies, including Lowell Portfolio Ltd, Zinc and CCS Collect.

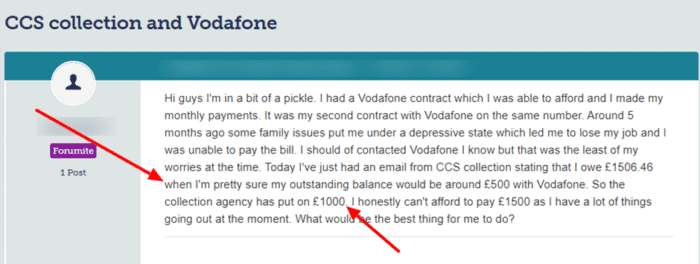

Check out what happened to one person who posted this message on a popular online forum:

Source: Moneysavingexpert

When a Vodafone debt collector contacts you, don’t panic. Stay calm and do the following:

- Ask Vodafone to confirm the debt is yours

- Make sure the amount is correct

- Arrange a repayment plan

You should also check whether your debt is statute-barred. But when the debt is correct, you’ll have no choice but to pay what you owe. My advice? Try to settle the amount before things go too far. It could affect your credit rating and history!

Missed Vodafone payment: Will Vodafone cut me off?

Vodafone doesn’t cut you off straight away when you miss a payment. But to avoid being cut off, I suggest you contact Vodafone support as often as possible and stay in touch.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is your bill wrong?

Vodafone makes mistakes, and your bill could be wrong! It happens and you have the right to open a Vodafone bill dispute.

If you think something about your monthly account is incorrect, contact Vodafone. Ask their support to check whether it’s correct or not. The provider’s Vodafone bill assistance could help you sort things out.

In short, If you think your Vodafone bill needs to be corrected, contact their support team to resolve the problem. There are various contact method options when you need to speak to Vodafone.

Vodafone must oblige when you file a complaint about a bill you’ve been sent. If the provider fails and you are unhappy with things, contact Ofcom. Take the matter further and protect your Vodafone customer rights.

I can’t pay my Bill. What can I do?

The key to a successful outcome when you can’t pay your Vodafone bill is not to panic. The provider doesn’t pass your details for debt collection until the last minute.

You have several options when you’re struggling to pay a bill and all the fees you may have incurred.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can someone else pay for me?

Yes, someone else could pay your Vodafone bill for you. They must call the support team from your phone. Alternatively, they could pay your bill using the online payment option.

Vodafone Customer Support Contact Details

| Phone: | 191 using your Vodafone mobile phone 0333 3040 191 from any other phone |

| Opening hours: | 8 am to 8 pm, Monday through Friday |

| Live Chat: | Vodafone Contact Us |

| Address: | The Connection, Newbury, RG14 2FN (Head Quarters) |

| Website: | https://www.vodafone.co.uk/ |