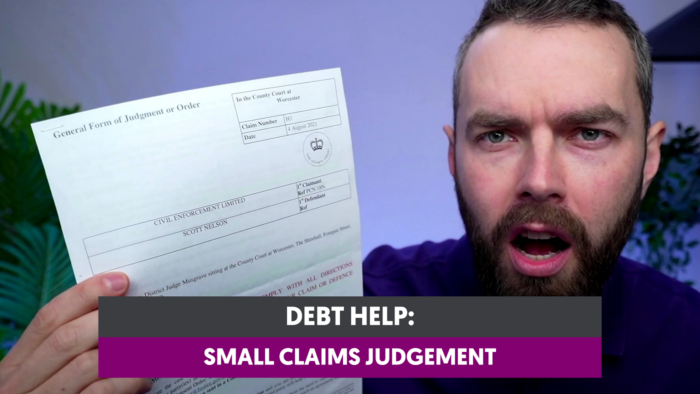

What Happens if You Don’t Pay a Small Claims Judgement?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

In this article, we’ll address the worry you might feel about not paying a small claims judgement. We understand this is a tricky spot to be in. Every month, we guide over 170,000 people through tough money situations just like this one, so you’re not alone in this.

Here’s what we’ll cover in this article:

- What happens if you don’t pay a small claims judgement.

- How to act if you can’t afford to pay after losing in small claims court.

- Understand what the small claims court is.

- Find out if you can write off part of your debt.

Our team knows well how it feels to deal with debt issues, as some of us have been in similar situations before. We’re here to provide you with the knowledge and help you need. Let’s dive in and find out more about handling small claims judgements.

What if a defendant cannot pay?

If the judge requests the defendant to pay, you must pay within 14 days.

If you decide not to pay because you cannot afford the payment in addition to your essential living costs, the claimant may first try to gather information about your personal finances. This will tell them if you can afford to pay or not.

They will do this by asking a judge to order you to a hearing where you will disclose your income and expenses to a judge. With this financial information, the claimant may decide to pursue you for the payment with enforcement action (listed below).

If your finances are unconvincing, the claimant may choose not to chase you for the payment until your finances improve.

If you have a judgement against you, I suggest you explore all options to pay the debt. Do the following:

- Set up a CCJ payment plan to pay the debt at a more affordable rate.

- Apply to change the payment terms if you’re still struggling to keep up with payments.

- Apply to have the judgment cancelled or set aside if you disagree with it.

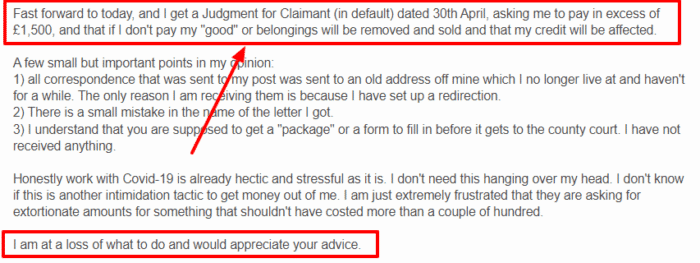

Remember, you can ask the court to set aside a judgment if you believe it shouldn’t have happened in the first place. This forum poster has a chance to successfully challenge on the basis that the letter of claim and the court papers were sent to the wrong address.

Nonetheless, if you don’t use any of the options above to pay the debt, the court can enforce the judgment in one of many ways.

They will, however, take your circumstances into account before deciding on the most appropriate debt collection method.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

For example, they can:

1. Use bailiffs to recover payment or goods

The court may seek bailiffs‘ intervention to recover the money. The bailiffs will first send a letter to your address asking for the debt to be paid within seven working days of the date of the letter, also known as an enforcement notice.

And if you don’t, they will attend your home and try to take control of assets that can be sold at auction. The money raised at the auction will be used to pay off some or all of the money owed.

This enforcement action could be used against individuals or a limited company that owes money on a judgment.

2. Take money from the debtor’s wages

Instead, the court may use an attachment of earnings order to collect the money from your employment income.

This is when the defendant’s employer is made to send a percentage of their wages to the court, which then sends the money to the creditor/claimant. They will continue to collect the debt this way until it is all paid off.

3. Freeze assets

Alternatively, though less common, the court may decide to freeze the debtor’s bank account and other financial products by issuing third party debt order. They will then decide if the money in any savings or bank account can be used to pay any of the debt owed to the claimant.

4. Use a charging order

This enforcement order places a charging order on any land or property the debtor owns. If your property or land is sold, the charging order will ensure that some of the income raised is used to pay the debt. The debtor may even be forced to sell their land or property to repay the debt faster.

» TAKE ACTION NOW: Fill out the short debt form

Can you be forced to pay?

Yes. If you receive a judgment to pay and do not wilfully do so after the court’s decision, you can be forced to pay.

The business or person making a claim can ask the courts to collect the money from the debtor. There will be a fee for this service, but any person receiving benefits or on a low income can request that the fee is waived by completing a form.

What if a defendant does not respond to the court?

If you have received notice that someone is taking you to court over a small claim and you ignore it, the claimant may be able to get the court to issue a judgment forcing you to pay.

In other words, they may get the court to issue a County Court Judgement (CCJ) against you. A CCJ will negatively affect your credit status.

Therefore, doing nothing and ignoring the creditor can work against you.

How claimants can ask the courts

If you do not respond to their claim within 14 days, the claimant can ask that the courts issue you with a court order making you legally responsible for paying.

The way the claimant can ask for a judgement depends on how they raised their case:

- Ask for a judgment online if the claim was initially made online

- Use Form N225 for a fixed amount

- Use Form N227 for an unspecified amount

They can also use the above to ask for a court order if you do respond, but in your response, you admit you owe the money.

If you have to attend a hearing, it will be beneficial to get legal advice. You probably don’t need a solicitor, but it’s wise to get help from Citizens Advice with your case.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

I want to fight the case…

Alternatively, you may want to respond to the claimant and may have to attend a hearing to decide the outcome of the case. Be sure to put a strong legal defence in small claims court.

Gather together any documents or photographs you have to support your defence. I suggest you list what happened in date order and then find evidence to back it up.

A judge will decide if any money is owed to the claiming party and issue a judgment based on their decision.

Can I appeal the court order?

Yes. You may be able to appeal against the order as long as you get the court’s permission to do so.

The appeal must be lodged within 21 days and will only be successful if the previous judge has made a legal mistake, which is highly unlikely.

If you are awarded the chance to have your case looked at again, you will not be allowed to put forward new evidence.