01389493417 – Who Called? Stop Opos Debt Collectors

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering about a phone call or letter from the number 01389493417? This number is linked to Opos Debt Collectors, a real debt collection agency from Scotland.

I know it can be a bit scary, as nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1. But don’t worry; you’re not alone. Each month, over 170,000 people visit our website for advice on handling debt.

In this guide, we’ll talk about:

- Who Opos Debt Collectors are.

- Why they might be calling you.

- How to deal with their calls.

- If and how you need to pay them.

- Ways to stop them from contacting you.

You might be confused about where the debt has come from, or if you should pay it. Maybe you’re worried about affording the payment. We understand these worries, and we’re here to help you understand your situation better.

Who Called Me?

The business that called you from 01389493417 is a debt collection company called Opos Debt Collectors.

These guys are quite well known, which is why we have already covered them in a dedicated debt collection guide here.

If you don’t find what you’re looking for below, we recommend checking out our detailed Opos Debt Collection post as well.

Can I ignore the calls?

You’re not legally obligated to answer a call from Opos Debt Collection. However, it could be in your best interest to answer at least one call to find out why they’re calling your number.

I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

Managing collection calls could also reduce your anxiety about the situation.

If you decide to answer a call, don’t volunteer any information to the caller. Opos should already know who you are if they’re calling you to pay a debt.

In most cases, these types of calls usually occur after a debtor hasn’t responded to a debt letter from the company. It can be better to deal with this letter.

We have discussed the best ways to deal with Opos debt collection letters in the Opos Debt Collector guide mentioned earlier. By reading the guide you could even find ways to avoid paying the debt!

For example, you might not have to pay due to the age of the debt!

Why have they contacted me?

If you have been contacted by 01389493417, there is a good chance that Opos Debt Collection is trying to locate an alleged debtor to make them pay a debt. They may have traced the debtor to your phone number.

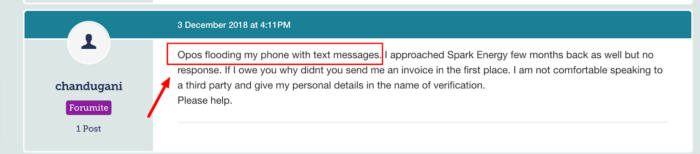

On top of calls, there is evidence from online forums suggesting Opos will send frequent text messages as well:

Source: https://forums.moneysavingexpert.com/discussion/comment/76315502#Comment_76315502

By ignoring them, you’ll eventually be escalated onto later and more uncomfortable steps.

To offer you a quick insight into the average timeline adopted by debt collectors, I’ve created this table. To better understand the debt collection process, be sure to explore our detailed breakdown of the debt collection timeline.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Repeat calls and text messages are not allowed. Later in this guide, we will explain how to complain about Opos if they do this, which could help you with your debt problem as well!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

» TAKE ACTION NOW: Fill out the short debt form

How do I stop them from contacting me?

You won’t be able to stop all contact from Opos Debt Collection because they are allowed to contact you in some way!

That said, excessive contact can cause financial stress, and your mental health could be affected.

The FCA states that alleged debtors can provide the debt collection company with their communication preferences. For example, you could tell them that you want all communication in writing, meaning they could only send letters in the future.

If they ignored your communication preferences, you could then make a complaint about their behaviour. This can have serious consequences for Opos and might even help with your debt. Harassment from debt collectors is taken very seriously.

But the easiest way to stop Opos from contacting you is to pay them! Make sure that you validate the debt and make sure that you are actually liable for it before you pay. If you don’t think that you can afford to pay off the debt in one go, you can keep reading to find out more about your options.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I Complain about the calls?

If you think that Opos Debt Collectors has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Opos so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Opos may be fined. You could even be owed compensation.

Opos Debt Collectors Contact Details

| Telephone number | 0141 428 3993 |

| Email address | [email protected] |

| Postal address | Opos Limited 2nd Floor15 Meadowbank Street Dumbarton G82 1JR |