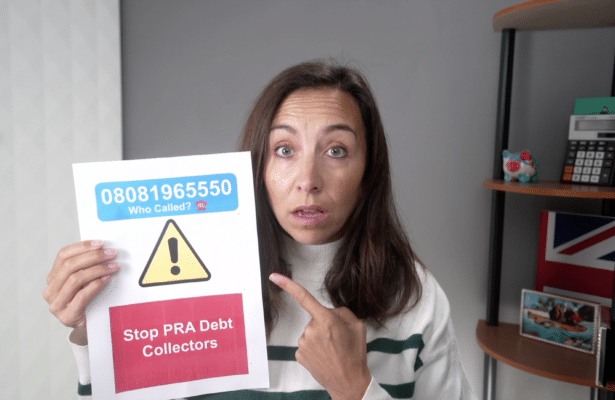

08081965550 – Who Called? Stop PRA Debt Collectors

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a call from 08081965550? This may be PRA Group, a big debt collection agency in the UK.

We know this can feel scary and confusing. Luckily, you’ve come to the right place. Every month, more than 170,000 people visit our website for advice on debt solutions.

This guide will help you understand:

- Who is calling you from 08081965550

- How to deal with PRA Debt Collectors

- What happens if you don’t answer the phone

- Ways to manage your debt with PRA

- How to stop calls from 08081965550

Research shows that 64% of people in the UK feel stressed when dealing with debt collectors,1 and some of us have also experienced this.

So, we understand your concerns and are here to help you make informed decisions.

Who Called You From 08081965550?

The number 08081965550 is associated with a firm of debt collectors known as PRA Group, which essentially purchases debts from banks and other financial institutions.

This firm will chase debts aggressively.

You see, debt collection agencies like this one buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2

This means that they will call you every day, at the weekend and in the evenings, to try and get in touch with you and make a profit off of the debt they purchased from the party you originally owed money to.

These calls are made automatically, with no human involved in the loop until you actually pick up your phone and answer.

At this stage, you will be diverted to a collection agent.

If you don’t answer the phone, an automatic message will be left if you have an answering service.

» TAKE ACTION NOW: Fill out the short debt form

What Happens if You Don’t Answer the Phone to PRA Debt Collectors?

If you don’t answer the phone when PRA Group calls you and can manage to avoid speaking to them for an entire 6 years, there is a chance that you could have the debt written off.

However, this is a pretty unlikely scenario, as PRA Group will not simply give up trying to get you to pay the debt.

You will receive letters and phone calls constantly until such time as you speak to PRA Group and arrange for repayment of the debt.

We always recommend responding to debt collectors – even just to question the debt’s validity.

You have the right to request proof of the debt. They have to prove it, or they can’t charge you.

If you ignore all of the phone calls and correspondence, PRA Group has other tools at its disposal that can be used to force you to pay the debt.

Typical Debt Collection Process

Typically there’s a due process that is followed when it comes to debt collection. Please check out our related article and take a quick look at the table below.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will PRA Take You to Court?

It is highly likely that if you fail to negotiate repayment of the debt with PRA Group, they will eventually begin legal proceedings against you.

Your first clue that this is about to happen will be when PRA Group sends you a letter before the claim.

This tells you that the company is about to contact the county court and ask them to make a judgment on the debt. Meaning that you are then legally liable to pay the debt in full.

If the court does issue a County Court Judgment (CCJ) against the debt, this could result in bailiffs being sent to your home to collect the debt.

You will either have to give them money, or they will take goods from your home to sell off and pay the debt.

Alternatively, in some cases, it may be more appropriate for PRA Group to apply to the court to have you declared bankrupt.

Or to have a charging order issued against your home, which could eventually mean you have to sell it to pay the debt off.

How To Stop Them From Calling You

There are a few things that you can do which might stop PRA Group from constantly calling you on the phone.

Below, we have explained the things that you need to do to begin the process of stopping 08081965550 from calling you.

- Collect evidence – to prove that PRA Group has been harassing you. You can make a list of all the dates and times you were called by 08081965550. Also, keep all of the letters you were sent. YOU can also get a witness statement from friends and neighbours stating they have seen how badly this company has been harassing you.

- Write to the original creditor that you owe the debt to – tell them that you want the harassment to stop and that harassment is a criminal offence in the UK. Inform them that if does not stop, you will take further action. Tell them how you would prefer to be contacted in the future. Send the letter recorded delivery and keep a copy.

Your creditor is then given three business days to make an informal response to your letter.

Additionally, the creditor has to let the Financial Conduct Authority (FCA) that a complaint has been made against them.

In most cases, this should stop the constant phone calls, although probably not all of them. If you continue to be harassed by PRA Group after this, you can complain to the FCA directly, yourself.