Zenith Collections – Beat Debt Collectors (Guide, FAQs & More)

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

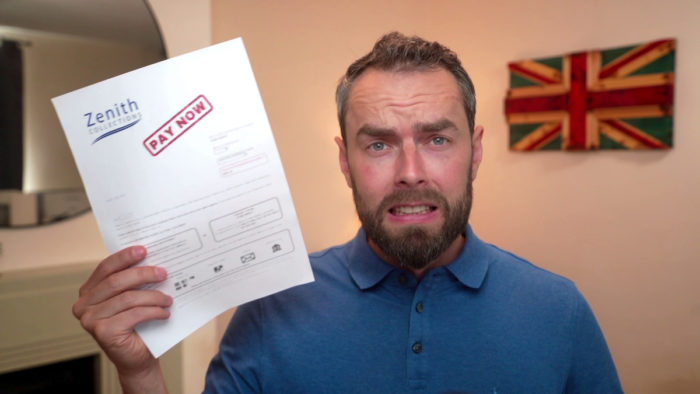

When a letter from Zenith Collections pops through your letterbox, it can be quite a shock. You may wonder where this debt has come from or if you really have to pay it.

Don’t worry; you’ve come to the right place. Each month, over 170,000 people visit our website looking for guidance on debt issues.

In this guide, we’ll cover:

- Why Zenith Collections is contacting you

- Checking if the debt is really yours

- How to deal with Zenith Collections if you can’t afford to pay

- Ways you might be able to write off some of your debt

- Where to get help if you need it

According to StepChange UK, 83% of 1794 clients said at least one creditor didn’t consider their vulnerabilities. Some of our team members have experienced this firsthand.

So we know that getting a letter from Zenith Collections can feel really intimidating. That’s why we’re here to help you understand your options. Our advice is based on real experiences and facts, not scare stories.

Why are Zenith Debt Recovery contacting you?

As you’ve probably guessed by now, Zenith Collections are reaching out to you because of an overdue parking ticket.

If they have contacted you, the chances are that you haven’t paid a fine and have been ignoring letters requesting you pay.

However, you’ll see that they are very persistent, and often will send fairly threatening letters claiming that they’ll take you to court or inflate your total penalty. Obviously, this can be quite intimidating, but as we’ll see, they actually don’t have very many powers.

If they are in touch with you, it can be annoying, and it does have the potential to escalate. However, if you have a parking fine, you should try to deal with the parking company that issued it.

That said, they might be contacting you about a debt that isn’t enforceable – this means that there is no legal way to force you to pay. We go through ‘requesting proof’ below.

Sometimes, you’ll hear from Debt Recovery Plus first, who will then ‘refer’ your case to Zenith. As we know, however, they are one and the same.

Do you have to pay Zenith Collections?

This depends on the exact circumstances of where and when your fine was issued.

You might be able to get the penalty removed by speaking with the original company or the retailer that uses them. This can often resolve the matter and minimise the amount you have to pay.

If you are going to pay, you shouldn’t pay Zenith. They are trying to profit from your misfortune.

They’ll escalate the cost of your ticket, pay the original company what they’re owed, and pocket the rest. If you want to pay, go directly to the company that issued the fine.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What should you do if you have an outstanding debt?

There are a few options you have when facing debt from Zenith.

The first one is to simply pay the original parking company the amount that you owe. It can be annoying, but it’s often the fastest way to deal with the matter.

StepChange found the average unsecured debt amount per client increased by 27% year-on-year to £16,1742. So, it’s common for people to struggle with debt. If that’s your case, and you can’t pay Zenith, consider reaching out to the original parking company.

Don’t pay Zenith, as they’ll take on extra fees that you might not have to pay.

If there are any exceptional circumstances, they might take these on board and dismiss the penalty. However, Zenith won’t be able to do anything about this, so there’s no point reaching out to them about it.

If your parking ticket was issued at a retail car park, you could approach that retailer. They might be able to contact the parking company to request that the fine is removed. Again, there are no guarantees they’ll do so, but it can be worth a try.

You can continue to ignore Zenith and see if they give up.

They’re unlikely to do so, and they’ll probably send you a letter before county court claim (LBCCC). This basically means that they’re trying to settle the matter in court, such as by requesting a CCJ.

» TAKE ACTION NOW: Fill out the short debt form

Can they visit your house?

As a debt collection agency, Zenith’s debt recovery team can pay you a visit at your home.

However, they usually have to send notice of such an event, and they don’t have any powers once they’re there.

Our financial expert, Janine, says on debt collectors: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

All they can do is continue to ask that you pay back the money you owe.

They might try and intimidate you into paying, but as mentioned above, they can’t actually force entry to your property or seize goods.

Your Rights With Debt Collectors

Understanding your rights when dealing with Zenith or any other debt collection agency is crucial.

That’s why we’ve prepared this table to explain what debt collectors are allowed to do. If you’d like to learn more about your rights, be sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Remember that Zenith isn’t a bailiff, which means that they don’t have any court-mandated powers.

However, if things progress and escalate, the original parking company can attempt to issue a CCJ or send the actual bailiffs around. As such, it’s worth taking their letters seriously.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Where can you get help dealing with Zenith?

There are a few options when it comes to getting help.

If you feel that you’ve received a call or letter from Zenith that is intimidating, harassing, or misleading, you can complain to Trading Standards. They might be able to help resolve the matter in some ways.

You could also complain to the original company, who may take a lenient approach.

If you’re struggling with debt in general, there are plenty of options. Check out our article on debt options for more information.

One of the most common ways people with a lot of debt get help is through an individual voluntary arrangement, debt management plan, or other forms of debt help.

Debt Recovery Plus Ltd Contact Information

| Phone: | 0208 234 6775 |

| Website: | https://www.debtrecoveryplus.co.uk/ |

| Address: | 78 York Street, London, W1H 1DP |