Zinc Group Credit Management Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Did you receive a letter from the Zinc Group and aren’t sure what to do next? You’re not alone. Each month, over 170,000 people visit our website for help with debt problems.

In this article, we’ll:

- Guide you on what to do if you’ve received a letter from Zinc Group.

- Explore if you really need to pay and what might happen if you don’t.

- Discuss ways to manage your debt.

- Show you where to get free advice about your debt.

Research shows 64% of people in the UK feel stressed when dealing with debt collectors1. Some of our team members have even experienced this.

Don’t worry. We’re here to share our knowledge and help you understand your debt.

Been Hit with a Zinc Debt Collection Letter?

This is called “debt purchasing”, and it’s extremely profitable.

In fact, debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2

We go through handling both of these scenarios below.

Can You Ask Them To Prove Your Debt?

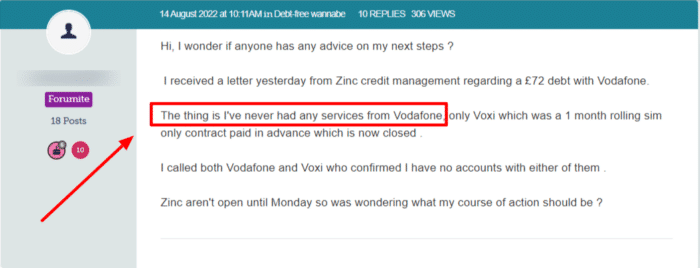

This is why asking for proof that you owe the debt is so important! This person should write to Zinc and ask for evidence that they are liable for the debt. It doesn’t sound like Zinc will be able to give them any!

Keep in mind that sometimes debts are too old to chase. Once 6 years (or 5 years in Scotland) have passed since you last made a payment towards the debt or wrote to your creditors about it, it is statute-barred.

This means that there is no legal way for your creditor or a debt collection agency to force you to pay.

Paying off your debt immediately will get Zinc Group off your back the quickest.

If you can’t pay in a lump sum you may be able to negotiate with them and agree on a repayment plan. Just make sure you get an agreement in writing from Zinc as soon as possible – this will make it impossible for them to argue with you down the line!

If you don’t think that you can afford even a repayment plan with Zinc, you may need to consider a debt solution.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When You Don’t Have to Pay the Debt

Don’t Ignore Zinc Collection Letters

What Debt Solution Can You Get?

There are a few different debt solutions available to you, depending on your circumstances and financial situation.

Keep in mind that, with so many options available,we recommend that you speak to a specialist who will be able to help you work out which one will be best for you.

Debt Management Plan (DMP)

A DMP is an informal debt solution between you and your creditors. You pay a set monthly sum that is shared among your non-priority debts.

A DMP is not legally binding, which means you can cancel it at any time, and there is no minimum term for the agreement.

Individual Voluntary Arrangement (IVA)

An IVA is a formal debt solution for those who owe several thousand pounds to more than one creditor.

Typically, an IVA will last for 5 or 6 years, and during this time you pay an agreed monthly sum that your Insolvency Practitioner (IP) will share between your creditors. Your creditors can’t contact you in any way during your IVA and, at the end, any of your remaining IVA debts are wiped off.

Trust Deed

IVAs are not available in Scotland. Instead, opt for a Trust Deed.

They work in the same way as an IVA – you pay an agreed sum that’s shared between your creditors, they don’t contact you, and any remaining debts are wiped off at the end.

Debt Relief Order (DRO)

If you have a few debts but no valuable assets and a small income, you may be eligible for a DRO.

From the date that your application is accepted, your DRO will last 12 months. During this time your creditors do not contact you, and they freeze your interest. You don’t make any payments towards your debts during this time either.

After a year, your finances are reassessed. If there is no improvement in your financial situation, your debts can be written off.

Bankruptcy

If you owe substantial debts but have no real possibility of paying them back, you may need to declare bankruptcy.

Bankruptcy has a negative image, but it is often your only way of clearing debts and getting a fresh financial start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

You may be eligible for a minimal asset process bankruptcy (MAP) if you have a small income and few assets. A MAP is cheaper, quicker, and more straightforward than sequestration, so is worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Zinc Take Your Valuable Items?

Debt Collectors vs Bailiffs

We recently spoke to the Mirror about debt collectors and bailiffs. While a bailiff may be permitted to take your possessions, a debt collector never can.

All they are allowed to do is ask for a payment. To learn more about this, please take a quick look at the table below.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

Stopping Nuisance Calls

» TAKE ACTION NOW: Fill out the short debt form

How to complain

First, make a complaint directly to Zinc so they have the opportunity to sort out the issue themselves.

If you feel that they have not dealt with your complaint properly, you can escalate matters and make a complaint to the Financial Ombudsman Service (FOS). They will investigate and if your complaint is upheld, Zinc Group may be fined, and you could be owed compensation.