Expert care and guidance from The Debt Advice Service

Stop calls from creditors.

Freeze interest and charges.

Stop bailiffs coming to your home.

See how an IVA could help you turn multiple unsecured debts into one smaller monthly payment.

| Situation | |

|---|---|

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

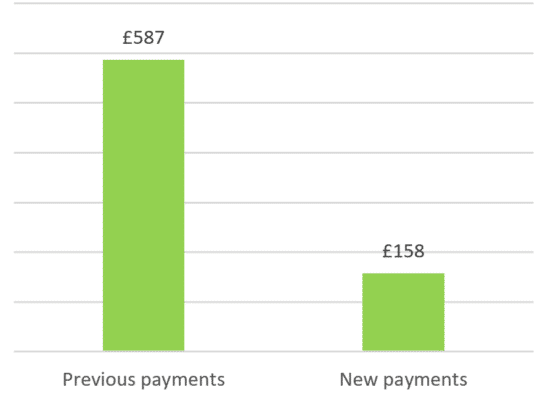

| Monthly debt repayments | |

|---|---|

| Before | £587 |

| After | £158 |

Average IVA cases at The Debt Advice Service between 1st January to 27th September, 2023. Monthly payments are based on individual circumstances.

Every financial journey is unique. The Debt Advice Service provides tailored guidance for a brighter future.

With a Debt Management Plan (DMP), tackle your debts at a pace that fits your budget.

With an Individual Voluntary Arrangement (IVA), settle your debts in a structured and manageable way.

With a Debt Relief Order (DRO), experience a fresh start by pausing overwhelming debts.

With Debt Consolidation you can merge multiple debts into one simplified payment, making it all more manageable.

The Debt Advice Service is a leading IVA provider, boasts over 1,200 five-star reviews on TrustPilot.

Lee

Georgie

Adam

To avoid losing your utilities, making a plan to pay back what you owe can help. If that’s not possible, there are other ways to manage your debts. Check out this guide about gas and electricity bills.

In some cases, yes. If it’s going to take too long to pay back what you owe, you might be able to erase some or all of your debt. But remember, it’s important to get debt advice before making any decisions. Find out more about writing off debt here.

If you have a poor credit history, you might be offered loans and credit to consolidate your debt. But these usually come with high interest rates. So, consolidation might not be the best option for you. Learn more about debt consolidation here.

Even if it feels like there’s no help, there are actually many resources available. Trust funds, credit unions, councils, energy companies, the government, and charities all offer assistance. Budgeting can also help you afford your bills. Find out how to get emergency help here.

Creating a budget is the first step to managing your money and getting back on track. It helps you see where your money is going and makes it easier to cover all your expenses. Check out this article on budgeting.

Knowing your rights when dealing with bailiffs is important. They should write to you before coming to your home and there are rules about what they can and can’t do. Remember, not all debt collectors are bailiffs. Learn more about how debt collection works here.

If you can’t pay your rent, your landlord might try to evict you. And if you can’t pay your mortgage, your lender could consider repossessing your home. But you can avoid these situations by figuring out what you can afford to pay. Making a budget can help with this. Show your budget to your lender or landlord to prove you’re serious about paying as much as you can. Then, stick to your new payment plan.