How Many Times Can a Bailiff Visit?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

We understand that dealing with a bailiff company can be a scary time. You may be worried about visits to your home, losing your things, or talking with the bailiffs. But don’t worry, we’re here to help. Each month, over 170,000 people like you visit our site to get answers to their debt questions.

In this article, we will explain:

- How many times a bailiff can visit your home.

- What a bailiff’s job is and what they can do.

- What to do when a bailiff visits.

- How to check if a bailiff is real.

- Ways to stop bailiffs from visiting your home.

StepChange found that 90% of people who have been visited by a bailiff in the last 2 years identify as vulnerable. With over 50% reporting depression and more reporting stress and anxiety. 1 So, we know how scary it can be.

Don’t worry! We’ll share our knowledge with you, based on real facts. Let’s dive in to help you get back in control of the situation.

How Long Do They Leave Between Visits?

Your Rights

If you’ve been visited by bailiffs, it’s important to understand your rights. This way, you’ll prevent unfair treatment and stressful situations.

Here’s a quick table that explains what bailiffs can and can’t do. If you’d like to learn more about your rights, be sure to read our detailed guide.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

What to Do When They Visit

How to Confirm their ID

Our financial expert, Janine Marsh, advises on letting a bailiff into your home: ‘It’s crucial you check who they say are before you open your door. Ask for their certificate through the letterbox or a window.’

Authenticity verification is something that, in my experience, not enough people know about.

County Court, Civilian Enforcement Officers, and Family Court Bailiffs

High court Enforcement Officers

Certified Enforcement Agents

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to Prepare for a Visit

Can They Force Entry to My Home?

» TAKE ACTION NOW: Fill out the short debt form

Can They Take Everything?

No, bailiffs can’t take everything in your house. There are strict rules on what bailiffs are allowed to remove from your property and what are classed as exempted items.

Things bailiffs just can’t take include:

- Things that belong to someone else, including things that belong to your children

- Things that you need for your job – including vehicles or tools – or things that you need to study – like a computer

- A Motability vehicle or any vehicle with a valid Blue Badge displayed

- Any pets or guide dogs.

Bailiffs also can’t take things that are essential for your ‘basic domestic needs.’ This means that, as a minimum, they need to leave you with:

- Beds and bedding for everyone in your home

- A cooker or microwave and fridge

- A phone or mobile phone

- A washing machine

- A table with enough chairs for everyone in your home

- All medicine or medical equipment that you need to care for a child or older person.

While bailiffs can take things that are permanently attached or fitted to your home, they can’t remove them if they will cause significant damage. This generally means things like kitchen units aren’t removed by bailiffs.

Any of the debt charities listed at the bottom of this page will be able to give you a comprehensive breakdown of what bailiffs can and can’t take.

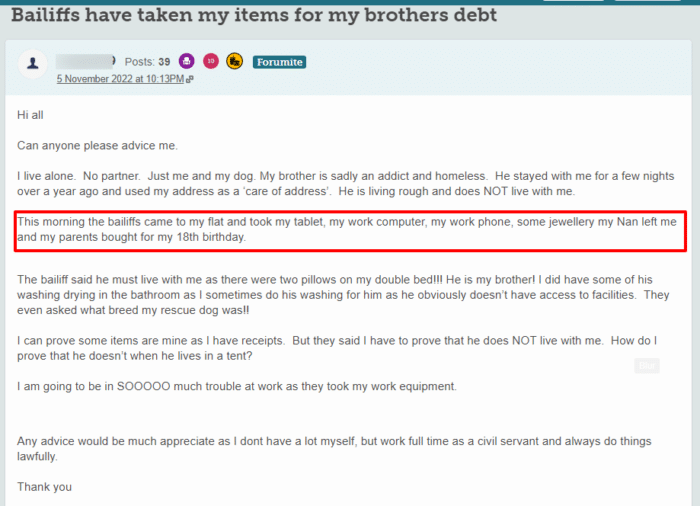

Sometimes, you need to be very aware of your rights because they might try to take things that they shouldn’t.

Technically this is theft!

If you are in a similar situation, contact a debt charity immediately. Some have specialist bailiff departments who will be able to advise you on the best next steps.

Arrange a Payment to Stop Them From Visiting Your Home

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I get a Debt Solution?

You might be able to get a debt solution to prevent bailiffs from visiting your home.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

» TAKE ACTION NOW: Fill out the short debt form

How do I Complain?

If you think that a bailiff has behaved inappropriately, you can make a complaint.

Make your first complaint to the bailiff’s company so that they have the chance to sort out the issue themselves. But if you think that their response or the way that they dealt with the complaint was insufficient, you can escalate matters.

You can make a secondary complaint to a regulatory body, such as the Civil Enforcement Association (CIVEA).

Bodies like CIVEA produce rules and guidance for companies to help protect the public from unprofessional behaviour or unfair practices. They can also investigate your concerns or complaint and let you know of their findings and proposed solutions if appropriate.

You might need to contact ta debt charity to work out which complaints procedure you need to follow.