How to Beat Debt Collectors UK? Quick guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried because you’ve got a letter from a debt collector? Don’t worry; we’re here to help. Each month, over 170,000 people come to our website for advice on debt matters. We’ll guide you on how to deal with debt collectors in the UK.

In this article, we’ll show you:

- How to find out if the debt is really yours.

- Ways to stop the debt collector from bothering you too much.

- What you can do if you cannot pay.

- How to talk to the people you owe money to.

- How to possibly get rid of some of your debt.

We know how scary it can be when debt collectors start asking for money, as some of us have been in the same boat. We understand how you feel.

Let’s get started and learn more about how to handle debt collectors in the UK.

First, What Is a Debt Collector?

How to Beat Them

1. Learn Everything there is to Know

2. See if Your Debt Is Statute Barred

3. Request for Proof

You can also request a detailed breakdown of the debt as proof that it exists. You may find that some charges or fees have been added that should not have to pay.

4. Make Official Complaints If Necessary

» TAKE ACTION NOW: Fill out the short debt form

How Do I Deal With The Agency?

The most important thing to remember about a debt collector is that you shouldn’t ignore them! This is a surefire way for the agency to take further and more drastic action against you.

Some debt collectors will ask you to pay them immediately. Before you make any payment you need to verify that you do actually owe the debt. Don’t pay until the debt is verified and you are satisfied that you do actually owe it.

If you can afford it, you should take them up on their offer now. If a lump sum is out of the question, many debt collectors will accept a repayment plan.

If you opt for a repayment plan, it is essential that you do not miss a payment so only agree to pay what you will realistically be able to.

Keep in mind that most debt collectors will not visit you at home. If they do, you can phone up the company yourself to organise a standing order or other payment. This makes it easier to keep accurate records of your debt payments.

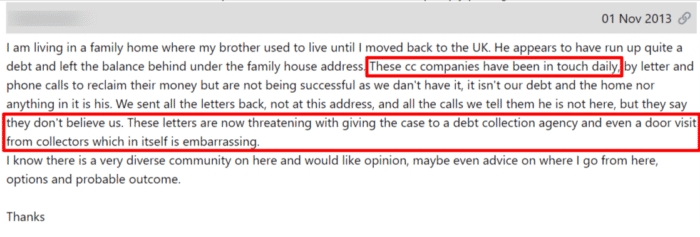

But sometimes you will find yourself dealing with debt collectors looking for debt that is not even yours!

If this person made a complaint to the FCA or the FOS, it would probably be upheld and they would be due some compensation.

It is unreasonable for debt collectors in this example to contact someone daily just because they don’t believe that the person who owes the money is still there.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can You Really Beat Them?

How Do I Talk To My Creditor?

One of the easiest ways that you can avoid debt collectors is by communicating with your creditors. Regular communication with creditors means that they are aware of your financial situation and intention to pay off your debt. This makes it less likely that they will sell your debt to a collection agency.

I recommend talking to them via letter or email because it is much easier to keep detailed records.

Don’t contact your creditors about a debt that you think is going to be statute-barred soon! This will effectively reset the timer and you will need to wait another six years from the date you sent the letter for it to become unenforceable.

You can confirm with your creditors what debts you owe and how much. Once you have acknowledged these debts, you may find that your creditors are more likely to stop chasing you for payments for an agreed period of time. They may even be willing to freeze your interest.

If you know that you can afford to repay some of the debt, you can negotiate a repayment scheme. Only agree to pay if you can afford it and make sure you get any repayment plans written in writing before you make a payment. This will make it harder for your creditor to dispute!

Keep in mind that your creditor doesn’t have to agree to any of this – they are allowed to ask for you to pay back all of your debt as you originally agreed. However, it is often in their best interest as they may not get as much money back if you opt for a formal debt solution like an IVA.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Beating Them with Debt Solutions

Individual Voluntary Agreement (IVA)

If you do not have any disposable income, you may wish to consider a Debt Relief Order (DRO).

Debt Relief Order

A DRO is a good alternative for those who can’t afford an IVA.

To qualify, you need to demonstrate that you have less than £75 of disposable income each month and that you do not own assets not including a car worth more than £2,000. You will also need to prove that your car is not worth more than £2,000.

Once your DRO is approved, your creditors can’t contact you. This includes sending a debt collection agent after you.

You do not need to make any payments on DRO-approved debts during your DRO which will last a year. After a year, your finances are reassessed and you will not have to pay your debts if your financial situation has not improved.

Some debts aren’t part of a DRO – including court fines or child maintenance – so you will need to check with your DRO advisor. You will need to work out a way of paying these debts during your DRO.

Keep in mind that there are different debt solutions that you can use to help beat debt collectors. I always recommend talking to an expert who can help you find the best solution for your financial situation.

Contact any of the following organisations for free debt and financial advice:

What Debts Do I Deal With First?

If you are struggling to manage your debts it can be hard to work out where to start.

The first thing that you should do is identify your priority debts. These are debts that will cause you serious problems if you don’t get them sorted.

Priority debts can include:

- Rent or mortgage arrears

- Council tax arrears

- Energy bill arrears

- Court fines

- TV license payments

- Overpaid tax credits

- Unpaid child maintenance.

Once your priority debts are sorted, you can move on to dealing with any others that you might have.

Non-priority debts are usually unsecured debts and can include:

- Credit card or store card debts

- Unpaid parking tickets

- Unsecured loans – eg payday loans

- Unpaid water bills – your water can’t be cut off

- Debts owed to your family or friends.

These creditors can take you to court to get you to pay. But, unlike priority debts, these services will not be cut off and you will not receive a court fine or the possibility of prison if you do not pay immediately.