O2 Debt – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about an O2 debt? If so, you can rest easy now – this article is just what you need. Every month, more than 170,000 people come to our website for guidance on debt matters, so you’re not alone.

In this guide, we’ll help you with:

- Understanding who O2 is and why you might owe them money.

- Understanding how to deal with your O2 debt.

- Finding out if you can lessen your debt.

- Learning about the O2 debt repayment plan.

- Dealing with old O2 debts.

We know how it feels to be chased for money you owe, as some of us have been in your shoes. We understand your worries and fears, which is why we want to help you.

We’ll help you know more about O2 debts and what to do about them. We’ll also give you tips on how to handle debt issues in general. Let’s start this journey together

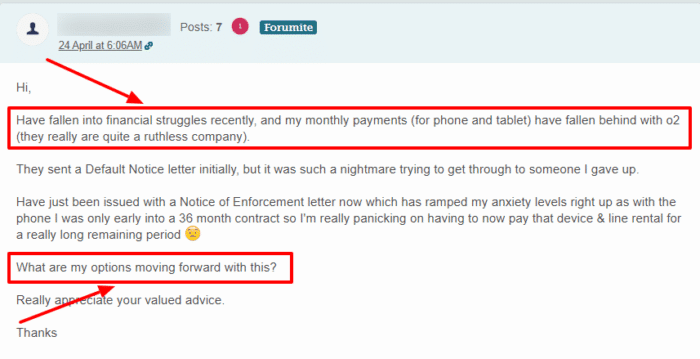

Why Might You Get into Debt?

Most people get into debt with O2 because they take out a contract for one of their smartphones. They agree to make repayment each month to buy the phone along with packages for calls, texts and data.

As these contractual obligations are usually long-term, with some lasting up to 24 months, people hit difficulty at some point and fail to make their payments. Thus, entering into O2 debt.

Or they simply miss a payment because they forgot to add money to the account they pay from.

Another common scenario is an individual signing an O2 mobile phone financing on behalf of someone else, such as a partner, who then stops paying for the phone after a breakup.

» TAKE ACTION NOW: Fill out the short debt form

They Provided Proof, What Now?

If they provide proof of your O2 debt with an O2 contract in your name, it is time to make arrangements to pay.

Seek ways to make the debt affordable so you can clear it without putting too much strain on your financial situation.

My advice: Don’t let the debt go to court, as this could cost you more than just money. You could even end up having to face bailiffs that take your possessions to pay off the O2 debt.

Remember, if you don’t clear your O2 debt, it will be recorded on your credit file as missed or late payment. This could hurt your credit score, further eroding your chances of obtaining credit.

You can get support on how to pay your debt more comfortably by contacting independent UK debt charities like StepChange or MoneyHelper.

These organisations offer free impartial advice to those struggling with debt and other financial hardships.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Repayment Plan

If you find yourself in arrears with O2, you can contact their specialist team to discuss a repayment plan.

They will take into account your situation and try to agree on flexible payment options that don’t cause you financial distress and eventually clear the debt over time.

If you agree to a repayment plan and still have an O2 contract active, or a second O2 contract, there is a chance that O2 will block you from accessing further services.

This is to allow you to concentrate on making repayments and not get into more debt.

How Can I Contact their Team?

The O2 Debt Repayment Team are free to call on 0800 902 0217. They are open on weekdays between 8 am and 8 pm.

And on weekends, the helpline is available on Saturday between 8 am and 6 pm, whereas Sunday, their lines are open from 9 am to 6 pm.

You might feel worried about calling the O2 Debt Repayment Team, but these people are trained to offer assistance with your sensitive circumstances and are usually very friendly.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

But, What About Old Debt?

Sometimes, your O2 debt doesn’t get paid, and it catches up with you in a few years.

If you don’t pay your O2 debts, it is known that O2 will use debt collection agencies to chase you for the money.

They would rather sell your debt for a fraction of the owed amounts than use the time and resources to track you down themselves.

One of the third-party collection agencies they have been known to use is called Moorcroft, though a different agency might contact you.

First, Request for Proof

Now that your O2 debt has been passed on, you must deal with the debt collection agency, who will probably be asking for full payment or threatening court action.

The first move you can make is to request they provide proof that you owe the debt (CCA agreement).

They must avail you with a copy of the O2 contract you signed. Do this even if you know you owe the money because:

- It buys you time to assess your options

- If they don’t provide it, you won’t have to pay (it makes them work!)

- Helps identify mistakes on their side

Keep a copy of your prove the debt letter but don’t sign it.

If the collection agency continues to ask for payment without supplying proof, you can report them to the Financial Ombudsman for harassment.

Use this prove the debt letter template to request a CCA and save time.

Or, Send a Statute Barred Letter

The only time you don’t need to send a prove the debt letter is when you need to send a Statute Barred letter instead.

Statute of Limitations on debt is a legal loophole that prevents old debts from being judged in court. To ease the pressure on the courts, any debt which is/has:

- At least six years old

- Not been paid in part in the previous six years

- Not been acknowledged in writing in the past six years

- Never had a CCJ issued on it

If you believe O2 or their debt collectors are pursuing you for a Statute Barred debt, know that they cannot go to court. As a result, you can never be forced to pay.

So instead of asking for proof of the debt, simply send a Statute Barred letter (download it for free on a debt charity website like Citizens Advice), and you shouldn’t hear from them again.

O2 Contact Details

| Contact us: | https://www.o2.co.uk/contactus |

| Website: | https://www.o2.co.uk/ |